Markets in Rotation: Cyclical Stocks Take the Lead in 2025

Ion Jauregui – Analyst at ActivTrades

In a 2025 marked by tariff uncertainty, persistent geopolitical tensions, and stock markets that started the year at record highs, it seemed reasonable to favor defensive stocks. However, market behavior has made it clear that the rotation toward cyclical sectors has taken firm hold, leaving behind traditionally more stable segments. Since the imposition of reciprocal tariffs between the United States and China on April 2nd—an event known as "Liberation Day"—the indices experienced a brief correction that temporarily favored defensive sectors. Nevertheless, the swift rebound, led by U.S. equities, has returned the spotlight to cyclical stocks, which are now trading at historical highs relative to defensives, according to Bloomberg and Bank of America data.

According to MSCI classification, cyclical sectors include consumer discretionary, technology, industrials, financials, real estate, communication services, and basic resources. In contrast, defensive sectors consist of consumer staples, healthcare, energy, and utilities.

Leaders of the Rotation: Financials and Technology

In this context, two sectors have led the rotation: financials and technology. The former benefits from a high interest rate environment that boosts profit margins. In Europe, this backdrop has also fueled a rally in the banking sector, with the Stoxx 600 Banks index up 39% year-to-date. Meanwhile, the technology sector remains dominated by the “Magnificent Seven,” with Nvidia (+33%), Meta (+33%), and Microsoft (+27%) delivering strong gains thanks to the momentum of artificial intelligence and demand for digital solutions.

Lagging Sectors: Energy and Healthcare

On the other hand, the energy and healthcare sectors have weighed on defensive performance. Energy is suffering from bearish pressure on oil prices, driven by an oversupply led by OPEC. Healthcare has been hurt by former President Trump's proposals to lower drug prices in the U.S., directly impacting the margins of major pharmaceutical companies.

Rotation Reaches Europe: EuroStoxx 50 and DAX 40 on the Rise

Europe hasn’t been immune to this rotation. Both the EuroStoxx 50 and the DAX 40 have reflected this shift, especially benefiting banks, tech, and industrials, while leaving traditional defensive sectors lagging.

EuroStoxx 50: Boosted by Banking and Industry

The EuroStoxx 50, the eurozone’s benchmark index, is up 11.2% so far in 2025, thanks to strong performance in banking and industrials. Institutions like BNP Paribas, Santander, and ING have gained more than 30%, supported by high rates and share buyback programs. Industrial giants like Airbus and Siemens have also stood out, driven by increased investment in infrastructure and defense.

In contrast, defensive sectors like utilities and consumer staples have posted flat or negative returns, penalized by declining consumption in southern Europe and margin compression in energy.

DAX 40: Germany Aligns with the Cycle

Germany’s benchmark DAX 40 index has risen 13.8% year-to-date, strengthened by domestic recovery and exposure to cyclical sectors.

• SAP (+22%) and Infineon (+31%) lead the tech segment, benefiting from industrial digitalization and AI adoption.

• The automotive sector has also rebounded, with BMW and Mercedes-Benz gaining ground due to stabilization in the Asian market and the shift toward electric vehicles.

Conversely, healthcare companies such as Bayer and Fresenius have issued guidance cuts, reflecting global weakness in the sector amid regulatory pressure and legal challenges.

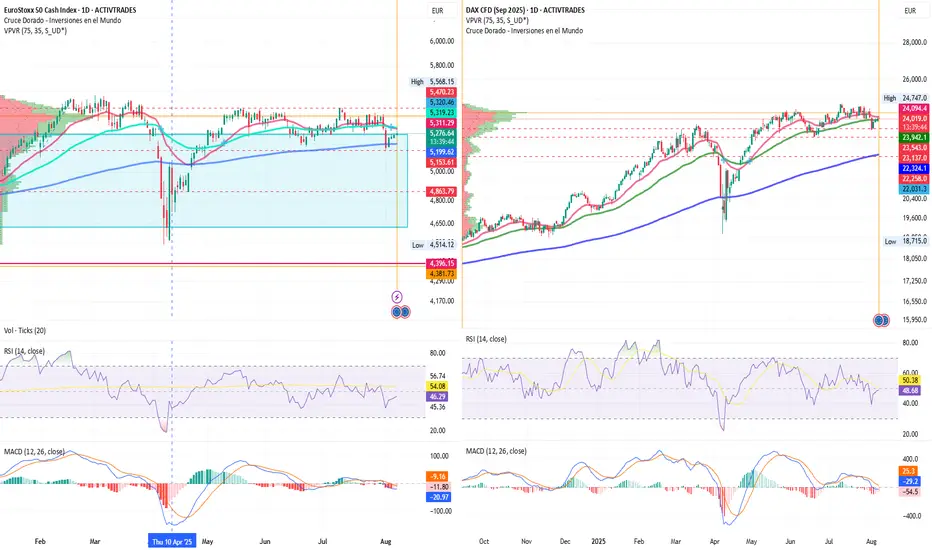

Technical Analysis – EuroStoxx 50

Current price (August 7, 2025): 5,288 points

YTD Change: +15%

Trend

• The index maintains a medium-term bullish structure, respecting an ascending trendline from the October 2023 lows.

• After the April correction driven by tariffs, the EuroStoxx 50 has regained ground and is now trading near its yearly high.

Key Levels

• Main Resistance: 5,470.23 → A breakout with volume could project a move toward the year’s high at 5,568.15

• Immediate Support: 5,153.61 → 100-day MA crossing above the 50-day may signal a corrective phase toward support

• Major Support: 4,863.79 and April lows at 4,514.12 → Technical and psychological level aligned with the April correction

Likely Scenario

• As long as the index holds above 4,570, the bias remains bullish

• A break below 4,400 would activate a correction toward 4,200–4,100

Technical Indicators

• RSI: 47% → recovering from oversold territory

• MACD: Negative and crossed downward since June, confirming a favorable correction

• Volume: Slight increase supporting the bullish trend

• POC (Point of Control): Located near the upper zone at 5,408, indicating a recovery direction

Technical Analysis – DAX 40

Current price (August 7, 2025): 24,098 points

YTD Change: +26%

Trend

• The DAX 40 also maintains a clear uptrend, with a structure of higher lows since the start of the year

• It is currently in a sideways-upward consolidation phase between 23,137 and the highs at 24,747

Key Levels

• Main Resistance: At highs → key level that has capped gains since the end of Q2

• Immediate Support: 23,359 → congestion area supporting the current rally

• Major Support: 23,137 → base of the congestion area

Likely Scenario

• The current consolidation suggests a healthy pause before a breakout, provided the 17,950 support holds

• A daily close below 23,000 would trigger a technical correction toward yearly lows

Technical Indicators

• RSI: 50 → in positive neutral territory

• MACD: Slightly flat entering positive territory; may signal renewed momentum

• Volume: MACD trend is bearish, approaching neutrality—typical of a congestion zone

• POC: Slightly below current highs, suggesting potential continuation of the uptrend

Technical Conclusion

Both the EuroStoxx 50 and DAX 40 maintain a clearly bullish bias, supported by the strength of cyclical sectors. However, they are near key resistance levels, so a technical pullback cannot be ruled out if global markets enter a profit-taking phase.

• Short-term traders should remain cautious unless breakouts are confirmed with volume

• Medium-term investors may view any pullbacks as buying opportunities, as long as key support levels hold

Is a Cycle Shift Coming?

Despite the strong performance of cyclicals so far this year, some analysts—including Morgan Stanley, Deutsche Bank, and Evercore—anticipate a 10% to 15% correction in the S&P 500 in the short term. Such a scenario could favor a return to defensive stocks, especially if volatility spikes or central banks adopt a more dovish tone.

Conclusion

2025 is undoubtedly the year of cyclical stocks. The recovery after the tariff shock has been swift, and sectors like banking, technology, and industry have taken the reins of growth. However, in rotating markets, trends can reverse as quickly as they emerge. The key will be anticipating the next turn.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

Ion Jauregui – Analyst at ActivTrades

In a 2025 marked by tariff uncertainty, persistent geopolitical tensions, and stock markets that started the year at record highs, it seemed reasonable to favor defensive stocks. However, market behavior has made it clear that the rotation toward cyclical sectors has taken firm hold, leaving behind traditionally more stable segments. Since the imposition of reciprocal tariffs between the United States and China on April 2nd—an event known as "Liberation Day"—the indices experienced a brief correction that temporarily favored defensive sectors. Nevertheless, the swift rebound, led by U.S. equities, has returned the spotlight to cyclical stocks, which are now trading at historical highs relative to defensives, according to Bloomberg and Bank of America data.

According to MSCI classification, cyclical sectors include consumer discretionary, technology, industrials, financials, real estate, communication services, and basic resources. In contrast, defensive sectors consist of consumer staples, healthcare, energy, and utilities.

Leaders of the Rotation: Financials and Technology

In this context, two sectors have led the rotation: financials and technology. The former benefits from a high interest rate environment that boosts profit margins. In Europe, this backdrop has also fueled a rally in the banking sector, with the Stoxx 600 Banks index up 39% year-to-date. Meanwhile, the technology sector remains dominated by the “Magnificent Seven,” with Nvidia (+33%), Meta (+33%), and Microsoft (+27%) delivering strong gains thanks to the momentum of artificial intelligence and demand for digital solutions.

Lagging Sectors: Energy and Healthcare

On the other hand, the energy and healthcare sectors have weighed on defensive performance. Energy is suffering from bearish pressure on oil prices, driven by an oversupply led by OPEC. Healthcare has been hurt by former President Trump's proposals to lower drug prices in the U.S., directly impacting the margins of major pharmaceutical companies.

Rotation Reaches Europe: EuroStoxx 50 and DAX 40 on the Rise

Europe hasn’t been immune to this rotation. Both the EuroStoxx 50 and the DAX 40 have reflected this shift, especially benefiting banks, tech, and industrials, while leaving traditional defensive sectors lagging.

EuroStoxx 50: Boosted by Banking and Industry

The EuroStoxx 50, the eurozone’s benchmark index, is up 11.2% so far in 2025, thanks to strong performance in banking and industrials. Institutions like BNP Paribas, Santander, and ING have gained more than 30%, supported by high rates and share buyback programs. Industrial giants like Airbus and Siemens have also stood out, driven by increased investment in infrastructure and defense.

In contrast, defensive sectors like utilities and consumer staples have posted flat or negative returns, penalized by declining consumption in southern Europe and margin compression in energy.

DAX 40: Germany Aligns with the Cycle

Germany’s benchmark DAX 40 index has risen 13.8% year-to-date, strengthened by domestic recovery and exposure to cyclical sectors.

• SAP (+22%) and Infineon (+31%) lead the tech segment, benefiting from industrial digitalization and AI adoption.

• The automotive sector has also rebounded, with BMW and Mercedes-Benz gaining ground due to stabilization in the Asian market and the shift toward electric vehicles.

Conversely, healthcare companies such as Bayer and Fresenius have issued guidance cuts, reflecting global weakness in the sector amid regulatory pressure and legal challenges.

Technical Analysis – EuroStoxx 50

Current price (August 7, 2025): 5,288 points

YTD Change: +15%

Trend

• The index maintains a medium-term bullish structure, respecting an ascending trendline from the October 2023 lows.

• After the April correction driven by tariffs, the EuroStoxx 50 has regained ground and is now trading near its yearly high.

Key Levels

• Main Resistance: 5,470.23 → A breakout with volume could project a move toward the year’s high at 5,568.15

• Immediate Support: 5,153.61 → 100-day MA crossing above the 50-day may signal a corrective phase toward support

• Major Support: 4,863.79 and April lows at 4,514.12 → Technical and psychological level aligned with the April correction

Likely Scenario

• As long as the index holds above 4,570, the bias remains bullish

• A break below 4,400 would activate a correction toward 4,200–4,100

Technical Indicators

• RSI: 47% → recovering from oversold territory

• MACD: Negative and crossed downward since June, confirming a favorable correction

• Volume: Slight increase supporting the bullish trend

• POC (Point of Control): Located near the upper zone at 5,408, indicating a recovery direction

Technical Analysis – DAX 40

Current price (August 7, 2025): 24,098 points

YTD Change: +26%

Trend

• The DAX 40 also maintains a clear uptrend, with a structure of higher lows since the start of the year

• It is currently in a sideways-upward consolidation phase between 23,137 and the highs at 24,747

Key Levels

• Main Resistance: At highs → key level that has capped gains since the end of Q2

• Immediate Support: 23,359 → congestion area supporting the current rally

• Major Support: 23,137 → base of the congestion area

Likely Scenario

• The current consolidation suggests a healthy pause before a breakout, provided the 17,950 support holds

• A daily close below 23,000 would trigger a technical correction toward yearly lows

Technical Indicators

• RSI: 50 → in positive neutral territory

• MACD: Slightly flat entering positive territory; may signal renewed momentum

• Volume: MACD trend is bearish, approaching neutrality—typical of a congestion zone

• POC: Slightly below current highs, suggesting potential continuation of the uptrend

Technical Conclusion

Both the EuroStoxx 50 and DAX 40 maintain a clearly bullish bias, supported by the strength of cyclical sectors. However, they are near key resistance levels, so a technical pullback cannot be ruled out if global markets enter a profit-taking phase.

• Short-term traders should remain cautious unless breakouts are confirmed with volume

• Medium-term investors may view any pullbacks as buying opportunities, as long as key support levels hold

Is a Cycle Shift Coming?

Despite the strong performance of cyclicals so far this year, some analysts—including Morgan Stanley, Deutsche Bank, and Evercore—anticipate a 10% to 15% correction in the S&P 500 in the short term. Such a scenario could favor a return to defensive stocks, especially if volatility spikes or central banks adopt a more dovish tone.

Conclusion

2025 is undoubtedly the year of cyclical stocks. The recovery after the tariff shock has been swift, and sectors like banking, technology, and industry have taken the reins of growth. However, in rotating markets, trends can reverse as quickly as they emerge. The key will be anticipating the next turn.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.