Following the acrimonious meeting between the US and Ukrainian Presidents in the White House last Friday, the leaders of most EU member states, Canada, the UK and the European Commission met yesterday in London to discuss plans to achieve a lasting peace in Ukraine. Official comments after the “Ukraine summit” signalled willingness to increase support for Ukraine as well as their respective NATO contributions. As highlighted in our recent EUR-outlook, a US-brokered peace in Ukraine could usher in a period of growing military spending and easing geological risks in Europe that could boost the Eurozone and EUR outlook in H225.

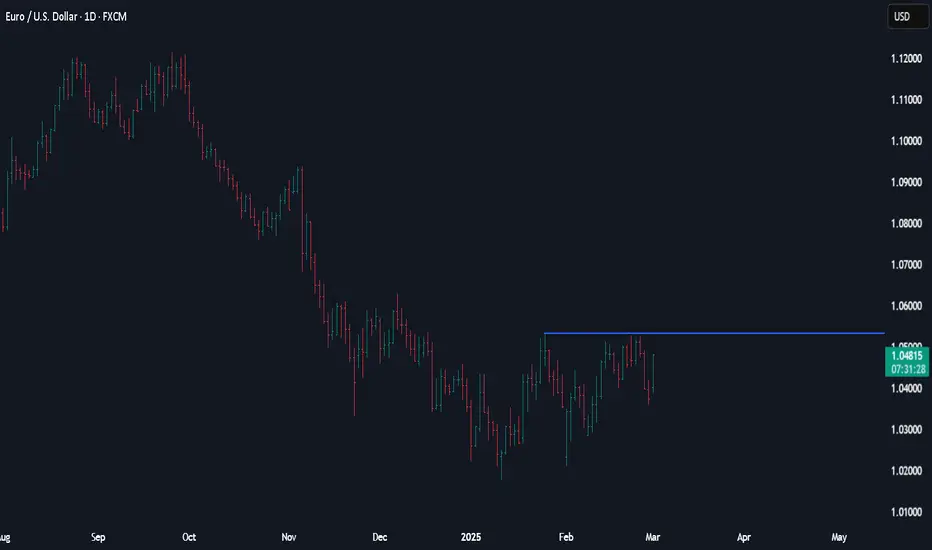

Uncertainty about the Ukraine peace prospects and the threat of a trade war between the US and the EU have weighed heavily on EUR/USD in recent days. The FX spot underperformance belies an important shift in the relative EUR-USD fundamental drivers, however. In particular, we note that the EUR-USD nominal (and real) rate spread has rebounded sharply of late to reach one of its highest levels so far in 2025. The move, coupled with abating sovereign credit risks in the Eurozone, has lifted the EUR/USD short-term fair value to its highest since 24 December.

Looking ahead, the EUR price action this week will increasingly be dominated by the outcome of the March ECB meeting on Thursday. On the day, focus will be on the Eurozone HICP estimate and the final manufacturing PMI print for February. Ahead of the inflation data, Crédit Agricole CIB inflation strategists and the market consensus are looking for a drop in the headline print to 2.3% YoY from 2.5% previously. At the same time, we expect the core inflation print to prove stickier and come closer to 2.6% YoY – down from 2.7% and vs 2.5% for the market consensus expectation.

If confirmed, our inflation expectation could corroborate the view that the ECB could deliver a ‘hawkish cut’ on Thursday, with President Christine Lagarde sounding even more non-committal to future rate cuts and an upward revision of the bank’s inflation forecasts. EUR investors will also continue to follow the latest newsflow on EU tariffs and any peace process for Ukraine.

Uncertainty about the Ukraine peace prospects and the threat of a trade war between the US and the EU have weighed heavily on EUR/USD in recent days. The FX spot underperformance belies an important shift in the relative EUR-USD fundamental drivers, however. In particular, we note that the EUR-USD nominal (and real) rate spread has rebounded sharply of late to reach one of its highest levels so far in 2025. The move, coupled with abating sovereign credit risks in the Eurozone, has lifted the EUR/USD short-term fair value to its highest since 24 December.

Looking ahead, the EUR price action this week will increasingly be dominated by the outcome of the March ECB meeting on Thursday. On the day, focus will be on the Eurozone HICP estimate and the final manufacturing PMI print for February. Ahead of the inflation data, Crédit Agricole CIB inflation strategists and the market consensus are looking for a drop in the headline print to 2.3% YoY from 2.5% previously. At the same time, we expect the core inflation print to prove stickier and come closer to 2.6% YoY – down from 2.7% and vs 2.5% for the market consensus expectation.

If confirmed, our inflation expectation could corroborate the view that the ECB could deliver a ‘hawkish cut’ on Thursday, with President Christine Lagarde sounding even more non-committal to future rate cuts and an upward revision of the bank’s inflation forecasts. EUR investors will also continue to follow the latest newsflow on EU tariffs and any peace process for Ukraine.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.