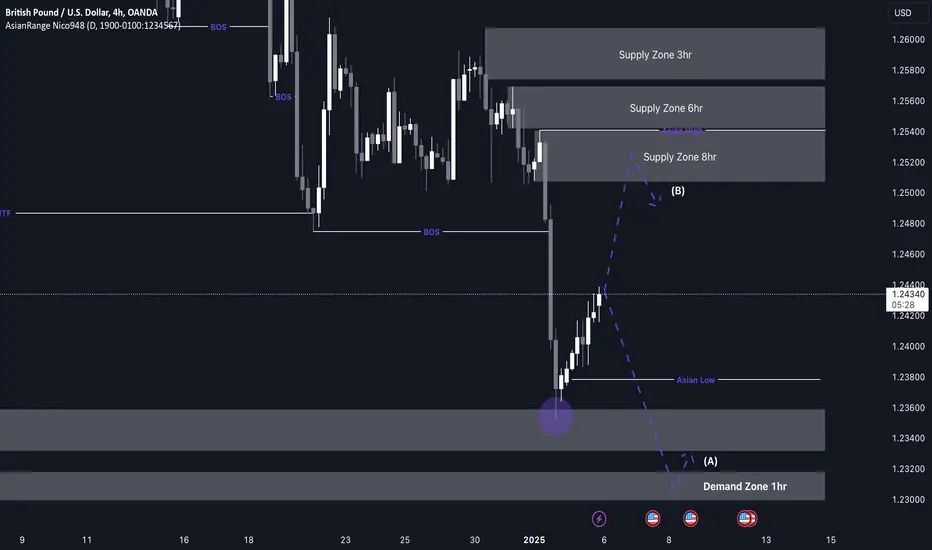

This week, my analysis for GBP/USD (GU) suggests a potential move higher to complete a corrective phase, as the pair has experienced heavy bearish momentum recently. Once the price reaches my point of interest (POI), which lies within the confluence of three key supply zones, I’ll be looking for signs of a slowdown in that region.

I’ll wait for the price to form a redistribution pattern in this area, signaling an opportunity to align with the overall bearish trend. Since GU is already in a bearish trend, it’s ideal to capitalize on this movement and target the underlying liquidity below.

Confluences for GU Sells:

The price has shown a Change of Character (CHOCH) and multiple Breaks of Structure (BOS) to the downside.

Several unmitigated supply zones remain, which are likely to be tapped.

Significant liquidity below, along with imbalances that need to be filled.

The Dollar Index (DXY) is bullish, supporting the bearish case for GU through correlation.

Note: If the price drops first before retracing upward, I’ll look for a buying opportunity around the 1-hour demand zone at 1.23000.

I’ll wait for the price to form a redistribution pattern in this area, signaling an opportunity to align with the overall bearish trend. Since GU is already in a bearish trend, it’s ideal to capitalize on this movement and target the underlying liquidity below.

Confluences for GU Sells:

The price has shown a Change of Character (CHOCH) and multiple Breaks of Structure (BOS) to the downside.

Several unmitigated supply zones remain, which are likely to be tapped.

Significant liquidity below, along with imbalances that need to be filled.

The Dollar Index (DXY) is bullish, supporting the bearish case for GU through correlation.

Note: If the price drops first before retracing upward, I’ll look for a buying opportunity around the 1-hour demand zone at 1.23000.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.