Welcome back, traders! My name is Steven, and this is your daily EUR/USD outlook. Make sure to leave a like, follow, and share your thoughts in the comments below. Now let’s dive straight into the charts.

The Bigger Picture: Weekly Insights

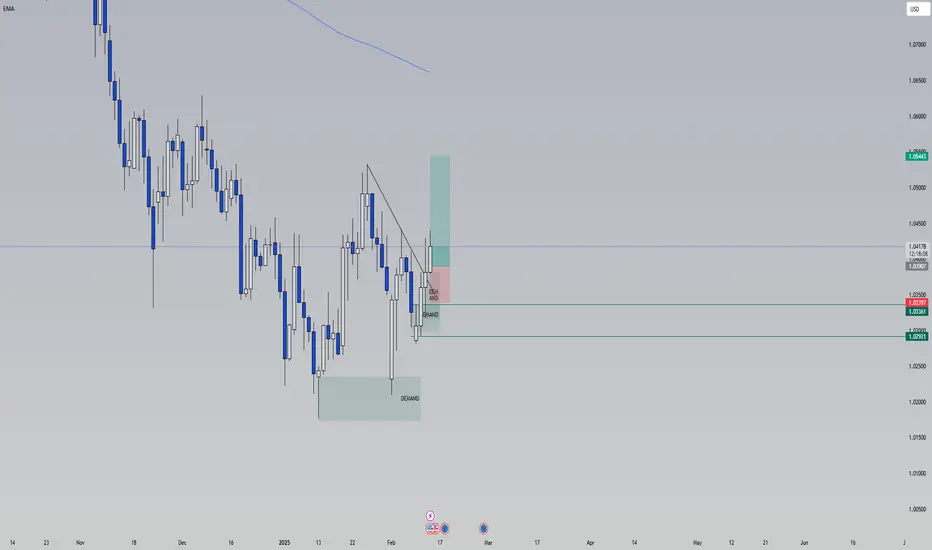

On the weekly timeframe, EUR/USD has made a strong bullish statement. After a series of lower lows and retracements, we’ve now broken above the weekly fractal high This move has solidified a bullish structure, setting the stage for further upside.

Where did this momentum come from?

The pair retraced into a fresh daily demand zone, formed around equal lows just above a key candlestick. Once those equal lows were swept, the demand zone held firm, leading to a V-shaped reversal. This is a textbook liquidity grab, and now the market is pushing back toward the highs.

Key Levels to Watch

Previous Weekly High – The next logical liquidity target sits above last week’s high, which remains untapped.

Monthly High – Just beyond the weekly high lies the previous month’s high, which also holds a cluster of liquidity.

Liquidity Bump in the Road – Zooming out, we can identify a minor “bump” in the impulse down, where significant stops and liquidity remain.

Lower Timeframe Strategy: Entries and Targets

If you’re trading the four-hour or lower timeframes, here’s what I’m watching:

Setup #1: The market is currently trading inside a four-hour demand zone, formed after yesterday’s inflation-driven dip. For confirmation, I’ll drop to the 1-hour or 15-minute timeframe and look for a trend shift. This means waiting for lower lows to turn into higher highs, creating fresh demand zones to trade from.

Setup #2: Alternatively, if we sweep the previous daily low, I’ll look for a reversal from that level to go long.

Both setups rely on lower timeframe order flow aligning with the higher timeframe bullish trend. Be patient—this confirmation is key.

What’s Driving EUR/USD Higher?

Yesterday’s inflation data sparked volatility, initially strengthening the dollar. However, the rally quickly reversed, with EUR/USD tapping a four-hour demand zone and bouncing higher.

Additionally, positive geopolitical developments—specifically talks of peace between Russia and Ukraine—have provided a boost to the euro, as a potential resolution would alleviate Europe’s energy inflation concerns.

Technical Takeaways

Bullish Trend Intact: Both weekly and daily structures remain bullish, supported by liquidity grabs and demand zone rejections.

Targets in Sight: I’m watching for a move toward the previous weekly high and potentially beyond, toward the monthly high.

Risk Management: As always, use tight stops and manage your risk, especially when trading lower timeframes.

Action Plan for Today

Monitor the four-hour demand zone for lower timeframe confirmations.

Watch the previous daily low for a potential liquidity sweep and reversal.

Stay tuned for any major news updates that could shift sentiment or momentum.

That’s it for today’s EUR/USD outlook! Let me know your thoughts in the comments below, and don’t forget to like and follow for more insights. Trade safe and good luck!

The Bigger Picture: Weekly Insights

On the weekly timeframe, EUR/USD has made a strong bullish statement. After a series of lower lows and retracements, we’ve now broken above the weekly fractal high This move has solidified a bullish structure, setting the stage for further upside.

Where did this momentum come from?

The pair retraced into a fresh daily demand zone, formed around equal lows just above a key candlestick. Once those equal lows were swept, the demand zone held firm, leading to a V-shaped reversal. This is a textbook liquidity grab, and now the market is pushing back toward the highs.

Key Levels to Watch

Previous Weekly High – The next logical liquidity target sits above last week’s high, which remains untapped.

Monthly High – Just beyond the weekly high lies the previous month’s high, which also holds a cluster of liquidity.

Liquidity Bump in the Road – Zooming out, we can identify a minor “bump” in the impulse down, where significant stops and liquidity remain.

Lower Timeframe Strategy: Entries and Targets

If you’re trading the four-hour or lower timeframes, here’s what I’m watching:

Setup #1: The market is currently trading inside a four-hour demand zone, formed after yesterday’s inflation-driven dip. For confirmation, I’ll drop to the 1-hour or 15-minute timeframe and look for a trend shift. This means waiting for lower lows to turn into higher highs, creating fresh demand zones to trade from.

Setup #2: Alternatively, if we sweep the previous daily low, I’ll look for a reversal from that level to go long.

Both setups rely on lower timeframe order flow aligning with the higher timeframe bullish trend. Be patient—this confirmation is key.

What’s Driving EUR/USD Higher?

Yesterday’s inflation data sparked volatility, initially strengthening the dollar. However, the rally quickly reversed, with EUR/USD tapping a four-hour demand zone and bouncing higher.

Additionally, positive geopolitical developments—specifically talks of peace between Russia and Ukraine—have provided a boost to the euro, as a potential resolution would alleviate Europe’s energy inflation concerns.

Technical Takeaways

Bullish Trend Intact: Both weekly and daily structures remain bullish, supported by liquidity grabs and demand zone rejections.

Targets in Sight: I’m watching for a move toward the previous weekly high and potentially beyond, toward the monthly high.

Risk Management: As always, use tight stops and manage your risk, especially when trading lower timeframes.

Action Plan for Today

Monitor the four-hour demand zone for lower timeframe confirmations.

Watch the previous daily low for a potential liquidity sweep and reversal.

Stay tuned for any major news updates that could shift sentiment or momentum.

That’s it for today’s EUR/USD outlook! Let me know your thoughts in the comments below, and don’t forget to like and follow for more insights. Trade safe and good luck!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.