Nikkei Nears Historic Highs One Year After Its Steepest Drop in Three Decades

Ion Jauregui – Analyst at ActivTrades

The Nikkei 225 enters August trading above 41,500 points, approaching its all-time highs after recovering 26% from the lows recorded one year ago. In August 2024, the Japanese benchmark suffered its sharpest monthly drop in over 35 years, falling 12.4% due to domestic political uncertainty, global inflationary pressures, and tightening international monetary policy.

Twelve months later, the landscape has changed significantly. The resignation of the Japanese Prime Minister and the announcement of a new trade agreement between Japan and the United States have served as catalysts for a solid recovery that has restored investor confidence in Japanese financial markets.

Political Stability and External Momentum

The Prime Minister’s resignation, following the ruling coalition’s defeat in the Upper House elections, has reshaped the political scenario and paved the way for a new phase of moderate reforms. Simultaneously, U.S. President Donald Trump’s announcement of a 15% tariff on Japanese imports—including automobiles—has been interpreted by investors as a negotiated outcome that reduces the risk of a trade escalation.

Japan’s concessions to the U.S. can be seen as a means of avoiding a more significant conflict without committing to deep structural reforms. This has restored confidence not only in the Nikkei but also across Asian markets, albeit with renewed uncertainty this week.

Valuation and Outlook

According to Bloomberg's consensus forecasts, the index has a 12-month upside potential of 9%, with a target valuation around 45,133 points—above its previous historical high. However, only 48% of the companies in the index carry a buy recommendation, indicating the need for selective investment.

Companies such as Fujikura, IHI, Ryohin Keikaku, and Japan Steel Works have tripled their share prices since the August 2024 lows. Meanwhile, the automotive sector has seen sharp rebounds, with Subaru and Toyota posting gains above 15% in a single session following the trade agreement announcement.

Bond Market and Yen Pressures

The bond market’s reaction has been more cautious. Yields on Japanese government bonds have risen across the curve, with the 10-year JGB reaching 1.59%—its highest level in a decade. This reflects market expectations that the Bank of Japan may be forced to raise interest rates before year-end to offset fiscal pressures stemming from Japan’s new external investment commitments.

The yen is also under pressure following reports that Japan could invest up to $550 billion in U.S. infrastructure, potentially triggering capital outflows. This may affect the return of capital flows into Japan and influence index performance, particularly as the USD/JPY pair (nicknamed “Doruyen” in Japan) becomes increasingly relevant to carry-trade dynamics.

Technical Analysis

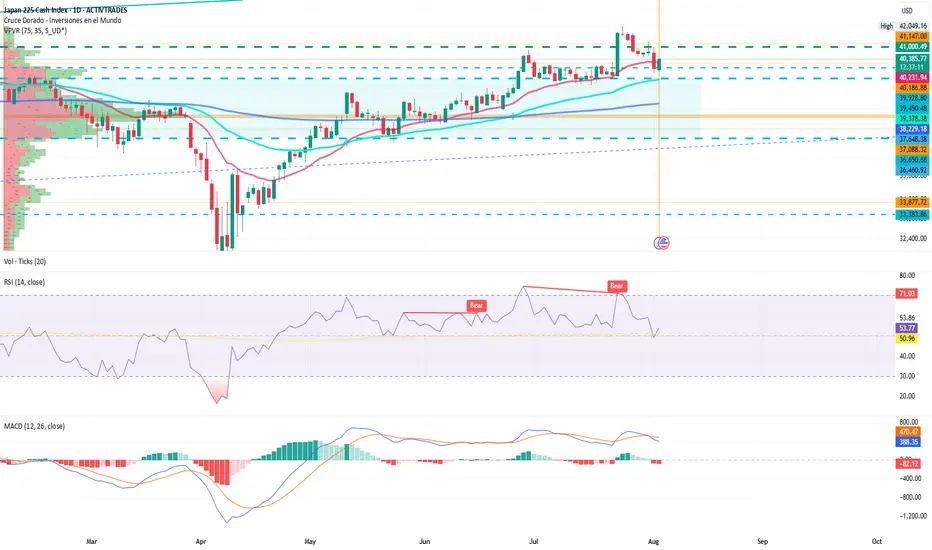

Asian trading began with a rebound from 39,727.15 points, extending gains into the European session and reaching 40,319.32 points. Technically, the index maintains a short-term bullish structure, though some indicators are beginning to show signs of momentum exhaustion.

In hourly charts, a notable technical signal has emerged: the 200-period moving average has crossed above the 100-period MA, an unusual move that may indicate a forthcoming pullback rather than continued short-term upside. This death cross, contrary to the classic golden cross pattern, although not visible yet on daily charts, suggests a phase of consolidation or correction in the coming sessions.

The RSI remains neutral at 53.41, showing no immediate signs of overbought or oversold conditions. Meanwhile, the MACD is trending downward, indicating growing bearish pressure.

Should this pressure materialize, key support levels are found near the point of control at 37,652, with further downside potential toward 36,658, where prior resistance may now serve as support. On the upside, a decisive break above 42,049.16 points would open the door to new record highs, reinforcing the long-term bullish trend established in 2024.

A Cautious Macro Environment

The Nikkei 225 has staged a remarkable recovery over the past year, driven by improvements in domestic politics and reduced trade tensions with the U.S. Nevertheless, structural risks remain—rising bond yields, a weaker yen, and major fiscal commitments could challenge both monetary policy and Japan’s economic competitiveness.

From a technical perspective, the index is nearing critical levels with mixed signals. While the underlying trend remains positive, the market could face short-term consolidation or correction, especially if pressure on the yen continues and the Bank of Japan signals policy tightening.

The Nikkei's performance for the remainder of 2025 will largely depend on the central bank’s response, global capital flows, and the stability of international trade relations. In this context, selective investment and disciplined technical analysis will be essential to identify opportunities without incurring excessive risk.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

Ion Jauregui – Analyst at ActivTrades

The Nikkei 225 enters August trading above 41,500 points, approaching its all-time highs after recovering 26% from the lows recorded one year ago. In August 2024, the Japanese benchmark suffered its sharpest monthly drop in over 35 years, falling 12.4% due to domestic political uncertainty, global inflationary pressures, and tightening international monetary policy.

Twelve months later, the landscape has changed significantly. The resignation of the Japanese Prime Minister and the announcement of a new trade agreement between Japan and the United States have served as catalysts for a solid recovery that has restored investor confidence in Japanese financial markets.

Political Stability and External Momentum

The Prime Minister’s resignation, following the ruling coalition’s defeat in the Upper House elections, has reshaped the political scenario and paved the way for a new phase of moderate reforms. Simultaneously, U.S. President Donald Trump’s announcement of a 15% tariff on Japanese imports—including automobiles—has been interpreted by investors as a negotiated outcome that reduces the risk of a trade escalation.

Japan’s concessions to the U.S. can be seen as a means of avoiding a more significant conflict without committing to deep structural reforms. This has restored confidence not only in the Nikkei but also across Asian markets, albeit with renewed uncertainty this week.

Valuation and Outlook

According to Bloomberg's consensus forecasts, the index has a 12-month upside potential of 9%, with a target valuation around 45,133 points—above its previous historical high. However, only 48% of the companies in the index carry a buy recommendation, indicating the need for selective investment.

Companies such as Fujikura, IHI, Ryohin Keikaku, and Japan Steel Works have tripled their share prices since the August 2024 lows. Meanwhile, the automotive sector has seen sharp rebounds, with Subaru and Toyota posting gains above 15% in a single session following the trade agreement announcement.

Bond Market and Yen Pressures

The bond market’s reaction has been more cautious. Yields on Japanese government bonds have risen across the curve, with the 10-year JGB reaching 1.59%—its highest level in a decade. This reflects market expectations that the Bank of Japan may be forced to raise interest rates before year-end to offset fiscal pressures stemming from Japan’s new external investment commitments.

The yen is also under pressure following reports that Japan could invest up to $550 billion in U.S. infrastructure, potentially triggering capital outflows. This may affect the return of capital flows into Japan and influence index performance, particularly as the USD/JPY pair (nicknamed “Doruyen” in Japan) becomes increasingly relevant to carry-trade dynamics.

Technical Analysis

Asian trading began with a rebound from 39,727.15 points, extending gains into the European session and reaching 40,319.32 points. Technically, the index maintains a short-term bullish structure, though some indicators are beginning to show signs of momentum exhaustion.

In hourly charts, a notable technical signal has emerged: the 200-period moving average has crossed above the 100-period MA, an unusual move that may indicate a forthcoming pullback rather than continued short-term upside. This death cross, contrary to the classic golden cross pattern, although not visible yet on daily charts, suggests a phase of consolidation or correction in the coming sessions.

The RSI remains neutral at 53.41, showing no immediate signs of overbought or oversold conditions. Meanwhile, the MACD is trending downward, indicating growing bearish pressure.

Should this pressure materialize, key support levels are found near the point of control at 37,652, with further downside potential toward 36,658, where prior resistance may now serve as support. On the upside, a decisive break above 42,049.16 points would open the door to new record highs, reinforcing the long-term bullish trend established in 2024.

A Cautious Macro Environment

The Nikkei 225 has staged a remarkable recovery over the past year, driven by improvements in domestic politics and reduced trade tensions with the U.S. Nevertheless, structural risks remain—rising bond yields, a weaker yen, and major fiscal commitments could challenge both monetary policy and Japan’s economic competitiveness.

From a technical perspective, the index is nearing critical levels with mixed signals. While the underlying trend remains positive, the market could face short-term consolidation or correction, especially if pressure on the yen continues and the Bank of Japan signals policy tightening.

The Nikkei's performance for the remainder of 2025 will largely depend on the central bank’s response, global capital flows, and the stability of international trade relations. In this context, selective investment and disciplined technical analysis will be essential to identify opportunities without incurring excessive risk.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.