Hi evreyone,

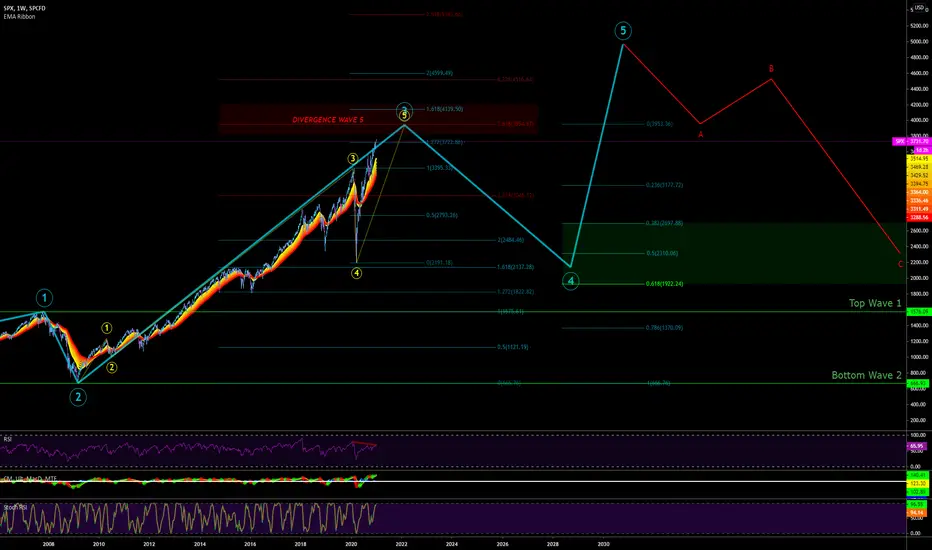

With a clear divergence on this last wave since january 2020, i believe investors must be careful with this main wave 5 inside the super cycle wave 3. If you ask me if it's the time to enter? My answer will be... "Bottom of wave 2 was the time to enter or bottom of main 4" which was the last march retracement.. but not now. On this chart you will see that many more entry points will be available on the retracement of Cycle Wave 4. For sure we can reach higher than 361.8% and make an extension... but i'm pretty sure that SPX will face big time resistance around 4000.00 and usualy 3.618% is the last exit for many patient investors. Also there is a clear bearish Divergence which is confirming Main W5. Long trader are now looking to exit slowly for cycle wave 4, HFT Bots will follow.

If Main Wave 5 Stop at 3.168% = 39 here are some entry points

0.398.87 = 2698.87

0.5 = 2310.86

0.618 = 1922.86 Golden Fib

You will find a lot of buyers between 0.5 and 0.618.

For sure those entry numbers refers only to a retracement that would start from the 3.618% a little less than 4k. The arrival of the Joe Biden

will be a great pretext, just be careful.

Defensive sectors would be appropriate right now like HEALTH. Health care tend to generate stable profit throughout all phases

of the economic cycle. Consumer Staples, Health Care, Utilities, Telecom services.

-If you take a look on the daily chart the daily EMA Ribbon is complety reversed which give more place to volatility and

retracements. I will post the EMA RIBBON under. For me this Look pretty scary at the moment, i would not be a buyer.

A gap like this usually can last around 65days to 80 days, this bring us between to the 6th and 21 of january.

Super Cycle wave 5 tend to loose strenght... but this wave can bring us around 5000 and more.

Have a wonderful christmas, best to you !

With a clear divergence on this last wave since january 2020, i believe investors must be careful with this main wave 5 inside the super cycle wave 3. If you ask me if it's the time to enter? My answer will be... "Bottom of wave 2 was the time to enter or bottom of main 4" which was the last march retracement.. but not now. On this chart you will see that many more entry points will be available on the retracement of Cycle Wave 4. For sure we can reach higher than 361.8% and make an extension... but i'm pretty sure that SPX will face big time resistance around 4000.00 and usualy 3.618% is the last exit for many patient investors. Also there is a clear bearish Divergence which is confirming Main W5. Long trader are now looking to exit slowly for cycle wave 4, HFT Bots will follow.

If Main Wave 5 Stop at 3.168% = 39 here are some entry points

0.398.87 = 2698.87

0.5 = 2310.86

0.618 = 1922.86 Golden Fib

You will find a lot of buyers between 0.5 and 0.618.

For sure those entry numbers refers only to a retracement that would start from the 3.618% a little less than 4k. The arrival of the Joe Biden

will be a great pretext, just be careful.

Defensive sectors would be appropriate right now like HEALTH. Health care tend to generate stable profit throughout all phases

of the economic cycle. Consumer Staples, Health Care, Utilities, Telecom services.

-If you take a look on the daily chart the daily EMA Ribbon is complety reversed which give more place to volatility and

retracements. I will post the EMA RIBBON under. For me this Look pretty scary at the moment, i would not be a buyer.

A gap like this usually can last around 65days to 80 days, this bring us between to the 6th and 21 of january.

Super Cycle wave 5 tend to loose strenght... but this wave can bring us around 5000 and more.

Have a wonderful christmas, best to you !

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.