Okay, let's refine your NZDUSD short trading idea for clarity and detail.

Concise Description:

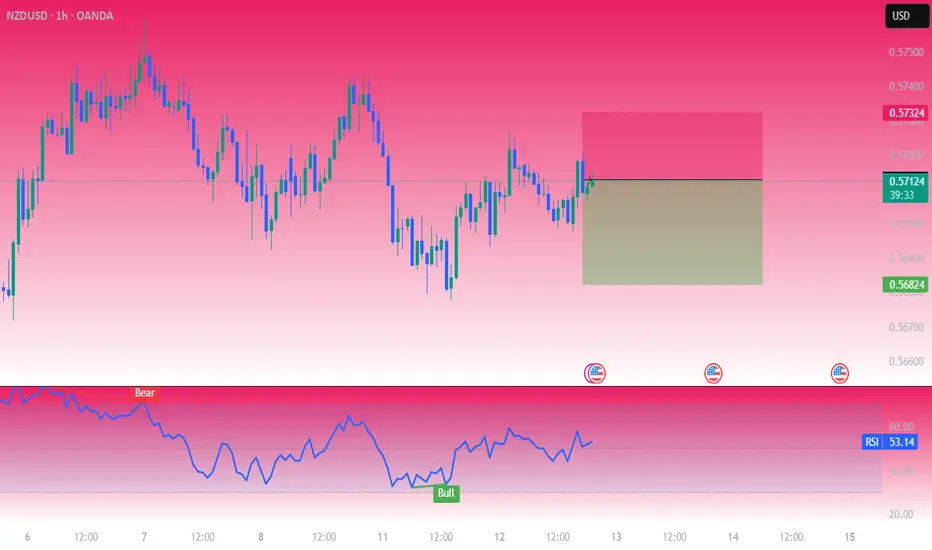

"NZDUSD immediate short trade: 20-pip risk, 30-pip reward. Based on 1-hour higher tail rejections, third touch of a descending trendline, and established downtrend momentum."

Detailed Description:

Trade Setup:

NZDUSD immediate short position.

Risk: 20 pips.

Reward: 30 pips.

Risk/Reward Ratio: 1.5:1.

Analysis:

1-Hour Higher Tail Rejections:

"On the 1-hour chart, multiple candles have exhibited prominent upper wicks (higher tails), indicating strong selling pressure and rejection of higher prices."

This shows that the price is having trouble sustaining upward movement.

Descending Trendline Third Touch:

"The price has made a third touch of a confirmed descending trendline, connecting a series of lower highs. This third touch reinforces the validity of the trendline and suggests a high probability of continued downward movement."

This is a classic technical analysis setup.

Established Downtrend Momentum:

"The overall price action indicates a clear downtrend, with a series of lower highs and lower lows. This confirms that bearish momentum is currently dominant."

This provides trend confirmation.

Concise Description:

"NZDUSD immediate short trade: 20-pip risk, 30-pip reward. Based on 1-hour higher tail rejections, third touch of a descending trendline, and established downtrend momentum."

Detailed Description:

Trade Setup:

NZDUSD immediate short position.

Risk: 20 pips.

Reward: 30 pips.

Risk/Reward Ratio: 1.5:1.

Analysis:

1-Hour Higher Tail Rejections:

"On the 1-hour chart, multiple candles have exhibited prominent upper wicks (higher tails), indicating strong selling pressure and rejection of higher prices."

This shows that the price is having trouble sustaining upward movement.

Descending Trendline Third Touch:

"The price has made a third touch of a confirmed descending trendline, connecting a series of lower highs. This third touch reinforces the validity of the trendline and suggests a high probability of continued downward movement."

This is a classic technical analysis setup.

Established Downtrend Momentum:

"The overall price action indicates a clear downtrend, with a series of lower highs and lower lows. This confirms that bearish momentum is currently dominant."

This provides trend confirmation.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.