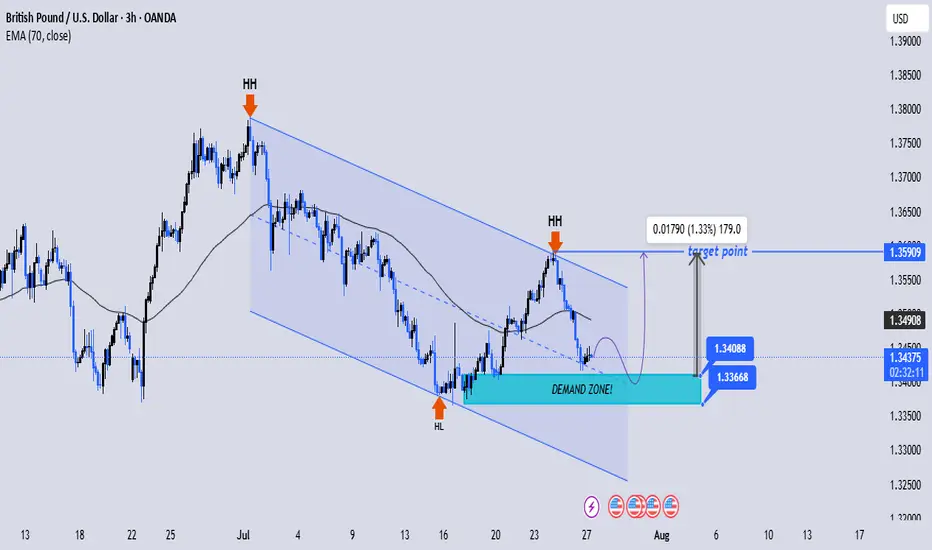

🔍 Chart Analysis (3H TF):

Price is trading within a downward channel.

Recent formation of a Higher Low (HL) in the key Demand Zone (1.3366 – 1.3408) indicates bullish interest.

EMA 70 is currently acting as dynamic resistance; price is consolidating below it.

Double Higher High (HH) pattern suggests strong bullish momentum before recent correction.

A bullish rejection candle and bounce from demand zone hint a potential reversal.

📈 Strategies Used:

Price Action: HH/HL structure confirms uptrend attempt.

Demand Zone: Strong institutional buying between 1.3366 – 1.3408.

Channel Trading: Bounce from lower trendline support.

EMA Strategy: Awaiting bullish crossover above EMA 70.

Risk-to-Reward: Targeting 1.3590, giving approx 1.33% upside.

✅ Potential Setup:

Entry: Near 1.3408–1.3435

SL: Below 1.3366

TP: 1.3590

📊 Conclusion: A bullish breakout is likely if price holds above the demand zone and breaks above EMA. Confirmation candle is key.

Price is trading within a downward channel.

Recent formation of a Higher Low (HL) in the key Demand Zone (1.3366 – 1.3408) indicates bullish interest.

EMA 70 is currently acting as dynamic resistance; price is consolidating below it.

Double Higher High (HH) pattern suggests strong bullish momentum before recent correction.

A bullish rejection candle and bounce from demand zone hint a potential reversal.

📈 Strategies Used:

Price Action: HH/HL structure confirms uptrend attempt.

Demand Zone: Strong institutional buying between 1.3366 – 1.3408.

Channel Trading: Bounce from lower trendline support.

EMA Strategy: Awaiting bullish crossover above EMA 70.

Risk-to-Reward: Targeting 1.3590, giving approx 1.33% upside.

✅ Potential Setup:

Entry: Near 1.3408–1.3435

SL: Below 1.3366

TP: 1.3590

📊 Conclusion: A bullish breakout is likely if price holds above the demand zone and breaks above EMA. Confirmation candle is key.

join my tellegram channel

t.me/JaMesGoldFiGhteR786

join my refferal broker

one.exnesstrack.org/a/g565sj1uo7?source=app

t.me/JaMesGoldFiGhteR786

join my refferal broker

one.exnesstrack.org/a/g565sj1uo7?source=app

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

join my tellegram channel

t.me/JaMesGoldFiGhteR786

join my refferal broker

one.exnesstrack.org/a/g565sj1uo7?source=app

t.me/JaMesGoldFiGhteR786

join my refferal broker

one.exnesstrack.org/a/g565sj1uo7?source=app

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.