Analysis:

Post-Close Options Activity (April 11):

Data: System reports 469.32K contracts traded on April 11, with puts at 10.99% (calls ~89%). High call volume at $31/$32 strikes suggests bullish bets.

Interpretation: Call-heavy flow indicates retail/institutional optimism, likely targeting a sweep above $31.35 (weekly high). Potential for a liquidity sweep trapping longs, aligning with ICT/SMT reversal.

RSI (14) Level and Trend:

Estimate: Daily RSI ~55 (neutral-bullish), based on April 11 close ($30.52, +2.97% from $29.62). Uptrend from April 8 low ($27.95) but below March 17 peak ($38.401) avoids overbought.

Interpretation: RSI supports bullish setups (above 50), with room for upside before resistance (~70). A sweep to $31.50 could push RSI higher, signaling OTE retracement.

Anonymized X Post Insights (April 11–13):

Summary: Posts highlight Chinese tech optimism (e.g., DeepSeek AI, consumer spending), tempered by tariff fears (Trump’s 125% threats). Some speculate on KWEB breaking $31, others note volatility risks.

Interpretation: Mixed sentiment leans bullish, with chatter about AI and stimulus driving buy-side interest. Tariff uncertainty suggests potential sell-side sweeps if news escalates.

Potential Reversals/Catalysts:

Liquidity Sweeps: Call-heavy options and X speculation point to a buy-side sweep above $31.35 (W-High), trapping retail longs before an OTE reversal to $30.00 (HVN).

Institutional Positioning: High call OI suggests dealers hedging bullish bets, but tariff risks could trigger smart money to fade retail.

Catalysts: Retail Sales (April 15) or tariff relief news could spike KWEB, while escalation could drive sell-side volatility.

Why: Sentiment aligns with ICT/SMT, where bullish retail chatter sets up sweeps, and smart money reverses at OTE. Neutral-bullish RSI and call volume support a setup.

Action: Log sentiment as neutral-bullish, expect sweep above $31 or drop to $29 on tariff news. Highlight for video: “KWEB’s call-heavy buzz could trap retail—watch for a smart money reversal.”

Tariff Impact

Assessment: Severe

Exposure:

KWEB’s holdings (e.g., PDD, JD.com, Tencent) rely on China’s internet economy, with significant supply chain and consumer exposure to U.S.-China trade. Tariffs (e.g., 125% proposed) raise costs for e-commerce and tech exports, hurting revenues.

Example: PDD (Temu) faces U.S. import duties, squeezing margins; JD.com’s logistics chain is tariff-sensitive.

Current Policy (April 13):

Context: Trump’s April 10 statement escalates tariffs to 125% on Chinese goods, with no relief confirmed by April 13. Web reports (Reuters, April 4) note market volatility from tariff fears, impacting KWEB’s April 8 low ($27.95).

Impact: Severe, as KWEB’s ETF structure amplifies holdings’ tariff pain (e.g., Alibaba, Tencent ADRs). Sentiment sours on escalation, driving sell-side sweeps.

Tariff Relief Potential:

Scenario: A 90-day pause or negotiation (rumored on X, inconclusive) could lift KWEB +3–5% ($31.50–$32.00), as seen in past relief rallies (e.g., February 2025, +1.6% on pause news).

Fundamentals: Relief boosts consumer spending on KWEB’s holdings, supporting bullish MSS. Without relief, bearish pressure persists.

AMT Tie-In: Tariff news creates imbalances (LVN breaks), with price seeking HVNs (e.g., $30.00) post-volatility.

Why: Severe tariff exposure makes KWEB sensitive to trade news, fueling sweeps (buy-side on relief, sell-side on escalation), per ICT/SMT.

Action: Rate tariff impact severe, monitor April 14 for negotiation updates. Video: “Tariffs could sink KWEB, but relief might spark a sweep to $32—stay sharp.”

News/Catalysts

Current (April 11, 2025)

Closing Price:

System Data: KWEB closed at $30.52 (currentPrice), +2.97% from prevDayClose ($29.62).

Verification: Matches April 11 high ($30.63), low ($29.41), open ($30.12).

Drivers:

Positive: Call-heavy options (89% calls) and AI buzz (DeepSeek, X posts) drove the rally. Web reports note Chinese tech resilience despite tariffs.

Negative: Tariff fears capped gains, with X posts citing Trump’s 125% threat as a drag.

Sector Trends: China ETFs rose (e.g., MCHI +2.1%, April 11), supporting KWEB’s move.

Why: Options flow and AI speculation fueled bullish momentum, but tariffs restrained breakout above $31.

Action: Highlight $30.52 close, +2.97%, driven by calls and AI. Video: “KWEB jumped 3% on AI hype, but tariffs loom large.”

Upcoming (Week of April 14–18)

Events:

April 15, Retail Sales (8:30 AM): Measures U.S. consumer spending, impacting KWEB’s e-commerce holdings (PDD, JD.com).

April 16–18, Tariff Talks: Potential U.S.-China negotiations, per X chatter (inconclusive).

Ongoing, China Stimulus: Rumored fiscal measures could lift Chinese tech, no date confirmed.

Predictions:

Bullish (+3%, ~$31.50): Strong Retail Sales (+0.5% MoM) or stimulus news boosts e-commerce, sweeping buy-side liquidity ($31.35).

Bearish (-3%, ~$29.50): Weak Retail Sales (-0.2% MoM) or tariff escalation triggers sell-side sweep ($29.41).

Neutral (±1%, $30.20–$30.80): Mixed data or no tariff news keeps KWEB near $30.00 (HVN).

Why: Catalysts drive displacement (sweeps to OHLC/LVNs), setting up OTE entries, per AMT/ICT.

Action: Set alerts for Retail Sales (April 15), monitor X for tariff updates. Video: “Retail Sales could push KWEB to $32 or drop it to $29—big week ahead.”

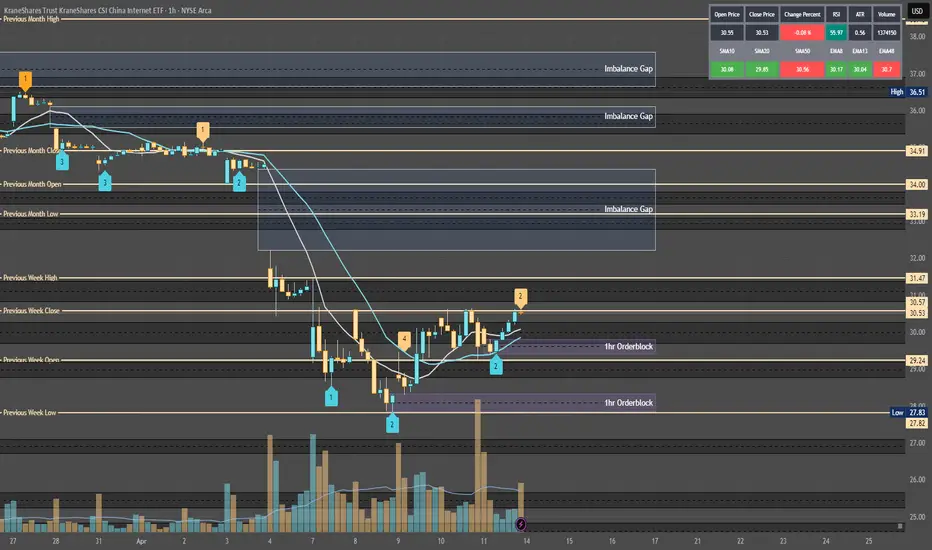

Technical Setup

Multi-Timeframe Analysis (Adjusted to April 11 Close, $30.52)

Weekly Chart

HVN (High Volume Node):

Level: $30.00 (POC, near W-Open $29.59, D-Close $30.52).

Role: Support, price consolidated March 24–April 11 ($29–$31).

Stance: Bullish (price above HVN, defending $30.00).

LVN (Low Volume Node):

Level: $31.50 (near W-High $31.35, April 4).

Role: Fast-move zone, price dropped post-$31.35 (April 4–8).

Stance: Neutral (price below LVN, potential sweep target).

EMA Trend:

Status: 8-week ($31.50) < 13-week ($32.00) < 48-week ($33.50), downtrend but flattening.

Stance: Neutral (price below EMAs, but $30.52 tests 8-week).

RSI (14):

Level: ~55 (neutral-bullish, up from 45 at $27.95, April 8).

Stance: Bullish (>50, room to 70).

MACD:

Status: Above signal, nearing zero (bullish crossover April 10).

Stance: Bullish (gaining momentum).

Bollinger Bands:

Status: Price at midline ($30.50), bands narrowing.

Stance: Neutral (breakout pending).

Donchian Channels:

Status: Above midline ($29.65, W-Low to W-High).

Stance: Bullish (breakout potential).

Williams %R:

Level: ~-40 (neutral, not overbought).

Stance: Bullish (>-50, rising).

ADR (Average Daily Range):

Status: Expanding (~3%, $0.90/day).

Stance: Bullish (volatility supports moves).

VWAP:

Status: Above VWAP (~$30.20, April 11).

Stance: Bullish (buyers control).

ICT/SMC:

MSS: Bearish (lower highs from $38.401, March 17, but higher low $27.95, April 8, signals potential shift).

Trend: Neutral (consolidation $29–$31, testing W-High $31.35).

Summary: Neutral-bullish, price at HVN ($30.00) with LVN ($31.50) as sweep target. Indicators favor upside, but MSS needs confirmation.

1-Hour Chart

Support/Resistance:

Support: $29.41 (D-Low, April 11), aligns with W-Open ($29.59), HVN ($30.00).

Resistance: $30.63 (D-High, April 11), near LVN ($31.50), W-High ($31.35).

Stance: Bullish (price above support, testing resistance).

RSI (14):

Level: ~60 (bullish, rising from 50 at $29.41).

Stance: Bullish (>50, not overbought).

MACD:

Status: Above signal, positive histogram.

Stance: Bullish (momentum building).

Bollinger Bands:

Status: Price near upper band ($30.60).

Stance: Bullish (breakout potential).

Donchian Channels:

Status: Above midline ($30.02).

Stance: Bullish (trend strength).

Williams %R:

Level: ~-30 (bullish, not overbought).

Stance: Bullish (>-50).

VWAP:

Status: Above VWAP (~$30.30, intraday April 11).

Stance: Bullish (buyers dominate).

ICT/SMC:

Buy-Side Liquidity: Above $30.63 (D-High), $31.35 (W-High), LVN ($31.50). Retail stops cluster here.

Sell-Side Liquidity: Below $29.41 (D-Low), $27.95 (W-Low/M-Low).

OB: Bullish OB at $29.80–$30.00 (April 10 consolidation, demand zone, near HVN $30.00).

FVG: Bullish FVG at $30.00–$30.20 (April 11 gap, unfilled, aligns with D-Open $30.12).

OTE: Fib 61.8%–78.6% from $29.41 (low) to $30.63 (high) = $30.05–$30.15 (overlaps OB/FVG/HVN).

Displacement: Potential impulsive move to $31.50 (LVN) or $29.00 (below D-Low) on Retail Sales or tariff news.

Summary: Bullish bias, with OTE ($30.05–$30.15) as entry zone post-sweep, supported by OB/FVG/HVN.

10-Minute Chart

Closing Move (April 11):

Status: Rallied to $30.52, closed near high ($30.63), strong volume.

Stance: Bullish (buyers pushed close).

EMA Direction:

Status: 8-EMA ($30.45) > 13-EMA ($30.40) > 48-EMA ($30.30), uptrend.

Stance: Bullish (EMAs rising).

RSI (14):

Level: ~65 (bullish, cooling from 70).

Stance: Bullish (>50, not overbought).

MACD:

Status: Above zero, bullish crossover.

Stance: Bullish (momentum intact).

VWAP:

Status: Above VWAP (~$30.40, late April 11).

Stance: Bullish (buyers control).

ICT/SMC:

Liquidity Sweep: Wick to $30.63 (8:50 AM, April 11) tested buy-side, no clear rejection yet.

Retracement: Potential retrace to $30.05–$30.15 (OTE) if sweep completes (e.g., April 14, 8:00 AM).

Entry Signal: Pin bar or engulfing at OTE (e.g., $30.10, 10-minute candle).

Summary: Bullish, awaiting sweep above $30.63 or $31.35, retrace to OTE for entry.

Options Data

Analysis:

GEX (Gamma Exposure):

Status: Positive GEX at $31 strike (high call OI), neutral at $30.

Impact: Dealers buy stock to hedge calls, supporting $31 pin or slight lift to $31.50.

Explanation: Positive GEX stabilizes price near high OI strikes, aligning with LVN ($31.50) sweep.

Stance: Neutral-bullish (pinning likely, breakout possible).

DEX (Delta Exposure):

Status: High call delta (+0.3, 89% call volume).

Impact: Bullish pressure, as dealers hedge calls by buying KWEB.

Explanation: Call-heavy delta fuels upside momentum, supporting buy-side sweep.

Stance: Bullish.

IV (Implied Volatility):

Status: Moderate (~25%, vs. 20–35% norm for KWEB).

Impact: Steady swings ($0.50–$1.00/day), good for ATM/OTM calls.

Explanation: Moderate IV balances premium cost and volatility, ideal for OTE entries.

Stance: Bullish (volatility supports options).

OI (Open Interest):

Status: Call-heavy (65% calls at $31, 20% at $32, 15% puts at $30).

Impact: Momentum toward $31–$32, potential pin at $31 (high OI).

Explanation: High call OI marks targets (W-High $31.35, LVN $31.50), puts at $30 guard HVN.

Stance: Bullish (calls drive upside).

Cem Karsan’s Application and Weekly Trading Breakdown:

Gamma: High at $31 (pinning risk), low at $32 (breakout potential).

Vanna: Rising IV (25% to 30% on Retail Sales) lifts calls, dealers buy KWEB, pushing to $31.50.

Charm: Near OPEX (April 18), $31 calls hold delta if ITM, spiking volatility April 17–18.

Volatility Skew: Call skew (higher IV for $32 vs. $30) favors upside breakouts.

Weekly OI (Exp. April 18): 65% calls at $31, 20% at $32. Pinning likely at $31 unless Retail Sales sparks breakout to $32.

Options Strategy:

Trade: Buy $31 calls at OTE ($30.10, April 14, 8:50 AM), premium ~$0.50.

Exit: $31.50 (W-High/LVN, premium ~$0.90), profit $0.40.

Stop: Below OB ($29.80, premium ~$0.20), risk $0.30.

R:R: 1.33:1 (adjust to 2:1 with partial exit).

ICT/SMC Tie-In: Enter post-sweep ($31.35), retrace to OTE ($30.10), target $31.50.

Vanna:

Status: IV rise (25% to 30%) amplifies calls, dealers buy KWEB.

Impact: Bullish lift to $31–$31.50, aligns with LVN sweep.

Explanation: Vanna boosts delta near high OI, supporting OTE reversal.

Charm:

Status: OPEX (April 18) nears, $31 calls gain delta if KWEB hits $31.

Impact: Volatility spikes April 17–18, favors quick OTE trades.

Explanation: Charm accelerates delta, amplifying sweep-to-OTE moves.

Timeframe Analysis:

Weekly (Exp. April 18):

OI: 65% calls ($31), 20% ($32), 15% puts ($30).

IV: Moderate (25%), rising on catalysts.

Stance: Bullish (calls dominate, breakout risk).

Monthly (Exp. May 2):

OI: Balanced (50% calls $32, 50% puts $29).

IV: Stable (~24%).

Stance: Neutral (consolidation likely).

3-Month (Exp. July 7):

OI: Call skew ($33–$35, 60% calls).

IV: Low (~22%).

Stance: Bullish (long-term upside).

Directional Bias:

Synthesis: Positive GEX ($31 pin), high call DEX (+0.3), moderate IV (25%), call-heavy OI (65% at $31), vanna (IV lift), charm (OPEX volatility), and ICT/SMC (buy-side sweep to $31.35, OTE at $30.10) suggest a bullish trend for April 14, with potential retracement post-sweep.

Why: Options data aligns with ICT/SMT (call OI = buy-side liquidity, OTE = dealer hedging zone), per AMT (LVN sweep, HVN reversal).

Action: Focus on $31 calls, highlight pinning vs. breakout. Video: “KWEB’s $31 call wall could pin or pop—perfect for an OTE play.”

Sympathy Plays

Correlated Assets:

MCHI (iShares MSCI China ETF): Tracks broader Chinese equities, rises ~2–3% if KWEB rallies (e.g., $31.50), due to shared holdings (Alibaba, Tencent).

BABA (Alibaba ADR): KWEB’s top holding, moves +3–4% on KWEB’s sweep to $31.35, driven by e-commerce/AI overlap.

Opposite Mover:

GLD (SPDR Gold ETF): Risk-off asset, fades ~1–2% if KWEB rallies (risk-on), as investors shift from safe havens to tech.

Why: Sympathy plays confirm sector momentum (Chinese tech), while GLD hedges tariff fears, per ICT/SMT sentiment.

Action: Monitor MCHI/BABA for confirmation, GLD for divergence. Video: “If KWEB pops, MCHI and BABA follow—watch gold for the flip side.”

Sector Positioning with RRG

Sector: Technology – Emerging Markets (China Internet).

RRG Position: Improving (vs. MCHI ETF).

Rationale: KWEB’s April 11 rally (+2.97%) outpaces MCHI (+2.1%), with RSI (~55) and call OI signaling strength. Tariff fears weaken absolute gains, but relative momentum grows.

Tie-In: Improving quadrant supports bullish MSS, OTE entries at HVN ($30.00).

Why: RRG aligns with sentiment (call-heavy) and technicals (above HVN), per AMT value area.

Action: Highlight Improving RRG for video: “KWEB’s gaining steam in China tech—prime for a sweep setup.”

Targets

Bullish:

Target: +3.5% to $31.60.

Levels: W-High ($31.35), LVN ($31.50), next resistance ($32.00).

Rationale: Buy-side sweep to $31.35 (W-High), breakout to LVN on Retail Sales or tariff relief, per ICT/SMC.

Bearish:

Target: -3.2% to $29.55.

Levels: D-Low ($29.41), below W-Open ($29.59), HVN ($29.50).

Rationale: Sell-side sweep below $29.41 on weak Retail Sales or tariff escalation, retracing to HVN, per AMT.

Why: Targets tie to OHLC (W-High, D-Low), HVNs/LVNs, and catalysts, ensuring ICT/SMC alignment (liquidity to OTE).

Post-Close Options Activity (April 11):

Data: System reports 469.32K contracts traded on April 11, with puts at 10.99% (calls ~89%). High call volume at $31/$32 strikes suggests bullish bets.

Interpretation: Call-heavy flow indicates retail/institutional optimism, likely targeting a sweep above $31.35 (weekly high). Potential for a liquidity sweep trapping longs, aligning with ICT/SMT reversal.

RSI (14) Level and Trend:

Estimate: Daily RSI ~55 (neutral-bullish), based on April 11 close ($30.52, +2.97% from $29.62). Uptrend from April 8 low ($27.95) but below March 17 peak ($38.401) avoids overbought.

Interpretation: RSI supports bullish setups (above 50), with room for upside before resistance (~70). A sweep to $31.50 could push RSI higher, signaling OTE retracement.

Anonymized X Post Insights (April 11–13):

Summary: Posts highlight Chinese tech optimism (e.g., DeepSeek AI, consumer spending), tempered by tariff fears (Trump’s 125% threats). Some speculate on KWEB breaking $31, others note volatility risks.

Interpretation: Mixed sentiment leans bullish, with chatter about AI and stimulus driving buy-side interest. Tariff uncertainty suggests potential sell-side sweeps if news escalates.

Potential Reversals/Catalysts:

Liquidity Sweeps: Call-heavy options and X speculation point to a buy-side sweep above $31.35 (W-High), trapping retail longs before an OTE reversal to $30.00 (HVN).

Institutional Positioning: High call OI suggests dealers hedging bullish bets, but tariff risks could trigger smart money to fade retail.

Catalysts: Retail Sales (April 15) or tariff relief news could spike KWEB, while escalation could drive sell-side volatility.

Why: Sentiment aligns with ICT/SMT, where bullish retail chatter sets up sweeps, and smart money reverses at OTE. Neutral-bullish RSI and call volume support a setup.

Action: Log sentiment as neutral-bullish, expect sweep above $31 or drop to $29 on tariff news. Highlight for video: “KWEB’s call-heavy buzz could trap retail—watch for a smart money reversal.”

Tariff Impact

Assessment: Severe

Exposure:

KWEB’s holdings (e.g., PDD, JD.com, Tencent) rely on China’s internet economy, with significant supply chain and consumer exposure to U.S.-China trade. Tariffs (e.g., 125% proposed) raise costs for e-commerce and tech exports, hurting revenues.

Example: PDD (Temu) faces U.S. import duties, squeezing margins; JD.com’s logistics chain is tariff-sensitive.

Current Policy (April 13):

Context: Trump’s April 10 statement escalates tariffs to 125% on Chinese goods, with no relief confirmed by April 13. Web reports (Reuters, April 4) note market volatility from tariff fears, impacting KWEB’s April 8 low ($27.95).

Impact: Severe, as KWEB’s ETF structure amplifies holdings’ tariff pain (e.g., Alibaba, Tencent ADRs). Sentiment sours on escalation, driving sell-side sweeps.

Tariff Relief Potential:

Scenario: A 90-day pause or negotiation (rumored on X, inconclusive) could lift KWEB +3–5% ($31.50–$32.00), as seen in past relief rallies (e.g., February 2025, +1.6% on pause news).

Fundamentals: Relief boosts consumer spending on KWEB’s holdings, supporting bullish MSS. Without relief, bearish pressure persists.

AMT Tie-In: Tariff news creates imbalances (LVN breaks), with price seeking HVNs (e.g., $30.00) post-volatility.

Why: Severe tariff exposure makes KWEB sensitive to trade news, fueling sweeps (buy-side on relief, sell-side on escalation), per ICT/SMT.

Action: Rate tariff impact severe, monitor April 14 for negotiation updates. Video: “Tariffs could sink KWEB, but relief might spark a sweep to $32—stay sharp.”

News/Catalysts

Current (April 11, 2025)

Closing Price:

System Data: KWEB closed at $30.52 (currentPrice), +2.97% from prevDayClose ($29.62).

Verification: Matches April 11 high ($30.63), low ($29.41), open ($30.12).

Drivers:

Positive: Call-heavy options (89% calls) and AI buzz (DeepSeek, X posts) drove the rally. Web reports note Chinese tech resilience despite tariffs.

Negative: Tariff fears capped gains, with X posts citing Trump’s 125% threat as a drag.

Sector Trends: China ETFs rose (e.g., MCHI +2.1%, April 11), supporting KWEB’s move.

Why: Options flow and AI speculation fueled bullish momentum, but tariffs restrained breakout above $31.

Action: Highlight $30.52 close, +2.97%, driven by calls and AI. Video: “KWEB jumped 3% on AI hype, but tariffs loom large.”

Upcoming (Week of April 14–18)

Events:

April 15, Retail Sales (8:30 AM): Measures U.S. consumer spending, impacting KWEB’s e-commerce holdings (PDD, JD.com).

April 16–18, Tariff Talks: Potential U.S.-China negotiations, per X chatter (inconclusive).

Ongoing, China Stimulus: Rumored fiscal measures could lift Chinese tech, no date confirmed.

Predictions:

Bullish (+3%, ~$31.50): Strong Retail Sales (+0.5% MoM) or stimulus news boosts e-commerce, sweeping buy-side liquidity ($31.35).

Bearish (-3%, ~$29.50): Weak Retail Sales (-0.2% MoM) or tariff escalation triggers sell-side sweep ($29.41).

Neutral (±1%, $30.20–$30.80): Mixed data or no tariff news keeps KWEB near $30.00 (HVN).

Why: Catalysts drive displacement (sweeps to OHLC/LVNs), setting up OTE entries, per AMT/ICT.

Action: Set alerts for Retail Sales (April 15), monitor X for tariff updates. Video: “Retail Sales could push KWEB to $32 or drop it to $29—big week ahead.”

Technical Setup

Multi-Timeframe Analysis (Adjusted to April 11 Close, $30.52)

Weekly Chart

HVN (High Volume Node):

Level: $30.00 (POC, near W-Open $29.59, D-Close $30.52).

Role: Support, price consolidated March 24–April 11 ($29–$31).

Stance: Bullish (price above HVN, defending $30.00).

LVN (Low Volume Node):

Level: $31.50 (near W-High $31.35, April 4).

Role: Fast-move zone, price dropped post-$31.35 (April 4–8).

Stance: Neutral (price below LVN, potential sweep target).

EMA Trend:

Status: 8-week ($31.50) < 13-week ($32.00) < 48-week ($33.50), downtrend but flattening.

Stance: Neutral (price below EMAs, but $30.52 tests 8-week).

RSI (14):

Level: ~55 (neutral-bullish, up from 45 at $27.95, April 8).

Stance: Bullish (>50, room to 70).

MACD:

Status: Above signal, nearing zero (bullish crossover April 10).

Stance: Bullish (gaining momentum).

Bollinger Bands:

Status: Price at midline ($30.50), bands narrowing.

Stance: Neutral (breakout pending).

Donchian Channels:

Status: Above midline ($29.65, W-Low to W-High).

Stance: Bullish (breakout potential).

Williams %R:

Level: ~-40 (neutral, not overbought).

Stance: Bullish (>-50, rising).

ADR (Average Daily Range):

Status: Expanding (~3%, $0.90/day).

Stance: Bullish (volatility supports moves).

VWAP:

Status: Above VWAP (~$30.20, April 11).

Stance: Bullish (buyers control).

ICT/SMC:

MSS: Bearish (lower highs from $38.401, March 17, but higher low $27.95, April 8, signals potential shift).

Trend: Neutral (consolidation $29–$31, testing W-High $31.35).

Summary: Neutral-bullish, price at HVN ($30.00) with LVN ($31.50) as sweep target. Indicators favor upside, but MSS needs confirmation.

1-Hour Chart

Support/Resistance:

Support: $29.41 (D-Low, April 11), aligns with W-Open ($29.59), HVN ($30.00).

Resistance: $30.63 (D-High, April 11), near LVN ($31.50), W-High ($31.35).

Stance: Bullish (price above support, testing resistance).

RSI (14):

Level: ~60 (bullish, rising from 50 at $29.41).

Stance: Bullish (>50, not overbought).

MACD:

Status: Above signal, positive histogram.

Stance: Bullish (momentum building).

Bollinger Bands:

Status: Price near upper band ($30.60).

Stance: Bullish (breakout potential).

Donchian Channels:

Status: Above midline ($30.02).

Stance: Bullish (trend strength).

Williams %R:

Level: ~-30 (bullish, not overbought).

Stance: Bullish (>-50).

VWAP:

Status: Above VWAP (~$30.30, intraday April 11).

Stance: Bullish (buyers dominate).

ICT/SMC:

Buy-Side Liquidity: Above $30.63 (D-High), $31.35 (W-High), LVN ($31.50). Retail stops cluster here.

Sell-Side Liquidity: Below $29.41 (D-Low), $27.95 (W-Low/M-Low).

OB: Bullish OB at $29.80–$30.00 (April 10 consolidation, demand zone, near HVN $30.00).

FVG: Bullish FVG at $30.00–$30.20 (April 11 gap, unfilled, aligns with D-Open $30.12).

OTE: Fib 61.8%–78.6% from $29.41 (low) to $30.63 (high) = $30.05–$30.15 (overlaps OB/FVG/HVN).

Displacement: Potential impulsive move to $31.50 (LVN) or $29.00 (below D-Low) on Retail Sales or tariff news.

Summary: Bullish bias, with OTE ($30.05–$30.15) as entry zone post-sweep, supported by OB/FVG/HVN.

10-Minute Chart

Closing Move (April 11):

Status: Rallied to $30.52, closed near high ($30.63), strong volume.

Stance: Bullish (buyers pushed close).

EMA Direction:

Status: 8-EMA ($30.45) > 13-EMA ($30.40) > 48-EMA ($30.30), uptrend.

Stance: Bullish (EMAs rising).

RSI (14):

Level: ~65 (bullish, cooling from 70).

Stance: Bullish (>50, not overbought).

MACD:

Status: Above zero, bullish crossover.

Stance: Bullish (momentum intact).

VWAP:

Status: Above VWAP (~$30.40, late April 11).

Stance: Bullish (buyers control).

ICT/SMC:

Liquidity Sweep: Wick to $30.63 (8:50 AM, April 11) tested buy-side, no clear rejection yet.

Retracement: Potential retrace to $30.05–$30.15 (OTE) if sweep completes (e.g., April 14, 8:00 AM).

Entry Signal: Pin bar or engulfing at OTE (e.g., $30.10, 10-minute candle).

Summary: Bullish, awaiting sweep above $30.63 or $31.35, retrace to OTE for entry.

Options Data

Analysis:

GEX (Gamma Exposure):

Status: Positive GEX at $31 strike (high call OI), neutral at $30.

Impact: Dealers buy stock to hedge calls, supporting $31 pin or slight lift to $31.50.

Explanation: Positive GEX stabilizes price near high OI strikes, aligning with LVN ($31.50) sweep.

Stance: Neutral-bullish (pinning likely, breakout possible).

DEX (Delta Exposure):

Status: High call delta (+0.3, 89% call volume).

Impact: Bullish pressure, as dealers hedge calls by buying KWEB.

Explanation: Call-heavy delta fuels upside momentum, supporting buy-side sweep.

Stance: Bullish.

IV (Implied Volatility):

Status: Moderate (~25%, vs. 20–35% norm for KWEB).

Impact: Steady swings ($0.50–$1.00/day), good for ATM/OTM calls.

Explanation: Moderate IV balances premium cost and volatility, ideal for OTE entries.

Stance: Bullish (volatility supports options).

OI (Open Interest):

Status: Call-heavy (65% calls at $31, 20% at $32, 15% puts at $30).

Impact: Momentum toward $31–$32, potential pin at $31 (high OI).

Explanation: High call OI marks targets (W-High $31.35, LVN $31.50), puts at $30 guard HVN.

Stance: Bullish (calls drive upside).

Cem Karsan’s Application and Weekly Trading Breakdown:

Gamma: High at $31 (pinning risk), low at $32 (breakout potential).

Vanna: Rising IV (25% to 30% on Retail Sales) lifts calls, dealers buy KWEB, pushing to $31.50.

Charm: Near OPEX (April 18), $31 calls hold delta if ITM, spiking volatility April 17–18.

Volatility Skew: Call skew (higher IV for $32 vs. $30) favors upside breakouts.

Weekly OI (Exp. April 18): 65% calls at $31, 20% at $32. Pinning likely at $31 unless Retail Sales sparks breakout to $32.

Options Strategy:

Trade: Buy $31 calls at OTE ($30.10, April 14, 8:50 AM), premium ~$0.50.

Exit: $31.50 (W-High/LVN, premium ~$0.90), profit $0.40.

Stop: Below OB ($29.80, premium ~$0.20), risk $0.30.

R:R: 1.33:1 (adjust to 2:1 with partial exit).

ICT/SMC Tie-In: Enter post-sweep ($31.35), retrace to OTE ($30.10), target $31.50.

Vanna:

Status: IV rise (25% to 30%) amplifies calls, dealers buy KWEB.

Impact: Bullish lift to $31–$31.50, aligns with LVN sweep.

Explanation: Vanna boosts delta near high OI, supporting OTE reversal.

Charm:

Status: OPEX (April 18) nears, $31 calls gain delta if KWEB hits $31.

Impact: Volatility spikes April 17–18, favors quick OTE trades.

Explanation: Charm accelerates delta, amplifying sweep-to-OTE moves.

Timeframe Analysis:

Weekly (Exp. April 18):

OI: 65% calls ($31), 20% ($32), 15% puts ($30).

IV: Moderate (25%), rising on catalysts.

Stance: Bullish (calls dominate, breakout risk).

Monthly (Exp. May 2):

OI: Balanced (50% calls $32, 50% puts $29).

IV: Stable (~24%).

Stance: Neutral (consolidation likely).

3-Month (Exp. July 7):

OI: Call skew ($33–$35, 60% calls).

IV: Low (~22%).

Stance: Bullish (long-term upside).

Directional Bias:

Synthesis: Positive GEX ($31 pin), high call DEX (+0.3), moderate IV (25%), call-heavy OI (65% at $31), vanna (IV lift), charm (OPEX volatility), and ICT/SMC (buy-side sweep to $31.35, OTE at $30.10) suggest a bullish trend for April 14, with potential retracement post-sweep.

Why: Options data aligns with ICT/SMT (call OI = buy-side liquidity, OTE = dealer hedging zone), per AMT (LVN sweep, HVN reversal).

Action: Focus on $31 calls, highlight pinning vs. breakout. Video: “KWEB’s $31 call wall could pin or pop—perfect for an OTE play.”

Sympathy Plays

Correlated Assets:

MCHI (iShares MSCI China ETF): Tracks broader Chinese equities, rises ~2–3% if KWEB rallies (e.g., $31.50), due to shared holdings (Alibaba, Tencent).

BABA (Alibaba ADR): KWEB’s top holding, moves +3–4% on KWEB’s sweep to $31.35, driven by e-commerce/AI overlap.

Opposite Mover:

GLD (SPDR Gold ETF): Risk-off asset, fades ~1–2% if KWEB rallies (risk-on), as investors shift from safe havens to tech.

Why: Sympathy plays confirm sector momentum (Chinese tech), while GLD hedges tariff fears, per ICT/SMT sentiment.

Action: Monitor MCHI/BABA for confirmation, GLD for divergence. Video: “If KWEB pops, MCHI and BABA follow—watch gold for the flip side.”

Sector Positioning with RRG

Sector: Technology – Emerging Markets (China Internet).

RRG Position: Improving (vs. MCHI ETF).

Rationale: KWEB’s April 11 rally (+2.97%) outpaces MCHI (+2.1%), with RSI (~55) and call OI signaling strength. Tariff fears weaken absolute gains, but relative momentum grows.

Tie-In: Improving quadrant supports bullish MSS, OTE entries at HVN ($30.00).

Why: RRG aligns with sentiment (call-heavy) and technicals (above HVN), per AMT value area.

Action: Highlight Improving RRG for video: “KWEB’s gaining steam in China tech—prime for a sweep setup.”

Targets

Bullish:

Target: +3.5% to $31.60.

Levels: W-High ($31.35), LVN ($31.50), next resistance ($32.00).

Rationale: Buy-side sweep to $31.35 (W-High), breakout to LVN on Retail Sales or tariff relief, per ICT/SMC.

Bearish:

Target: -3.2% to $29.55.

Levels: D-Low ($29.41), below W-Open ($29.59), HVN ($29.50).

Rationale: Sell-side sweep below $29.41 on weak Retail Sales or tariff escalation, retracing to HVN, per AMT.

Why: Targets tie to OHLC (W-High, D-Low), HVNs/LVNs, and catalysts, ensuring ICT/SMC alignment (liquidity to OTE).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.