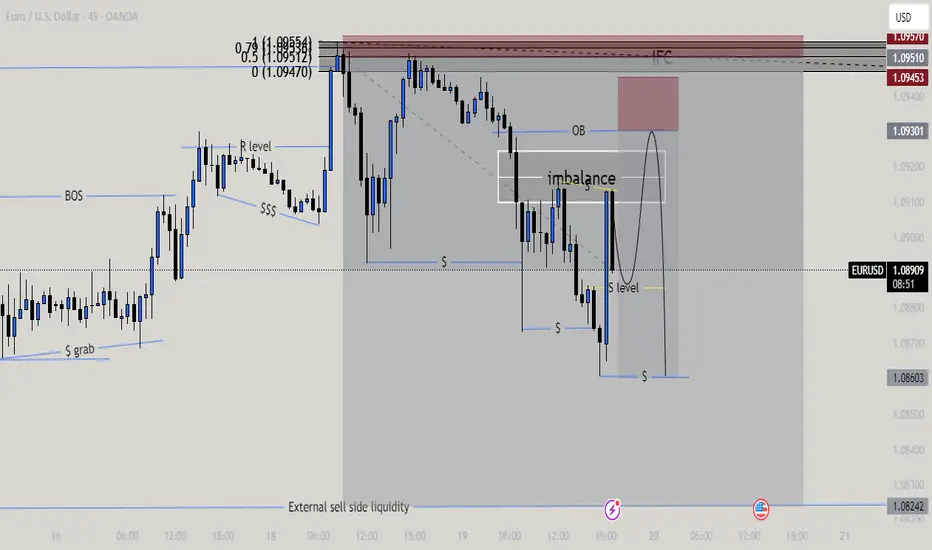

I entered a long position on EUR/USD at 1.09510, with a target at the external sell-side liquidity around 1.08242. The reason for taking this trade is based on the identification of a support zone and an Order Block (OB), where I used the 50% Fibonacci retracement level for my entry.

For a potential re-entry, I see an OB forming at the 1.09301 level, which I anticipate to act as a resistance (R) level. After the market fills the imbalance from the previous move, I expect a retracement to the support (S) level. Once that occurs, the market should push back towards the OB at 1.09301, which could trigger a short position. My targets for the short would either be the minor internal liquidity at 1.08603 (which could serve as TP1) or the POI at 1.08242. What do you think of it?

For a potential re-entry, I see an OB forming at the 1.09301 level, which I anticipate to act as a resistance (R) level. After the market fills the imbalance from the previous move, I expect a retracement to the support (S) level. Once that occurs, the market should push back towards the OB at 1.09301, which could trigger a short position. My targets for the short would either be the minor internal liquidity at 1.08603 (which could serve as TP1) or the POI at 1.08242. What do you think of it?

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.