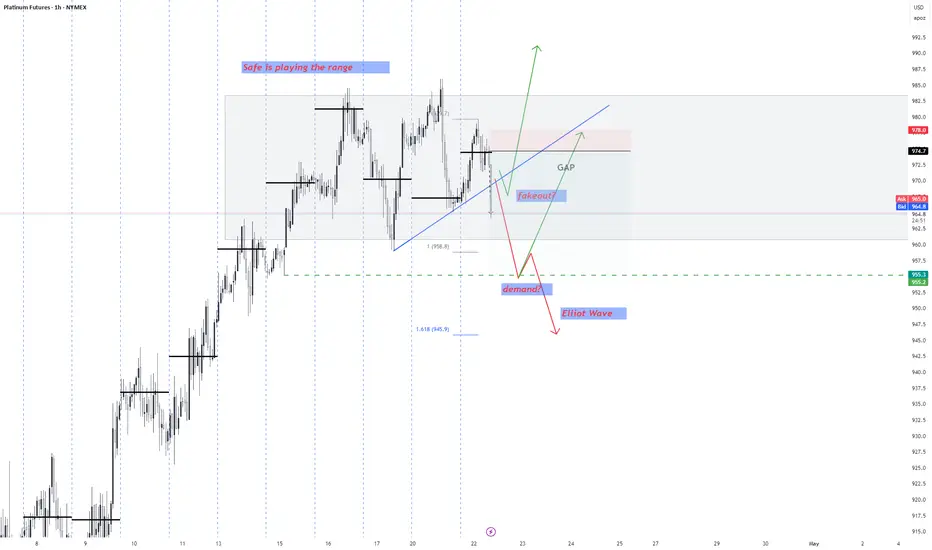

Along with the fundamentals supporting a weaker PL and no significant change in daily warehouse stock data for Platinum and Palladium. A neutral or slightly bearish approach might be the way for today.

Platinum Demand Breakdown (approx):

Sector Share (%)

Auto (catalysts) ICE ~35–40%

Jewelry ~25–30%

Industrial (chem, glass, petro) ~20%

Investment ~5–10%

Other (medical, etc) <5%

Supporting news:

- Used Car Sales Are At Their Strongest Since 2021

- The United States saw strong automobile sales in March as consumers rushed to buy before tariffs would kick in but the outlook looks gloomy afterwards. POOR SALES EXPECTED AFTER NEAR-TERM BUMP. ( My comment: Those cars were build months/year ago car manufacturing cutting production already)

- Major car brand cuts production of popular model in response to Donald Trump's harsh auto tariffs

Platinum Demand Breakdown (approx):

Sector Share (%)

Auto (catalysts) ICE ~35–40%

Jewelry ~25–30%

Industrial (chem, glass, petro) ~20%

Investment ~5–10%

Other (medical, etc) <5%

Supporting news:

- Used Car Sales Are At Their Strongest Since 2021

- The United States saw strong automobile sales in March as consumers rushed to buy before tariffs would kick in but the outlook looks gloomy afterwards. POOR SALES EXPECTED AFTER NEAR-TERM BUMP. ( My comment: Those cars were build months/year ago car manufacturing cutting production already)

- Major car brand cuts production of popular model in response to Donald Trump's harsh auto tariffs

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.