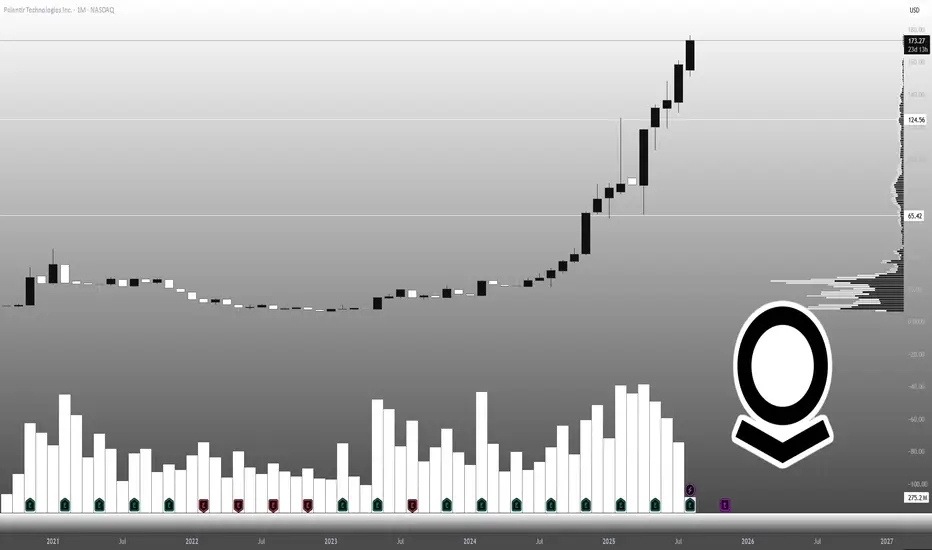

PLTR has run 10x since we called it in 2023 so time to unpack what’s driving the beast

They shattered Wall Street's estimates, blowing past the $1 billion quarterly revenue mark for the first time in company history , up a jaw dropping 48% year over year, and a cool $61 million north of what the Street had penciled in. That’s not just a beat; that’s a flex. The message?

Palantir isn’t just playing the AI game , they’re rewriting the rulebook

Let’s break it down. Total U.S. revenue came in at $733 million , up 68%. That locks the U.S. in as Palantir’s primary growth engine. Commercial sales in the U.S.? They exploded 93% to $306 million. Government revenue? Up 53% to $426 million. That’s a one-two punch: enterprise and defense, both running hot. They're not choosing sides , they're eating both pies

Management isn’t hiding their swagger either. Full year guidance just got a serious facelift. Revenue growth outlook bumped up to 43%, now targeting around $4.15 billion (versus the previous $3.9 billion). Free cash flow? Raised to $1.8 to $2.0 billion. That’s not cautious optimism , that’s controlled aggression

And here’s the kicker, they’re operating at a Rule of 40 score of 94. In other words, Palantir isn’t just growing fast; they’re growing profitably. Total contract value hit a record $2.27 billion that’s a 140% Y/Y surge, driven by sky high demand for their AI Platform (AIP) and major government wins, including that monster 10 year, $10 billion Army contract consolidation. That's not a deal, that’s a moat mate

Alex Karp, Palantir’s enigmatic CEO, called the results “once in a generation.” And he’s not wrong. The years they spent building the foundation, Ontology, AI tooling, infrastructure nobody understood at the time, it’s all cashing in now. Their tech isn’t just futuristic — it’s operational, in the field, making decisions that matter. When it comes to AI in defense and enterprise, Palantir isn’t knocking at the door. They already own the building.

And for investors who saw this coming? PLTR is now a 10-bagger since we took our position back in January 2024, up 900%. This is what conviction looks like when it pays off. It's also a case study in how fast narratives shift in tech. Palantir went from misunderstood outlier to the most electric AI growth story on the Street.

Sure, valuation risk is real. You don’t trade at the highest multiples in the S&P 500 without raising a few eyebrows. But Palantir’s not chasing hype — they’re cashing contracts, stacking cash, and securing national infrastructure. They’re the rare breed that’s actually delivering in a world full of pretenders.

long story short This isn’t a tech rally. It’s a regime change, Palantir just planted its flag on top

They shattered Wall Street's estimates, blowing past the $1 billion quarterly revenue mark for the first time in company history , up a jaw dropping 48% year over year, and a cool $61 million north of what the Street had penciled in. That’s not just a beat; that’s a flex. The message?

Palantir isn’t just playing the AI game , they’re rewriting the rulebook

Let’s break it down. Total U.S. revenue came in at $733 million , up 68%. That locks the U.S. in as Palantir’s primary growth engine. Commercial sales in the U.S.? They exploded 93% to $306 million. Government revenue? Up 53% to $426 million. That’s a one-two punch: enterprise and defense, both running hot. They're not choosing sides , they're eating both pies

Management isn’t hiding their swagger either. Full year guidance just got a serious facelift. Revenue growth outlook bumped up to 43%, now targeting around $4.15 billion (versus the previous $3.9 billion). Free cash flow? Raised to $1.8 to $2.0 billion. That’s not cautious optimism , that’s controlled aggression

And here’s the kicker, they’re operating at a Rule of 40 score of 94. In other words, Palantir isn’t just growing fast; they’re growing profitably. Total contract value hit a record $2.27 billion that’s a 140% Y/Y surge, driven by sky high demand for their AI Platform (AIP) and major government wins, including that monster 10 year, $10 billion Army contract consolidation. That's not a deal, that’s a moat mate

Alex Karp, Palantir’s enigmatic CEO, called the results “once in a generation.” And he’s not wrong. The years they spent building the foundation, Ontology, AI tooling, infrastructure nobody understood at the time, it’s all cashing in now. Their tech isn’t just futuristic — it’s operational, in the field, making decisions that matter. When it comes to AI in defense and enterprise, Palantir isn’t knocking at the door. They already own the building.

And for investors who saw this coming? PLTR is now a 10-bagger since we took our position back in January 2024, up 900%. This is what conviction looks like when it pays off. It's also a case study in how fast narratives shift in tech. Palantir went from misunderstood outlier to the most electric AI growth story on the Street.

Sure, valuation risk is real. You don’t trade at the highest multiples in the S&P 500 without raising a few eyebrows. But Palantir’s not chasing hype — they’re cashing contracts, stacking cash, and securing national infrastructure. They’re the rare breed that’s actually delivering in a world full of pretenders.

long story short This isn’t a tech rally. It’s a regime change, Palantir just planted its flag on top

🟣MasterClass moonypto.com/masterclass

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🟣MasterClass moonypto.com/masterclass

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.