GBP/USD: Technical Signals Point to Potential Bearish Reversal

In the early stages of the European session on Friday, GBP/USD is struggling to maintain its footing, trading below the 1.2925 mark as I compose this article. The pair faces pressure from a robust demand for the US dollar amid a backdrop of cautiousness from the Federal Reserve and prevailing economic uncertainties. This selling pressure persists despite the Bank of England's recent hawkish stance.

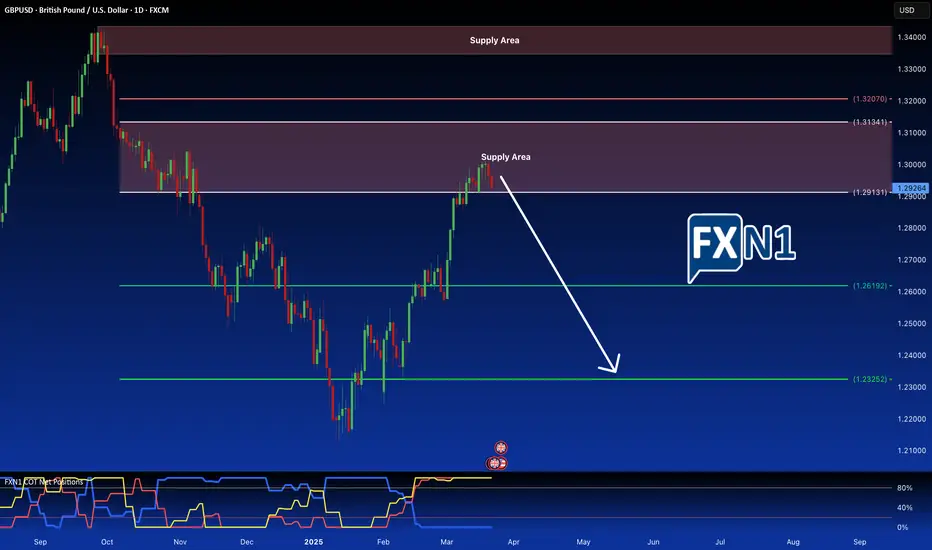

As market participants await insights from Federal Reserve officials as well as a speech from US President Trump in the Oval Office, attention is heightened. From a technical perspective, the currency pair has entered a supply zone, prompting expectations for a potential reversal and the commencement of a bearish trend.

✅ Please share your thoughts about GBP/USD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

As market participants await insights from Federal Reserve officials as well as a speech from US President Trump in the Oval Office, attention is heightened. From a technical perspective, the currency pair has entered a supply zone, prompting expectations for a potential reversal and the commencement of a bearish trend.

✅ Please share your thoughts about GBP/USD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Trade active

The Pound Sterling (GBP/USD - 6B1!) is currently hovering around the 1.2890 mark against the US Dollar (USD) during the European trading session on Wednesday. This movement comes in the wake of a disappointing Consumer Price Index (CPI) report for the UK for February, which showed a more significant decline in inflation than analysts had predicted.

The released data indicated that inflation has cooled at a faster pace, primarily driven by a substantial reduction in prices for clothing and footwear. This unexpected shift highlights the challenges the UK economy continues to face, as rising costs in other sectors have yet to stabilize. As a result, the market has responded with increased volatility, sending the Pound lower against the Dollar.

In our previous analysis, we noted particular levels of resistance that the price seemed to respond to, indicating a potential shift in market sentiment. Currently, the price action suggests that it has reacted to the identified supply area, raising the possibility of a bearish scenario unfolding. Traders and market participants are now closely monitoring developments, as further movement below the crucial 1.2900 level could trigger additional selling pressure and contribute to a downward trend in the Pound against the Dollar.

Overall, the economic landscape in the UK is delicate, with inflationary pressures behaving unexpectedly, prompting market participants to adjust their positions accordingly. How the GBP navigates through this bearish sentiment will be an important factor for traders in the coming days.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🔥 ZERO SPREAD BROKER: forexn1.com/usa/

🟪 Instagram: instagram.com/forexn1_com/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🔥 ZERO SPREAD BROKER: forexn1.com/usa/

🟪 Instagram: instagram.com/forexn1_com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🔥 ZERO SPREAD BROKER: forexn1.com/usa/

🟪 Instagram: instagram.com/forexn1_com/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🔥 ZERO SPREAD BROKER: forexn1.com/usa/

🟪 Instagram: instagram.com/forexn1_com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.