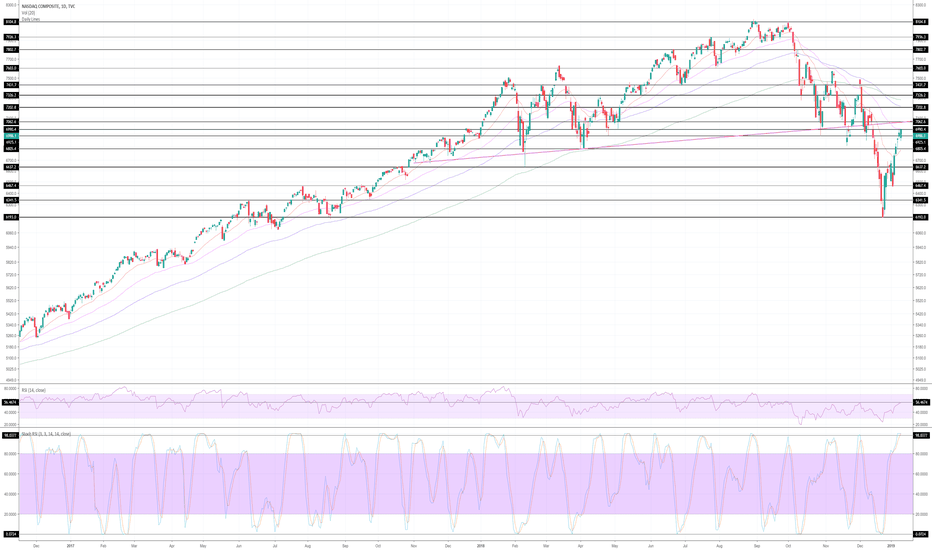

QQQ: huge resistance, 50 DMA, rising wedge, RSI/stoch, earnings

Everything about this chart and the underlying trends are so, so bearish. Here's a quick list:

$119.69 is still my first QQQ target.

The reason I am short QQQ most heavily (vs. smaller shorts on SPY) is because of the more extravagant P/E ratios (though this is normalizing) and it still has further to fall percent-wise to support.

Key to remember: Market can stay irrational longer than you can remain solvent and these dumps can play out over 6 months to 2 years time frames. Study past bear market cycles, especially 2000 and 2008 as they have the most similarity on the underlying conditions and processes and sentiment and media, etc, etc.

I'm a noob at this stuff, so I'm guessing there are mistakes and misunderstandings above. Please educate me on the things I'm missing or have gotten wrong.

- Just below or in a major resistance zone formed from major past support for huge bounces

- Just below 50 DMA, where we could see strong rejection. (Still well below 100 and 200 DMA.)

- Rising wedge or bear flag

- RSI is at same place QQQ dumped from before. Also my buddy did a study of past bear markets and found bear market rallies (which are sharp and violent) topped around 50 RSI.

- Stochastic is just about to cross over and is at the same place we dumped from at previous points in this bear market and the preceding bull market

- NAMO is pegged at record levels

- Earnings are missing or guidance is being cut as fast as possible, led by the bluest of the blue chip in tech: AAPL and Samsung (It's quite objectively badacross the board.)

- Germany dipped into recession

- China has economicdata indicating huge slowdowns and real estate and credit bubbles. I have a wealthy Chinese businessman friend that has confirmed some of these trends in 1-on-1 conversation.

- The pundit class has their heads in the sand, pretending Powell changed something about what the Fed is going to do (as an excuse for this rally to buy their puts) when in fact he reiterated that they would be data-driven (the data they use to make those decisions have not changed since they announced a target of 2 rate hikes) and that there will be continued and "substantially" more QT. In sharp contrast, the market currently has priced in one rate DECREASE! Can you say head in sand? Or more likely than head in sand is propping up market by market makers to build cheaper leveraged short positions. Huge SQQQ inflows, for instance. But options is where we'll see most of that action.

- We're at the end of the 10 year cycle (previous drops were '87/90, '00, '07-08, and now it's '18-'19). It's an inevitable economic cycle. Both 2000 and 2008 were ~50% drops. (There are structural hints that this one could be worse because we've depleted our monetary band-aids. And debt/leverage is worse than ever.)

- The rest of the world's stocks topped awhile ago and have been in decline, without the Trump fiscal bump blow-off top effect.

- Rising rates decrease attractiveness of tech borrowing against offshore funds not repatriated for tax purposes in order to do stock buybacks, which has had outsized effects on stock prices.

- Finally, look at declining volume on increasing price. That's very bearish. Fewer and fewer buyers up here.

- Corollary: Dump volume greatly exceeded bounce volume. We did not have convincing bounce volume.

- Unemployment is at the same low level as just before 2000 and 2008.

- Housing dumping in the US and Australia

- I've not even talked about yield curve inversion because that's one economic indicator I haven't taken the time to properly educate myself on, but those smarter than I are saying it's bad and indicates probable imminent recession.

- I've not talked about trade war

- I've only peripherally touched upon huge national debt with limited room for fiscal stimulus and government shutdown and possible AAA sovereign downgrade being discussed and interest expense death spiral

- Rich gulf states have their own fiscal and economic worries with low oil prices due to fracking means they're less likely to deploy their cash reserves to buy the dip

- I've only peripherally touched upon household debt

$119.69 is still my first QQQ target.

The reason I am short QQQ most heavily (vs. smaller shorts on SPY) is because of the more extravagant P/E ratios (though this is normalizing) and it still has further to fall percent-wise to support.

Key to remember: Market can stay irrational longer than you can remain solvent and these dumps can play out over 6 months to 2 years time frames. Study past bear market cycles, especially 2000 and 2008 as they have the most similarity on the underlying conditions and processes and sentiment and media, etc, etc.

I'm a noob at this stuff, so I'm guessing there are mistakes and misunderstandings above. Please educate me on the things I'm missing or have gotten wrong.

Note

PSI said everything about this chart is bearish. That was an incorrect overstatement, which forgot about one thing that worries me. The fact that it regained that uptrend line (which served as support for Dec. '17, Feb. '18, May '18, and Nov. '18 bounces) is bullish.

Now I've come to expect fakeouts like this. In fact, fakeouts/shakeouts of TA make me even more excited about the strength of the coming move, because it means big players are painting charts to grab liquidity pools for the move.

I also know that my targets need to be zones, not precise triggers, especially since we're dealing with SPY SPX and ONEQ IXIC and DIA DJI and RUT IWM and their respective resistances and the fact that they've been so correlated.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.