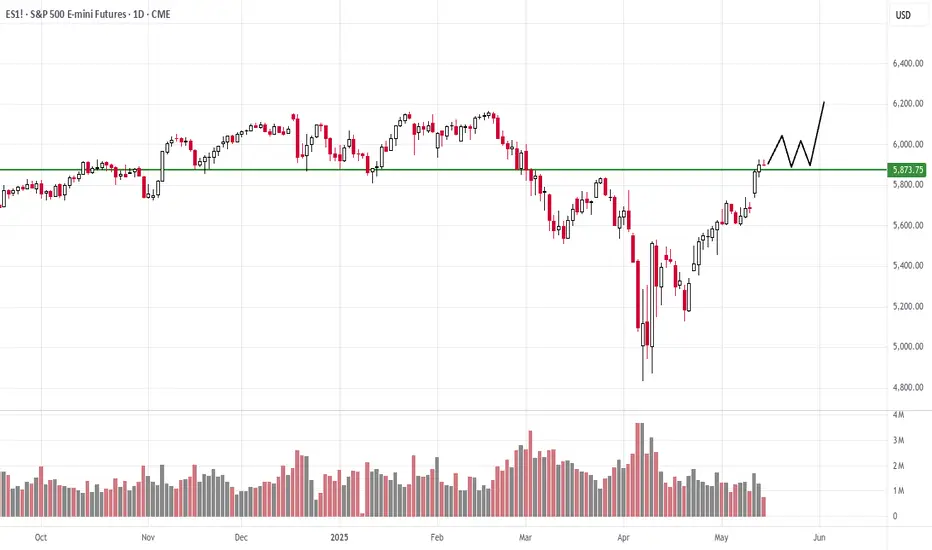

The S&P is now reaching the axis line, where heavy selling emerged months ago. It’s reasonable to expect a pause at this level, followed by a continuation of the strong uptrend.

Volume Analysis

Looking at the recent chart pattern, we can observe that the volume became quite climactic right on the break. It’s particularly noteworthy that the current bar is at the same level as previous significant price action. This pattern suggests we’re essentially going through the same cycle again, repeating familiar market behavior.

The Critical Axis Line

This axis line is critical for traders to monitor. If the market can successfully break above this level and then consolidate, spending sufficient time above this resistance, we’re likely going to experience a rally.

Chart Pattern Observations

The chart shows several technical elements:

Conclusion

The S&P is at a critical juncture, testing a well-established axis line. If we can get above it and then just consolidate, spending some time there, we’re probably going to have a rally.

Volume Analysis

Looking at the recent chart pattern, we can observe that the volume became quite climactic right on the break. It’s particularly noteworthy that the current bar is at the same level as previous significant price action. This pattern suggests we’re essentially going through the same cycle again, repeating familiar market behavior.

The Critical Axis Line

This axis line is critical for traders to monitor. If the market can successfully break above this level and then consolidate, spending sufficient time above this resistance, we’re likely going to experience a rally.

Chart Pattern Observations

The chart shows several technical elements:

- Multiple touch points along the resistance level

- Previous price action at similar levels

- The market cycling through similar patterns again

Conclusion

The S&P is at a critical juncture, testing a well-established axis line. If we can get above it and then just consolidate, spending some time there, we’re probably going to have a rally.

Wyckoff Method Trading and Education

wyckoffanalytics.com/

Stocks, Commodities, Indexes,

Cryptocurrencies

wyckoffanalytics.com/

Stocks, Commodities, Indexes,

Cryptocurrencies

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Wyckoff Method Trading and Education

wyckoffanalytics.com/

Stocks, Commodities, Indexes,

Cryptocurrencies

wyckoffanalytics.com/

Stocks, Commodities, Indexes,

Cryptocurrencies

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.