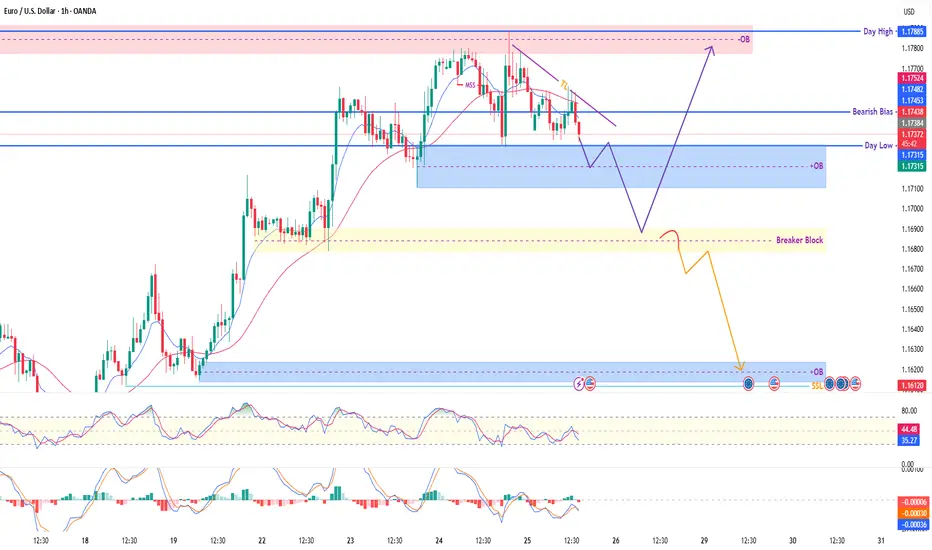

🔍 Market Insight:

The pair is hovering just above a fresh bullish OB zone, after forming a Market Structure Shift (MSS) and showing signs of bearish exhaustion. The chart outlines two clean scenarios – a potential reversal into premium OB or a deeper sweep toward the SSL below.

🧠 Smart Money Concepts Applied:

🔄 MSS + Trendline Liquidity (TL)

🧱 Order Blocks (OB) marked at high accuracy

⚡ Liquidity sweep potential toward SSL

🟨 Breaker Block acting as retest trap zone

📍 Key Price Zones:

🔴 Premium OB (Supply): 1.1752 – 1.1788

🔵 Demand OB (Buy Zone): 1.1731 – 1.1713

🟨 Breaker Block: ~1.1685 – 1.1700

🟦 Major Buy POI / SSL Trap Zone: 1.1612

🔵 Day High / Day Low: 1.1788 / 1.1733

📈 Scenario A – Bullish Reversal (Purple Path):

Price taps OB @ 1.1713 → reversal expected

First target: 1.1744 Bearish Bias Zone

Second target: 1.1788 OB

✅ Confirmation needed via bullish engulfing or BOS on LTF

📉 Scenario B – Liquidity Grab + Deeper Drop (Orange Path):

If OB fails, price may dive into the Breaker Block

Rejection from there can lead to the SSL sweep @ 1.1612

⚠️ This would trap breakout buyers & sweep below liquidity before bullish re-alignment

🎯 Trade Idea (Example – Scenario A):

Buy Limit: 1.1715

SL: 1.1695

TP1: 1.1744

TP2: 1.1785

Risk-Reward: ~1:3+

✅ Suggested TradingView Caption:

EUR/USD (1H) – Waiting for Liquidity Play

Price is consolidating near OB support with potential reversal to the premium zone. Two clean scenarios: a bullish break toward 1.1788 OB, or a liquidity sweep through the breaker block and into 1.1612 SSL.

RSI cooling off, MACD showing divergence. Staying patient for confirmation.

📘 Educational idea – not financial advice.

The pair is hovering just above a fresh bullish OB zone, after forming a Market Structure Shift (MSS) and showing signs of bearish exhaustion. The chart outlines two clean scenarios – a potential reversal into premium OB or a deeper sweep toward the SSL below.

🧠 Smart Money Concepts Applied:

🔄 MSS + Trendline Liquidity (TL)

🧱 Order Blocks (OB) marked at high accuracy

⚡ Liquidity sweep potential toward SSL

🟨 Breaker Block acting as retest trap zone

📍 Key Price Zones:

🔴 Premium OB (Supply): 1.1752 – 1.1788

🔵 Demand OB (Buy Zone): 1.1731 – 1.1713

🟨 Breaker Block: ~1.1685 – 1.1700

🟦 Major Buy POI / SSL Trap Zone: 1.1612

🔵 Day High / Day Low: 1.1788 / 1.1733

📈 Scenario A – Bullish Reversal (Purple Path):

Price taps OB @ 1.1713 → reversal expected

First target: 1.1744 Bearish Bias Zone

Second target: 1.1788 OB

✅ Confirmation needed via bullish engulfing or BOS on LTF

📉 Scenario B – Liquidity Grab + Deeper Drop (Orange Path):

If OB fails, price may dive into the Breaker Block

Rejection from there can lead to the SSL sweep @ 1.1612

⚠️ This would trap breakout buyers & sweep below liquidity before bullish re-alignment

🎯 Trade Idea (Example – Scenario A):

Buy Limit: 1.1715

SL: 1.1695

TP1: 1.1744

TP2: 1.1785

Risk-Reward: ~1:3+

✅ Suggested TradingView Caption:

EUR/USD (1H) – Waiting for Liquidity Play

Price is consolidating near OB support with potential reversal to the premium zone. Two clean scenarios: a bullish break toward 1.1788 OB, or a liquidity sweep through the breaker block and into 1.1612 SSL.

RSI cooling off, MACD showing divergence. Staying patient for confirmation.

📘 Educational idea – not financial advice.

Note

wait and if any quiry ask any time Note

After pull back will be bear till breaker blockNote

Ready Invetation card for Bear's Note

I told you befor its invetation card for bear's party hahahaNote

comment's here profit or lossNote

Dn't worry its just pull back it will be bearish,share your comments for my motivation and support.

Trade active

Bear's see the accuracy

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.