So the idea revolves around the prev idea that I shared.

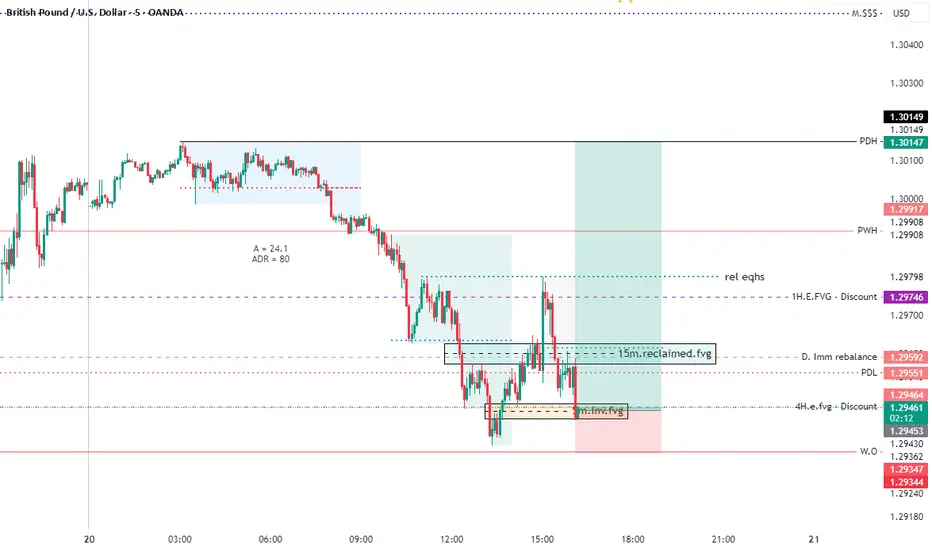

If the market melts below London low and W. ( Weekly open) I'ma know that I was wrong with my bias.

Remember that risk management is everything, so manage your trades responsibly

If the market melts below London low and W. ( Weekly open) I'ma know that I was wrong with my bias.

Remember that risk management is everything, so manage your trades responsibly

Trade active

Pretty big scare to some of you when it almost approached London low huh.Yea, no worries bout that esp when you are a novice or intermediate trader who's not mastered psychology in trading.

So, I wanna see the the market go above that 15 min reclaimed fvg and act as an institutional support area for the market to go and liquidate those rel eqhs

Note

I'ma reduce my stop now in a 1 min t.f and when the market liquidates those 5 min rel eqhs/ New York's high. I'ma B.E me trades

Trade closed manually

We're are in some kind of LRLR. So I suggest to close some partials to your trades too. Growing accounts sometimes ain't about hitting t.p's or being right every single time. Its about being there actively when you trade.

5 elements of a trade plan taught by ICT

1. Trade preparation

2. Opportunity discovery

3. Trade planning

4. Execution

5. Trade management.

And remember, Not every good trade has to be profitable & not every bad trade has to be a looser trade

#Psychology of the day

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.