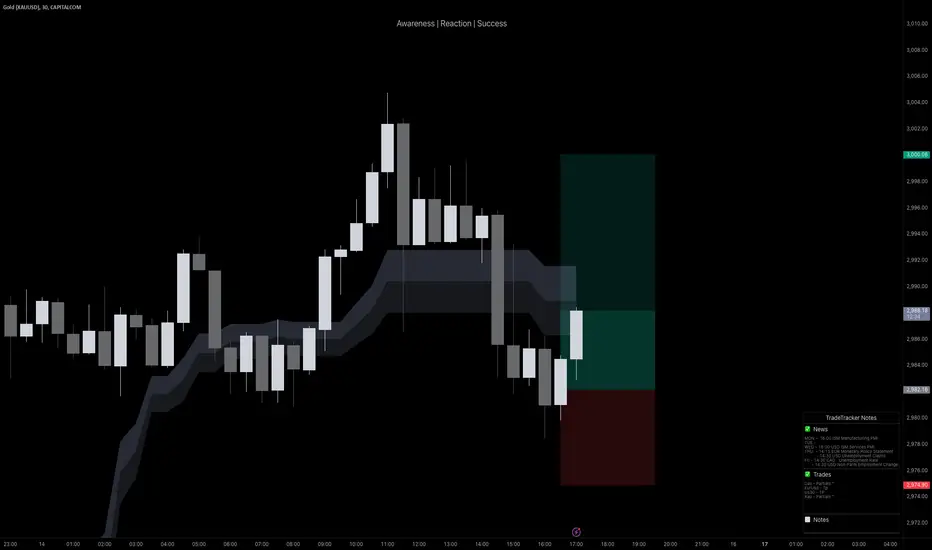

Gold has finally reached the psychological $3,000 level, triggering the first round of sell-offs as traders take profit. The question now is whether this move can sustain itself or if we are set for a deeper pullback. Given the rapid move up, I remain cautious, ready to cut the trade quickly if I see signs of weakness in the continuation.

Fundamentals:

• Market Sentiment: Bullish drivers remain strong as gold benefits from rising inflation expectations and the Fed’s rate pause, which has fueled demand for safe-haven assets.

• Geopolitical & Economic Factors:

• President Trump’s aggressive tariff agenda is fanning concerns about global trade, increasing risk aversion and driving flows into bullion-backed assets.

• Chinese jewelry stocks are soaring, signaling growing demand for gold in the region.

• The CME FedWatch Tool indicates a 97% probability that the Fed will hold rates steady at its next meeting, reinforcing gold’s appeal.

• Technical Considerations:

• Gold hit a fresh all-time high of $2,993, putting the psychological $3,000 mark in focus.

• Above $3,000, there is little historical price action to guide resistance levels, making price discovery uncertain.

• On the downside, $2,970 acts as a key pivot, with $2,951 and $2,914 serving as strong support zones if a deeper retracement occurs.

Risk Management:

• The first sell-off at $3,000 indicates short-term profit-taking.

• I am monitoring price action closely and will exit quickly if the move proves unsustainable.

Let’s see if gold can hold above $3,000 or if we are in for a correction!

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Fundamentals:

• Market Sentiment: Bullish drivers remain strong as gold benefits from rising inflation expectations and the Fed’s rate pause, which has fueled demand for safe-haven assets.

• Geopolitical & Economic Factors:

• President Trump’s aggressive tariff agenda is fanning concerns about global trade, increasing risk aversion and driving flows into bullion-backed assets.

• Chinese jewelry stocks are soaring, signaling growing demand for gold in the region.

• The CME FedWatch Tool indicates a 97% probability that the Fed will hold rates steady at its next meeting, reinforcing gold’s appeal.

• Technical Considerations:

• Gold hit a fresh all-time high of $2,993, putting the psychological $3,000 mark in focus.

• Above $3,000, there is little historical price action to guide resistance levels, making price discovery uncertain.

• On the downside, $2,970 acts as a key pivot, with $2,951 and $2,914 serving as strong support zones if a deeper retracement occurs.

Risk Management:

• The first sell-off at $3,000 indicates short-term profit-taking.

• I am monitoring price action closely and will exit quickly if the move proves unsustainable.

Let’s see if gold can hold above $3,000 or if we are in for a correction!

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Note

Gold trade is currently 0.27% in profit. On the order flow and market depth, price is testing VWAP, where it has been consistently rejected. If this level fails to hold, I will exit the trade in profit and look for a reentry on Monday. Enjoy the weekend and remember—pay yourself!Trade active

Gold opened the week with a strong move upward, pushing the position into 0.42% profit. I secured 80% of the position and will let the remaining trade play out under the same parameters. Enjoy the trading week and pay yourself!Trade closed: target reached

The position hit TP, reaching the 3K psychological level before facing a massive sell-off. A solid trade, but holding over the weekend added extra risk. Enjoy the trading week and keep showing up!Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.