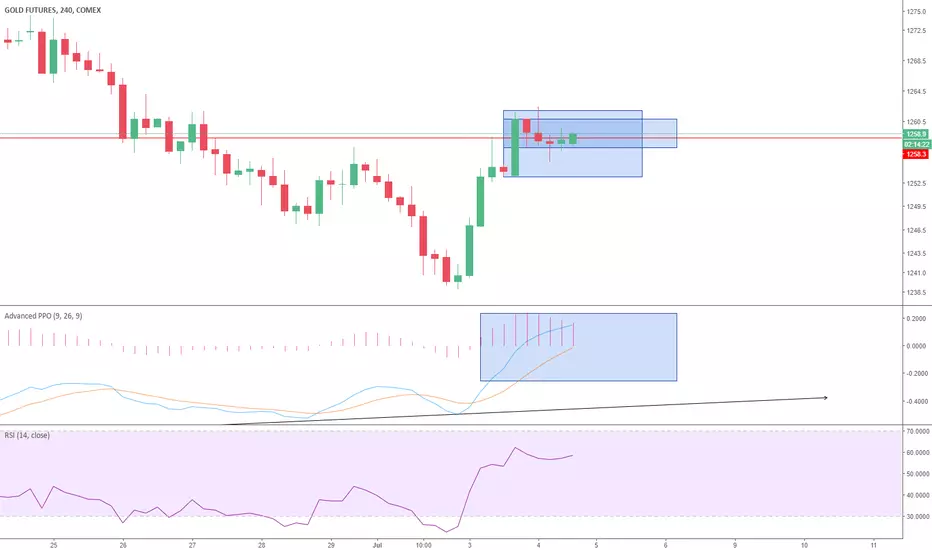

Gold has cooled off from a $20 bounce off a $60 drop, and has been consolidating at around 1258 area. If we look closely at the 4h chart, an inside bar was formed after the initial move to 1260 level, and price was pretty much faking both directions, showing that bulls cannot establish a higher high, while bears cannot establish a lower low. From technical point of view, a pullback seems more and more imminent as indicators on the hourly chart are starting to roll over, showing exhaustion. It is hard to bet which way gold will be going until the range is broken one way or the other. A trade can be designed once a candle is fully formed poking outside the range, which would carry us to the next important level for gold, either <1250 or >1270.

Note

Gold has pulled back to the bottom of the larger blue rectangle, but the selling was immediately followed by an outside bullish engulfing candle. Should this one close above the inner blue rectangle, and especially above the 1258 level, it will be very bullish for gold.Note

Still, top of the range remain key for gold.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.