Dear Traders,

I decide do a monthly review/analysis of ETH away from the noise in Lower timeframe to help you see the bigger picture and the higher timeframe market structure and price action without getting things too complicated.

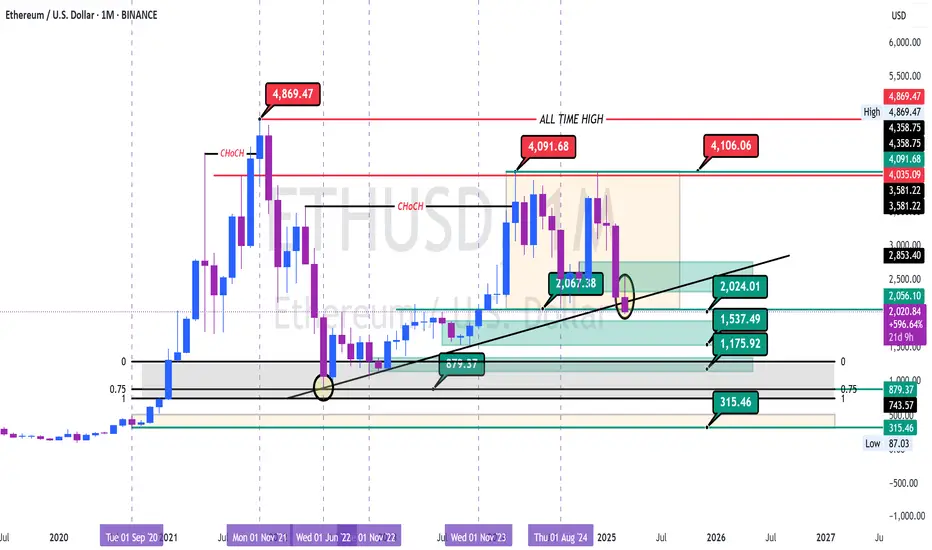

We say ETH hit its All-Time-High of $4,869 in November 2021 which was immediately followed by a 7-month low of $869 in June 2022 representing about 82% drop in price before a bullish run that ended in March 2024 creating a high of $4,091 representing a 465% increase in the price of the crypto asset over the 21-month period before dropping to its low of $2,067 which represent an approximate 50% drop in price over a 5-month period ending in August 2024 before hitting a new Lower High (LH) of $4,091 in December 2024.

Since December 2024, every subsequent monthly candle has been closing lower than the previous whilst currently trading below February, 2025 low.

If the downtrend continues over the next couple of days or weeks, my immediate prediction for ETH will be the next support at around $1,537 with possible extension to $1,175. If we don’t get to see a pullback within the zone referenced here, we may just see ETH do a free fall to $315.

Remember, as a trader, your job is to focus on price action and trade in the direction of price irrespective of your opinion. Also note that this is strictly on the basis of Technical analysis and fundamentals can change predictions and this is why price action should remain our focus so we can know when our bias is changing and we can adjust.

Having said all that also note that #ETH has fallen more than 21% in the week to March 9, marking its biggest weekly decline since November 2022.

A break of the bullish trend line that began in June 2022 suggests a possible end to Ethereum's three-year bull run unless we see a shift in market structure sooner than expected.

I decide do a monthly review/analysis of ETH away from the noise in Lower timeframe to help you see the bigger picture and the higher timeframe market structure and price action without getting things too complicated.

We say ETH hit its All-Time-High of $4,869 in November 2021 which was immediately followed by a 7-month low of $869 in June 2022 representing about 82% drop in price before a bullish run that ended in March 2024 creating a high of $4,091 representing a 465% increase in the price of the crypto asset over the 21-month period before dropping to its low of $2,067 which represent an approximate 50% drop in price over a 5-month period ending in August 2024 before hitting a new Lower High (LH) of $4,091 in December 2024.

Since December 2024, every subsequent monthly candle has been closing lower than the previous whilst currently trading below February, 2025 low.

If the downtrend continues over the next couple of days or weeks, my immediate prediction for ETH will be the next support at around $1,537 with possible extension to $1,175. If we don’t get to see a pullback within the zone referenced here, we may just see ETH do a free fall to $315.

Remember, as a trader, your job is to focus on price action and trade in the direction of price irrespective of your opinion. Also note that this is strictly on the basis of Technical analysis and fundamentals can change predictions and this is why price action should remain our focus so we can know when our bias is changing and we can adjust.

Having said all that also note that #ETH has fallen more than 21% in the week to March 9, marking its biggest weekly decline since November 2022.

A break of the bullish trend line that began in June 2022 suggests a possible end to Ethereum's three-year bull run unless we see a shift in market structure sooner than expected.

FINSPOT ACADEMY

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

FINSPOT ACADEMY

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.