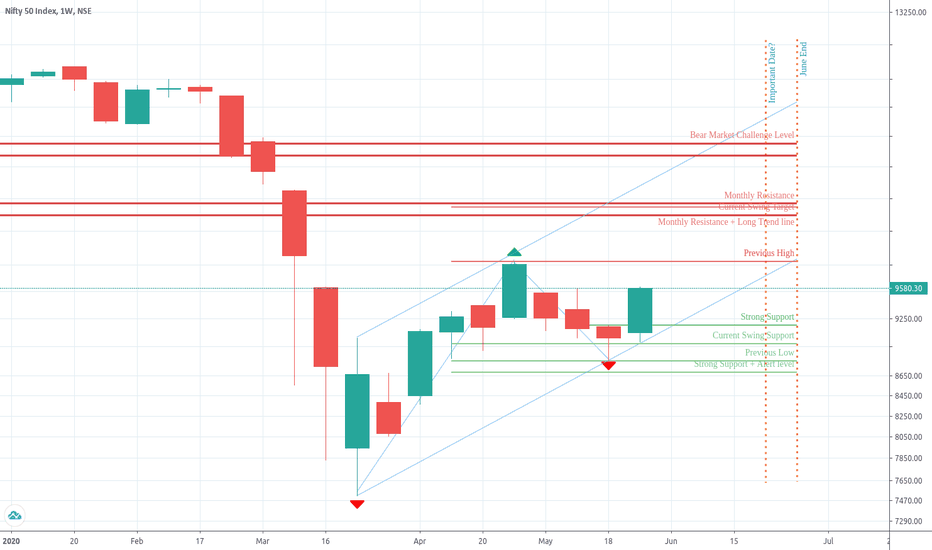

I’ll start my this week’s view with the larger context of monthly update which I posted start of this month

Few important points, I want to reiterate to myself

NIFTY is in bear market till my view invalidates , that is sustaining above 11200-11400. In bear markets, there is price / time value deterioration of wealth. This could last at least 12-15 months. Bear markets are volatile, the upswings are sharp and at times the price action makes you believe the worst is over.

Then zooming on to my last weeks commentary

Here are things I said in that post

Things I am very sure of (~80%)

1. NIFTY to stay above 9700.

2. There will be resistance in 10400-10600.

3. NIFTY will form a candle with shadows on a weekly frame. Like Doji / Hammer / Shooting star .

Things I am somewhat believing (~60%)

1. The current week's high will not be a turning point or swing high.

2. 10700 is the upper end of the range of this week.

3. This upswing is likely to continue at least till June 18.

I’ll review the points mentioned

NIFTY stayed above 9700. Resistance was 100 points below the level I anticipated. NIFTY actually formed a Hammer candle.

Other things are yet to play out.

Here are interesting things to observe

1. The entire week was spent in correction from 10300. NIFTY is not on the path of a steep up move like April. The current upswing starting from 8800 is smoother and likely to have less momentum.

NIFTY formed a large range candle ~400 points on Friday. This candle has many emotions from market players. There was a long standing gap of 100 points from 9600 to 9700 which was filled by this candle.

There is a stiff resistance zone from 10300-10600 which is well established now.

2. VIX is around 30.

3. FIIs have turned net sellers from June 10.

4. Option data shows 10000 - 10500 zones will be the zone where resistance levels are all over. These may be trapped call positions because of the gap down on Friday.Option data for June end expiry is showing that PUT sellers are less confident than last week of surpassing 10300.

Here are some points which I assume for the next week.

Things I am sure of (~80%)

1. NIFTY to stay above 9600.

2. There will be resistance from 10200-10500

Things I am somewhat believe (~60%)

NIFTY likely to be choppy movements in the region 10000-10300. Range boundaries could be 9850-10300.

Another touchdown of the 9730-9840 region is possible.

So I’ll consider

Current bullish swing in question if NIFTY closes or starts sustaining below 9800 levels. Possible range for the coming week is 9850 - 10300.

Some option trade ideas

Credit CALL spreads 10400/10500 stop loss is touch of 10400

Credit PUT spreads 9600/9700 stop loss is touch of 9600.

PUT spreads have higher probability of success.

If Monday closes above 10000, BUY CALL 10200 with SL of 9850. OR Sell 10200 CALL and Sell 10000 PUT. To reduce risk, Iron condor can be created.

That's all for the week. Have a great trading week ahead!

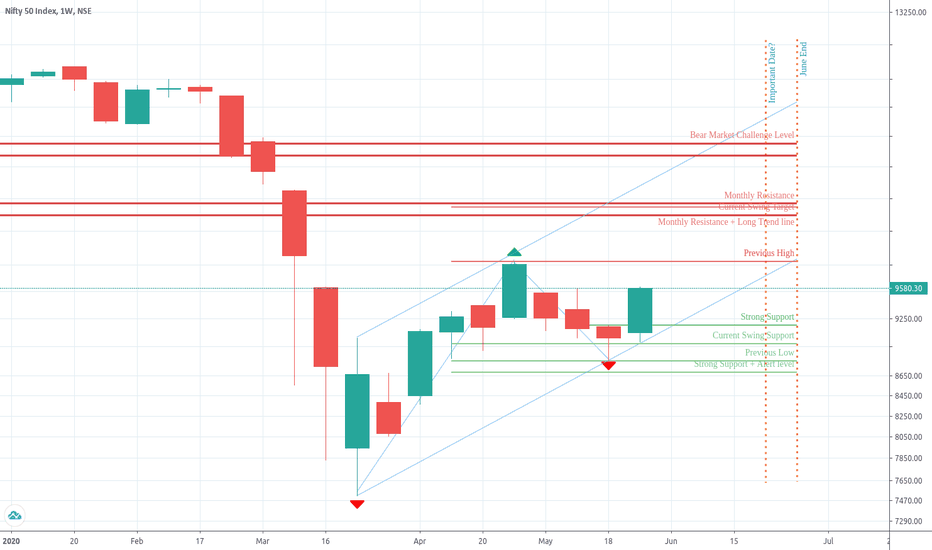

Few important points, I want to reiterate to myself

NIFTY is in bear market till my view invalidates , that is sustaining above 11200-11400. In bear markets, there is price / time value deterioration of wealth. This could last at least 12-15 months. Bear markets are volatile, the upswings are sharp and at times the price action makes you believe the worst is over.

Then zooming on to my last weeks commentary

Here are things I said in that post

Things I am very sure of (~80%)

1. NIFTY to stay above 9700.

2. There will be resistance in 10400-10600.

3. NIFTY will form a candle with shadows on a weekly frame. Like Doji / Hammer / Shooting star .

Things I am somewhat believing (~60%)

1. The current week's high will not be a turning point or swing high.

2. 10700 is the upper end of the range of this week.

3. This upswing is likely to continue at least till June 18.

I’ll review the points mentioned

NIFTY stayed above 9700. Resistance was 100 points below the level I anticipated. NIFTY actually formed a Hammer candle.

Other things are yet to play out.

Here are interesting things to observe

1. The entire week was spent in correction from 10300. NIFTY is not on the path of a steep up move like April. The current upswing starting from 8800 is smoother and likely to have less momentum.

NIFTY formed a large range candle ~400 points on Friday. This candle has many emotions from market players. There was a long standing gap of 100 points from 9600 to 9700 which was filled by this candle.

There is a stiff resistance zone from 10300-10600 which is well established now.

2. VIX is around 30.

3. FIIs have turned net sellers from June 10.

4. Option data shows 10000 - 10500 zones will be the zone where resistance levels are all over. These may be trapped call positions because of the gap down on Friday.Option data for June end expiry is showing that PUT sellers are less confident than last week of surpassing 10300.

Here are some points which I assume for the next week.

Things I am sure of (~80%)

1. NIFTY to stay above 9600.

2. There will be resistance from 10200-10500

Things I am somewhat believe (~60%)

NIFTY likely to be choppy movements in the region 10000-10300. Range boundaries could be 9850-10300.

Another touchdown of the 9730-9840 region is possible.

So I’ll consider

Current bullish swing in question if NIFTY closes or starts sustaining below 9800 levels. Possible range for the coming week is 9850 - 10300.

Some option trade ideas

Credit CALL spreads 10400/10500 stop loss is touch of 10400

Credit PUT spreads 9600/9700 stop loss is touch of 9600.

PUT spreads have higher probability of success.

If Monday closes above 10000, BUY CALL 10200 with SL of 9850. OR Sell 10200 CALL and Sell 10000 PUT. To reduce risk, Iron condor can be created.

That's all for the week. Have a great trading week ahead!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.