Last Week :

Last week played out very well even though middle of the week had us thinking that maybe market will continue to hold inside Value above 970s as we kept getting buying in that area but it just took time to build up for the break of that cost basis at VAL to give us more selling end of week. Sunday Globex again opened over Value and grinded towards the upper Edge but we had no tag or push inside it which signaled weakness and as noted if that did no happen we needed to be careful looking for acceptance inside that new range and instead possibly look for this move to return back toward previous Edge and get back under 930s to possibly signal a failed new ATH break out by getting back under Previous ATH Consolidation. We first failed over Value and got the push back inside to correct the Poor low from Previous Weeks Friday Globex which was around the Mean area of that range which kept getting buying that gave us moves back to VAH but we slowly transitioned into correction first on Hourly then on 2hr and finally on 4hr to end the week on Friday with a break/hold under VAL smaller cost basis which gave us more weakness and selling to finish the Week under the lower Edge.

This Week :

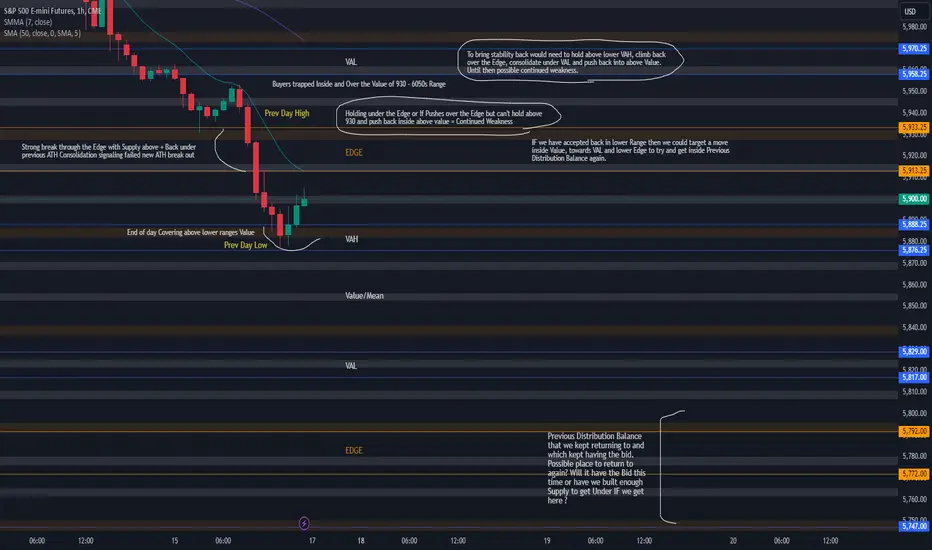

So far looking at the structure of Daily/Weekly and the way we closed on Friday we could gather some info to help us go into this week. On Weekly TF we had a failed break out into new balance over 5950 which returned back inside Previous Balance of 950 - 660s, on Daily TF we hit a key upper Edge of the Range, held under it, built some supply and got back trough its VAH and made a move under its Mean area, under Previous ATHs consolidating potentially signaling a failed new ATH break out with a strong close under the smaller Daily MA. On Hourly's we have trapped Supply in above Range and reversed the whole move back under 930 - 13 Edge.

All of this so far screams weakness and continuation lower to me, of course we have to be careful as market could hold and start balancing here above lower Mean/Value and even try to get back inside and over upper Edge which could bring stability back but I think we would need to do all that and be able to hold over 930s AND get back over above VAL in order to see real stability or strength return.

Holding under the Hourly's Edge and under Daily Mean/under Previous ATHs we are looking for possible continuation towards 840s - 20s areas which would put us inside lower Value with a visit of its VAL which is also Daily VAL, these areas could provide covering if we get there BUT if we get through them then we can't forget about our favorite Previous Distribution Balance which market liked returning back into so much into 800 - 750s area which kept having our strong bids that would give us pushes away this is also Daily Edge low as that is a potential return target after failing at upper Edge. Will we get all the way there this week or not ? who knows but that is our possibility and something to watch moves towards as the week develops, question is when or if we get there will that area act as absorption area of all this Supply coming out and be enough to give us a good hold OR we have some nice longer TF stops under it which if we took could give us more supply to try another push for our lower Roll Gap which we have been building up to fill. This seems like a big move so maybe not all the way to fill the gap but it is in the cards if the weakness continues as that is also around Previous Weekly balance lows and if we get under 820 - 05 ( Weekly mid ) then that open the doors for it.

To think higher prices from here again we would need either a strong bid to push us back through the upper Edge and be able to hold over 920-30s AND have the buying to eventually get us back inside above Value, or at least hold over 860s, consolidate without going lower and make a push for upper Edge. Until then will watch the short side or some sort of consolidation balance to be playing out.

Last week played out very well even though middle of the week had us thinking that maybe market will continue to hold inside Value above 970s as we kept getting buying in that area but it just took time to build up for the break of that cost basis at VAL to give us more selling end of week. Sunday Globex again opened over Value and grinded towards the upper Edge but we had no tag or push inside it which signaled weakness and as noted if that did no happen we needed to be careful looking for acceptance inside that new range and instead possibly look for this move to return back toward previous Edge and get back under 930s to possibly signal a failed new ATH break out by getting back under Previous ATH Consolidation. We first failed over Value and got the push back inside to correct the Poor low from Previous Weeks Friday Globex which was around the Mean area of that range which kept getting buying that gave us moves back to VAH but we slowly transitioned into correction first on Hourly then on 2hr and finally on 4hr to end the week on Friday with a break/hold under VAL smaller cost basis which gave us more weakness and selling to finish the Week under the lower Edge.

This Week :

So far looking at the structure of Daily/Weekly and the way we closed on Friday we could gather some info to help us go into this week. On Weekly TF we had a failed break out into new balance over 5950 which returned back inside Previous Balance of 950 - 660s, on Daily TF we hit a key upper Edge of the Range, held under it, built some supply and got back trough its VAH and made a move under its Mean area, under Previous ATHs consolidating potentially signaling a failed new ATH break out with a strong close under the smaller Daily MA. On Hourly's we have trapped Supply in above Range and reversed the whole move back under 930 - 13 Edge.

All of this so far screams weakness and continuation lower to me, of course we have to be careful as market could hold and start balancing here above lower Mean/Value and even try to get back inside and over upper Edge which could bring stability back but I think we would need to do all that and be able to hold over 930s AND get back over above VAL in order to see real stability or strength return.

Holding under the Hourly's Edge and under Daily Mean/under Previous ATHs we are looking for possible continuation towards 840s - 20s areas which would put us inside lower Value with a visit of its VAL which is also Daily VAL, these areas could provide covering if we get there BUT if we get through them then we can't forget about our favorite Previous Distribution Balance which market liked returning back into so much into 800 - 750s area which kept having our strong bids that would give us pushes away this is also Daily Edge low as that is a potential return target after failing at upper Edge. Will we get all the way there this week or not ? who knows but that is our possibility and something to watch moves towards as the week develops, question is when or if we get there will that area act as absorption area of all this Supply coming out and be enough to give us a good hold OR we have some nice longer TF stops under it which if we took could give us more supply to try another push for our lower Roll Gap which we have been building up to fill. This seems like a big move so maybe not all the way to fill the gap but it is in the cards if the weakness continues as that is also around Previous Weekly balance lows and if we get under 820 - 05 ( Weekly mid ) then that open the doors for it.

To think higher prices from here again we would need either a strong bid to push us back through the upper Edge and be able to hold over 920-30s AND have the buying to eventually get us back inside above Value, or at least hold over 860s, consolidate without going lower and make a push for upper Edge. Until then will watch the short side or some sort of consolidation balance to be playing out.

Note

Current intraday range we have accepted in is this 880s - 930 area, price could spend some time hanging out and balancing in these areas to possibly try to make another distribution balance, this is something to watch for to start the week if we dont get continuation lower right away on Monday, this will mean pushes outside this intraday range could find their way back inside it until price either holds above without coming in to signal stability or has a good push into lower VAH without coming back over 902 area.Note

So far Globex showed us that we have selling at the Edge and still have good enough covering here above lower Value to give us holds over VAH without continuation much lower. This week is to not get too biased or push for continuation/big bounces because we are inside Daily Ranges Mean area and between 2 MAs(Smaller, Bigger), price may balance/hold around here for longer than we think while it sets up for next move, yes lots of things are pointing lower from the prep above BUT does not mean it will continue right away this week as we are getting close to a Holiday and volume may die down some. Any bigger change out of this potential balance would come over 940s or acceptance under Intraday Edge of 887 - 82 and holds under 870s until then watch out for back and forth around the Edge/VAH Value AreaNote

Yesterday we balance in our intraday range with a failure to push out of 930s, Globex again made an attempt to get out of the Edge which resulted in another sell towards VAH and 87 - 82 Intraday Edge holding again. Remember holding under HTF Edge = Weakness and if we have built up enough supply we could see a push into lower Value today, if we still need time we will continue to balance in this intraday range under the HTF Edge but door is open for continuation so will be something to watch for. Note

Yday pre market we made a continuation push into Value but stopped dead at the Mean area tag and got a push back to VAH before RTH open, open got no continuation and showed acceptance back over 87-82 which gave us rotation back to the range top. We consolidated under the 930 top and ran the stops in the afternoon which brought more buying to push us into 40s, so far 930 - 880s is the Intraday Range we have accepted in, market made a push for above VAL but finding supply at and under it, for any higher prices from here we need consolidation under VAL and be able to push into and hold in it, for now if all this buying came from the stops that were ran yesterday then its possible we spend some time balancing over the Edge BUT something to watch for is if we build up enough supply without getting over VAL then we would look for us to return back into the Edge under 930s at some point today, this may take time to build up but as mentioned earlier we may try to find a distribution balance around these 880s - 930s areas which means pushes out of it below or above could find their way back in, so far it has been the case with a look below now we might get it with a push out. Something to watch for BUT must be careful with looking for too much continuation inside right away as this may be a slower process than a return up that we had. Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.