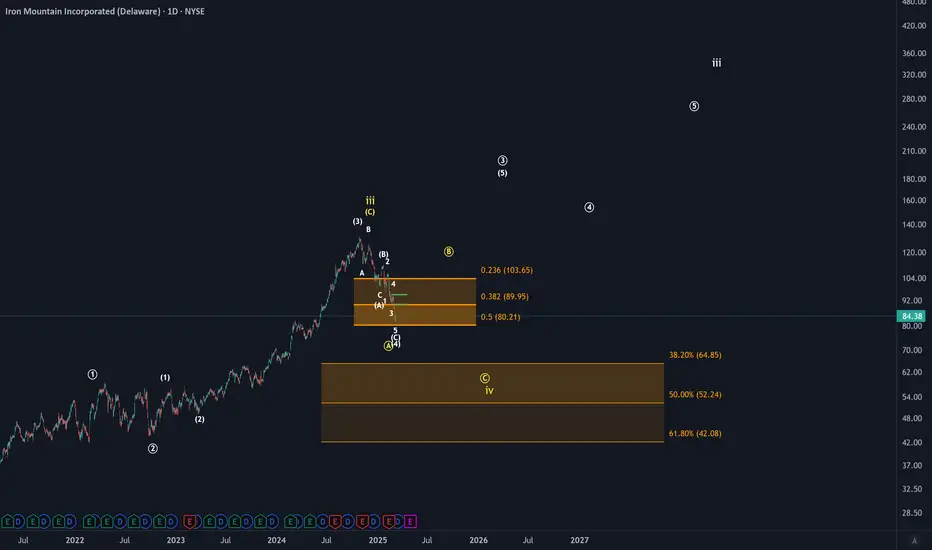

On the IRM chart, I'm currently tracking a potential bullish impulse unfolding, represented by the white scenario. According to this white scenario, we're in a fourth wave pullback within a larger third wave. However, it's critical for the price to remain above the $80 level; otherwise, the pullback would become too deep for this scenario to remain valid.

Alternatively, there's a broader wave-four correction underway, indicated by the yellow scenario. In this alternative perspective, we have deeper support levels at $64.85, $52.24, and crucially at $42. Although ideally, the price should hold above $42, technically, a diagonal pattern (which the yellow scenario would suggest) allows a deeper decline down to the 61.8% retracement level. The area around $42 also aligns with structural support.

On a shorter time frame, the price has reached the 50% retracement within the upper support area, and we now have enough waves to potentially consider wave C of the fourth wave in the white scenario as complete. Still, we'd need at least a break above the $90 level as an early indication that a low has been established. For now, this is an interesting price area to watch closely, but it's still too early to adopt a bullish stance with confidence.

Alternatively, there's a broader wave-four correction underway, indicated by the yellow scenario. In this alternative perspective, we have deeper support levels at $64.85, $52.24, and crucially at $42. Although ideally, the price should hold above $42, technically, a diagonal pattern (which the yellow scenario would suggest) allows a deeper decline down to the 61.8% retracement level. The area around $42 also aligns with structural support.

On a shorter time frame, the price has reached the 50% retracement within the upper support area, and we now have enough waves to potentially consider wave C of the fourth wave in the white scenario as complete. Still, we'd need at least a break above the $90 level as an early indication that a low has been established. For now, this is an interesting price area to watch closely, but it's still too early to adopt a bullish stance with confidence.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.