Context 1:

Supply Zone: 00000400 - 00000970

Support: 00000975 - 00001075

Demand Zone: 0001798 - 00002850

Resistance: 00001550 -00001420

Psychological Levels: 00001500, 00001000

Context 2:

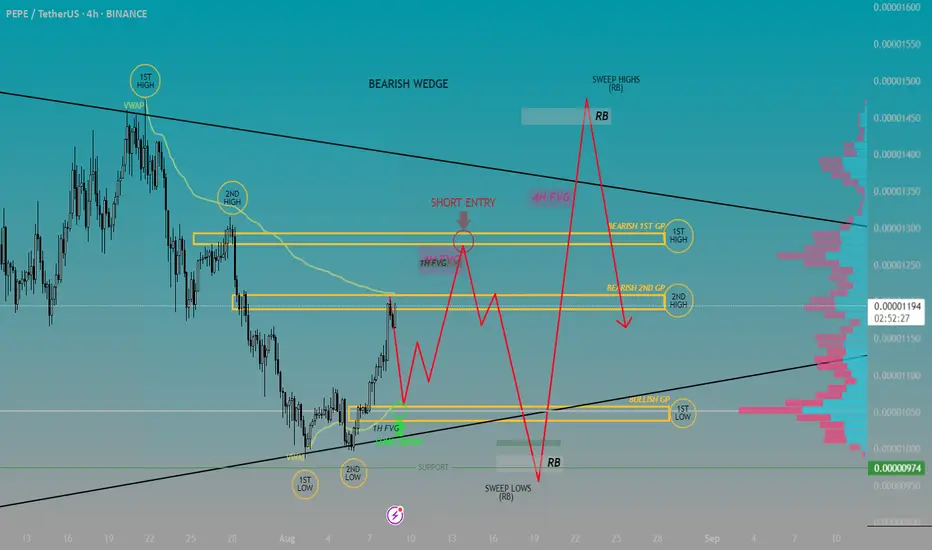

Technical Structure 1: Top Down Analysis shows us a Head and Shoulders pattern of which we are in the final stages of with bearish momentum.

Technical Structure 2: The overall trend has left us in a bearish wedge which has tested support 4 times and tested resistance 2 times.

FVG’s:

FVG Confluence 1: Theres a 1 hour FVG located just below price level. Also aligned with the POC. Strong confluence for return to this area.

FVG Confluence 2: Another 1 hour FVG inside of a 4 hour FVG that is also aligning with the bottom 0.618 Fib level of that move.

Golden Pocket Entry 1st Low (Bullish): Sits just above an FVG. Also engulfs the Point of Control.

Golden Pocket Entry 1st High (Bearish): Multiple TimeFrame FVG confluence. A key resistance point aligning with .00001300 Pschological Level.

Context 3:

Volume Insight: The most volume is located around .00001250 and .00001050 which show massive spikes in these key areas.

Bullish Scenario:

Price falls to the golden pocket- FVG- POC. Bounces off support to create a higher low.

Bearish Scenario:

Price rises to clear a 1H and 4H FVG- enters the golden pocket - sweeps liquidity around the .00001290 area.

Supply Zone: 00000400 - 00000970

Support: 00000975 - 00001075

Demand Zone: 0001798 - 00002850

Resistance: 00001550 -00001420

Psychological Levels: 00001500, 00001000

Context 2:

Technical Structure 1: Top Down Analysis shows us a Head and Shoulders pattern of which we are in the final stages of with bearish momentum.

Technical Structure 2: The overall trend has left us in a bearish wedge which has tested support 4 times and tested resistance 2 times.

FVG’s:

FVG Confluence 1: Theres a 1 hour FVG located just below price level. Also aligned with the POC. Strong confluence for return to this area.

FVG Confluence 2: Another 1 hour FVG inside of a 4 hour FVG that is also aligning with the bottom 0.618 Fib level of that move.

Golden Pocket Entry 1st Low (Bullish): Sits just above an FVG. Also engulfs the Point of Control.

Golden Pocket Entry 1st High (Bearish): Multiple TimeFrame FVG confluence. A key resistance point aligning with .00001300 Pschological Level.

Context 3:

Volume Insight: The most volume is located around .00001250 and .00001050 which show massive spikes in these key areas.

Bullish Scenario:

Price falls to the golden pocket- FVG- POC. Bounces off support to create a higher low.

Bearish Scenario:

Price rises to clear a 1H and 4H FVG- enters the golden pocket - sweeps liquidity around the .00001290 area.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.