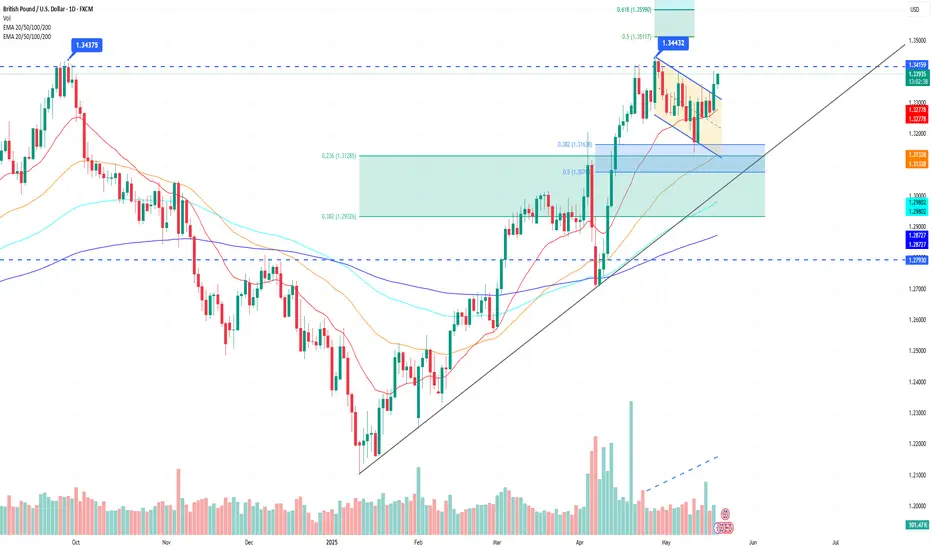

The GBP/USD pair has shown continued strength this week, briefly retesting the 1.3400 level for the second time in as many weeks. However, this zone remains a strong resistance area, and bulls have struggled to establish a sustained breakout above it. During the Asian session this morning, the pair saw some profit-taking, leading to a retracement toward 1.3350, as traders turn cautious ahead of key UK and UK macroeconomic data.

Markets are particularly focused on the upcoming UK core CPI data, where expectations point to a YoY rise to 3.7% from 3.4% previously. A hotter than expected print could reinforce the case for the BOJ to delay rate cuts.

Also on the radar are the S&P Global PMIs for May. Forecasts suggest a decline in both manufacturing and services activity, which, if confirmed, may reignite concerns over slowing economic momentum in the U.S., possibly offsetting any hawkish interpretation of inflation data.

Key levels to watch:

Resistance: 1.3400 (critical barrier), 1.3450

Support: 1.3350, 1.3300

Market sentiment remains data driven, and the pair may continue to trade with elevated volatility through the week.

Markets are particularly focused on the upcoming UK core CPI data, where expectations point to a YoY rise to 3.7% from 3.4% previously. A hotter than expected print could reinforce the case for the BOJ to delay rate cuts.

Also on the radar are the S&P Global PMIs for May. Forecasts suggest a decline in both manufacturing and services activity, which, if confirmed, may reignite concerns over slowing economic momentum in the U.S., possibly offsetting any hawkish interpretation of inflation data.

Key levels to watch:

Resistance: 1.3400 (critical barrier), 1.3450

Support: 1.3350, 1.3300

Market sentiment remains data driven, and the pair may continue to trade with elevated volatility through the week.

The Blueberry Team

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

The Blueberry Team

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.