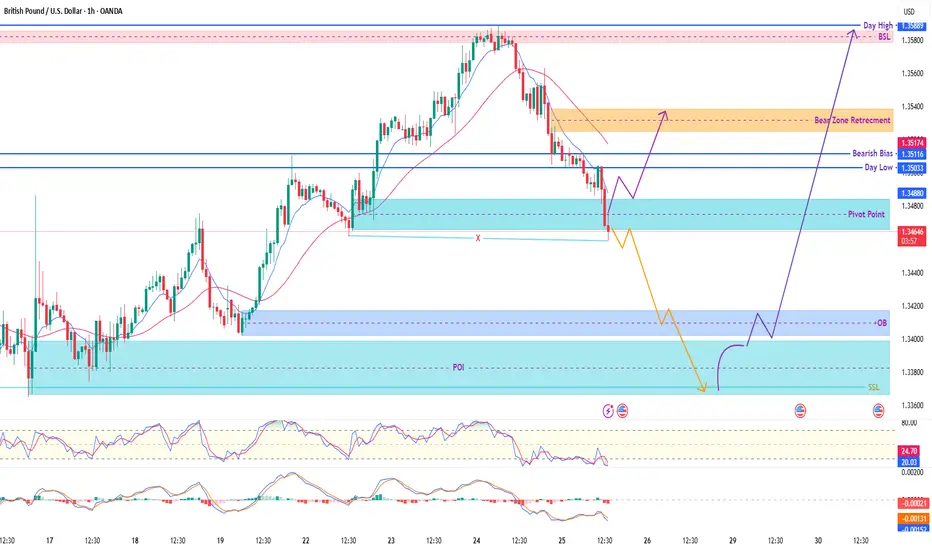

🔍 Structure Overview:

Price has tapped into a key intraday demand zone (Pivot Point region) after a clean drop from the bearish breaker area. The market is at a critical decision point, and we’re watching for either a short-term retracement rally or a deeper liquidity hunt into the major POI below.

🧠 Key SMC Concepts Applied:

✅ Clean BOS (Break of Structure)

✅ Well-mapped OB zones (above & below)

✅ Liquidity Traps: SSL & BSL identified

✅ Bear Zone Retracement mapped for short-sellers

✅ RSI + MACD divergence signals are building quietly

📍 Key Zones on Chart:

🔴 Bearish Zone Retracement (Short Area): 1.3511 – 1.3517

🔵 Pivot Point / Minor Demand: 1.3480 – 1.3490

🟦 Deep POI: 1.3380 – 1.3400

🟩 Strong OB: 1.3365 – 1.3385

🟪 Day High/BSL Target: 1.3588

❌ SSL (Sell-Side Liquidity): ~1.3360

📈 Scenario A – Short-Term Bullish Reversal (Purple Path):

Price may bounce from the pivot zone

Target 1: Bear Zone (1.3515)

Target 2: BSL @ 1.3588

✅ Bias flips bullish if 1.3515 is cleanly broken

📉 Scenario B – Liquidity Sweep (Yellow Path):

If the current zone fails, watch for a drop into the deep OB / POI

Potential long from 1.3365 – 1.3385, targeting full bullish swing toward BSL 1.3588

🎯 Trade Example (Scenario B):

Buy Limit: 1.3375

SL: 1.3345

TP1: 1.3485

TP2: 1.3588

Risk-Reward: 1:3+

✅ Suggested Caption for TradingView:

GBP/USD (1H): Decision Point Active!

Price has reacted off a local demand near the pivot. Watching for bullish momentum to target 1.3515 → 1.3588. If price dips into the deeper POI below 1.3400, I’ll be looking for a liquidity sweep and reversal. RSI + MACD divergence are hinting at strength building.

🔹 This is educational content – not financial advice.

Price has tapped into a key intraday demand zone (Pivot Point region) after a clean drop from the bearish breaker area. The market is at a critical decision point, and we’re watching for either a short-term retracement rally or a deeper liquidity hunt into the major POI below.

🧠 Key SMC Concepts Applied:

✅ Clean BOS (Break of Structure)

✅ Well-mapped OB zones (above & below)

✅ Liquidity Traps: SSL & BSL identified

✅ Bear Zone Retracement mapped for short-sellers

✅ RSI + MACD divergence signals are building quietly

📍 Key Zones on Chart:

🔴 Bearish Zone Retracement (Short Area): 1.3511 – 1.3517

🔵 Pivot Point / Minor Demand: 1.3480 – 1.3490

🟦 Deep POI: 1.3380 – 1.3400

🟩 Strong OB: 1.3365 – 1.3385

🟪 Day High/BSL Target: 1.3588

❌ SSL (Sell-Side Liquidity): ~1.3360

📈 Scenario A – Short-Term Bullish Reversal (Purple Path):

Price may bounce from the pivot zone

Target 1: Bear Zone (1.3515)

Target 2: BSL @ 1.3588

✅ Bias flips bullish if 1.3515 is cleanly broken

📉 Scenario B – Liquidity Sweep (Yellow Path):

If the current zone fails, watch for a drop into the deep OB / POI

Potential long from 1.3365 – 1.3385, targeting full bullish swing toward BSL 1.3588

🎯 Trade Example (Scenario B):

Buy Limit: 1.3375

SL: 1.3345

TP1: 1.3485

TP2: 1.3588

Risk-Reward: 1:3+

✅ Suggested Caption for TradingView:

GBP/USD (1H): Decision Point Active!

Price has reacted off a local demand near the pivot. Watching for bullish momentum to target 1.3515 → 1.3588. If price dips into the deeper POI below 1.3400, I’ll be looking for a liquidity sweep and reversal. RSI + MACD divergence are hinting at strength building.

🔹 This is educational content – not financial advice.

Note

Retest Started at LTF 15Min wait for pull back than can go for bearish (SHOrT)Trade active

For bear's Can go now with tight SL to targeted order blockNote

Hope Sl's will be now BE and don't be panic Note

hahaha Enjoy Guy's first TP hit haahaNote

hahaha Yummi profit Water fall water fall hahaha

Note

safe some profit parcially close Note

comments here who get profit who killed GBPUSD most commentsNote

COOL profit in water fall,share your comment for my motivation and support

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.