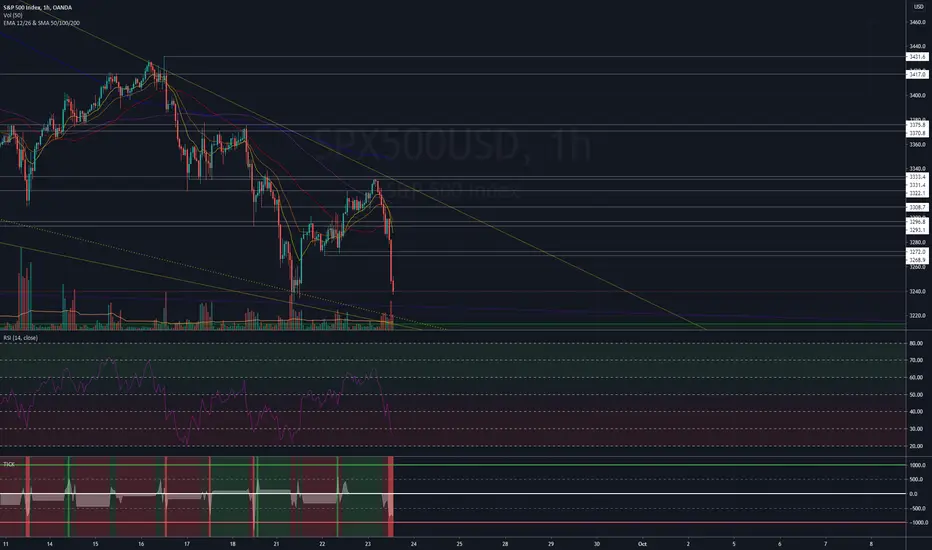

SPX Futures have formed a perfect falling wedge on the hourly chart,

3200 Zone is Huge support as it was tested numerous times in July before we ripped to all time highs

100 Dma also sitting at 3200

Trendline (Purple) Connects us from Pre-Covid High, June high pivot, as well as the low on Monday

Huge confluences of support here, however I'm not sure which sector will lead us higher as tech is extremely overvalued, financials have been tossed aside, healthcare has held up, but pretty much every sector has gotten wrecked

Essentially betting on more fiscal or a fed that goes extreme dove (not really sure what ammo they have left)

DXY also on its way higher here but will begin running into significant resistance levels, I still believe that's the number mover of all the markets rn, WATCH THE DOLLAR

Waiting for an hourly trend to go long, whereas a break of 3200 would force me to go short to the 200dma

3200 Zone is Huge support as it was tested numerous times in July before we ripped to all time highs

100 Dma also sitting at 3200

Trendline (Purple) Connects us from Pre-Covid High, June high pivot, as well as the low on Monday

Huge confluences of support here, however I'm not sure which sector will lead us higher as tech is extremely overvalued, financials have been tossed aside, healthcare has held up, but pretty much every sector has gotten wrecked

Essentially betting on more fiscal or a fed that goes extreme dove (not really sure what ammo they have left)

DXY also on its way higher here but will begin running into significant resistance levels, I still believe that's the number mover of all the markets rn, WATCH THE DOLLAR

Waiting for an hourly trend to go long, whereas a break of 3200 would force me to go short to the 200dma

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.