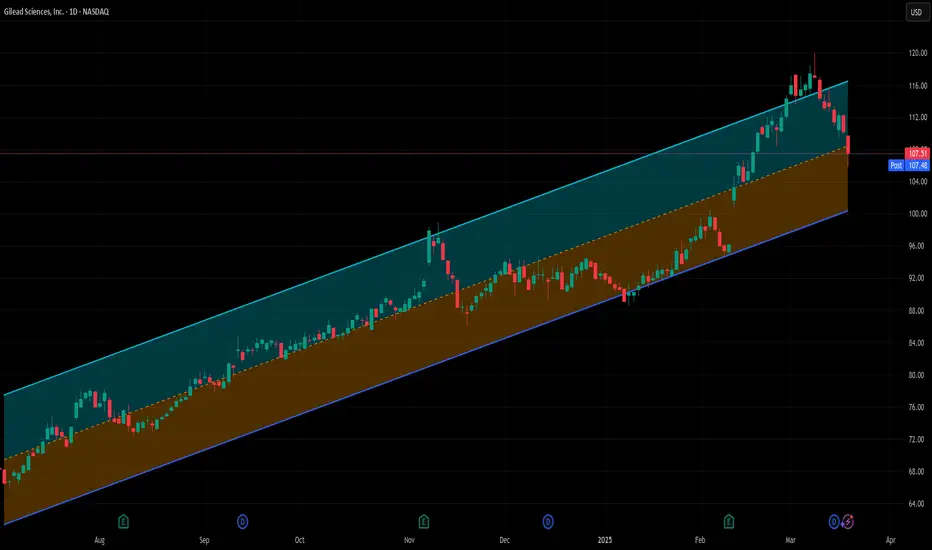

There is a lot NOT to like about this trade. Yes, I see how far it has run. Yes, I see how fast it is falling. Yes, I see the gap from 96 to 102 that “must” be filled. Yes, the market overall has been unhelpful of late. I realize all of it and I wouldn’t necessarily recommend anyone follow me on this trade because of all of that.

Here’s my “bull” case, such that it is with the way I trade. It's solidly in a long term uptrend. I know I’m jinxing myself with this, but GILD hasn’t had a trade with my system last longer than 5 days in almost a year. I did one last Friday that took 1 day to pay off, so going back so soon is REALLY tempting fate. But I am a slave to the data. The long term W/L record at this point is 988-0 for GILD.

The average gain for those trades is +2.55% in an average of 13 trading days. The vast majority have closed in 2 days or less. Those numbers are a compelling argument for me.

It is very possible, given the recent market action and its own price action, that this will be a longer than average trade in GILD. But it could also be like last Friday’s trade, too - one and done. There isn’t much else that is appealing to my algo right now - yesterday there was literally only one large cap stock that was a buy and it wasn’t in the top half of my rankings, so I didn’t trade it. Today this is one of fewer than 10, and the others are all lower tier stocks for me, historically.

So here’s hoping I catch lightning in a bottle twice in one week with this stock. Entered my initial position at the close for 107.51. Per my usual strategy, I'll add to my position at the close on any day it still rates as a “buy” and I will use FPC (first profitable close) to exit any lot on the day it closes at any profit.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

Here’s my “bull” case, such that it is with the way I trade. It's solidly in a long term uptrend. I know I’m jinxing myself with this, but GILD hasn’t had a trade with my system last longer than 5 days in almost a year. I did one last Friday that took 1 day to pay off, so going back so soon is REALLY tempting fate. But I am a slave to the data. The long term W/L record at this point is 988-0 for GILD.

The average gain for those trades is +2.55% in an average of 13 trading days. The vast majority have closed in 2 days or less. Those numbers are a compelling argument for me.

It is very possible, given the recent market action and its own price action, that this will be a longer than average trade in GILD. But it could also be like last Friday’s trade, too - one and done. There isn’t much else that is appealing to my algo right now - yesterday there was literally only one large cap stock that was a buy and it wasn’t in the top half of my rankings, so I didn’t trade it. Today this is one of fewer than 10, and the others are all lower tier stocks for me, historically.

So here’s hoping I catch lightning in a bottle twice in one week with this stock. Entered my initial position at the close for 107.51. Per my usual strategy, I'll add to my position at the close on any day it still rates as a “buy” and I will use FPC (first profitable close) to exit any lot on the day it closes at any profit.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

Note

Added a second lot today at the close for 105.87.Lots held:

Lot 1 - 107.51

Lot 2 - 105.87

Note

sold lot 2 at the close for 107.08 -- a 1.14% gain in 1 trading day.Lots held:

Lot 1 - 107.51

Trade closed: target reached

I decided to let GILD ripen overnight and just sold it for 108.68 for a 1.09% gain in 4+ trading days (let's call it 5). That closes the position entirely. The kind of trade I always expect, but lately haven't been getting.Note

Trade summary for my recordsWins 2 Losses 0

Avg gain per lot = 1.11%

Avg holding periods per lot = 3 days

Avg gain per lot per day held = 0.37%

Annualized RoR = .37% x 252 = +93%

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.