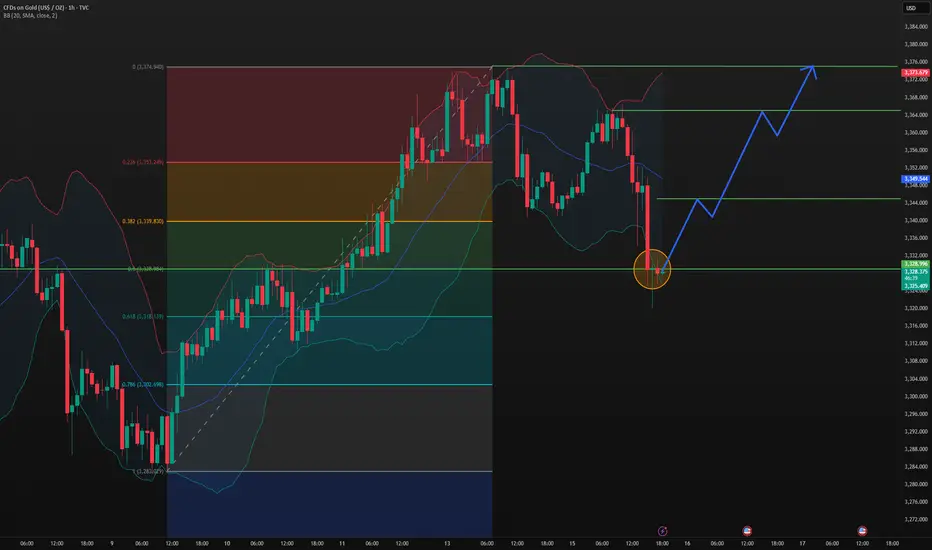

As the CPI data was released at 2.7%, which was in line with market expectations and the highest since February, it means that inflation will intensify and the probability of interest rate cuts will decrease, causing gold to fall rapidly in a short period of time.

From the trend point of view, the gold price fell below the support of 3340 and fluctuated around 3328.

From the Fibonacci retracement of the 3283-3374 upward trend, the 0.5 position is just around 3328.

If 3328 can be held, it is possible to test the previous high of 3375 again, or even break through.

I said before that the impact of CPI data is only temporary, and the decline will provide a lower buying position. Now that the impact of the data has been digested and stabilized, it will continue to rise next.

✅The trading strategy is as follows:

Buy at 3328

TP1: 3345

TP2: 3364

TP3: 3375

📣More detailed real-time trading strategies will be released on my channel.

🟢Go get it now! 👇👇👇

From the trend point of view, the gold price fell below the support of 3340 and fluctuated around 3328.

From the Fibonacci retracement of the 3283-3374 upward trend, the 0.5 position is just around 3328.

If 3328 can be held, it is possible to test the previous high of 3375 again, or even break through.

I said before that the impact of CPI data is only temporary, and the decline will provide a lower buying position. Now that the impact of the data has been digested and stabilized, it will continue to rise next.

✅The trading strategy is as follows:

Buy at 3328

TP1: 3345

TP2: 3364

TP3: 3375

📣More detailed real-time trading strategies will be released on my channel.

🟢Go get it now! 👇👇👇

Trade closed: target reached

The gold price rose as expected near 3328, and now the price is fluctuating at the suppression position of 3340-3345. I think it is time to close the position and lock in profits.The 3340-3345 area is still relatively important at present. As long as it can stand firm here, I think gold will really rise in the future, but it does not rule out the possibility of falling again after failing to break through. Therefore, it would be a good choice to stop profit in advance. When the market signals become clearer, we will re-enter the market.

📣More detailed real-time trading strategies will be released in the channel, welcome to join and get them

🟢Join the free Telegram group:

t.me/Reliable_Trading0

🟡Contact me to copy trading:

t.me/Reliable_Trading1

🟢Join the free Telegram group:

t.me/Reliable_Trading0

🟡Contact me to copy trading:

t.me/Reliable_Trading1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📣More detailed real-time trading strategies will be released in the channel, welcome to join and get them

🟢Join the free Telegram group:

t.me/Reliable_Trading0

🟡Contact me to copy trading:

t.me/Reliable_Trading1

🟢Join the free Telegram group:

t.me/Reliable_Trading0

🟡Contact me to copy trading:

t.me/Reliable_Trading1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.