Implied volatility jumped to about 18.5 percent in early trade which was related to weak macro data and re-hedging activities as dealer gamma in the neighbourhood of 400M expired, but declined throughout the rest of the day to close at 16.6 percent.

Option dealers are buying calls from institutional investors and are selling futures to hedge against the directional risk. When those calls expire at once, dealers have to buy back futures, and the sell-off after the Markit PMI release provided opportunities to cover.

The macro environment seems robust at the start of the new year and 10-year yields climbed almost 12 basis points to about 1,623 percent, which especially boosted bank stocks who finished 1.2 percent higher. As growth concerns were fading, yield hike expectations moved higher once again and I risk sounding like a broken record, but traders need to pay close attention to this metric in 2022.

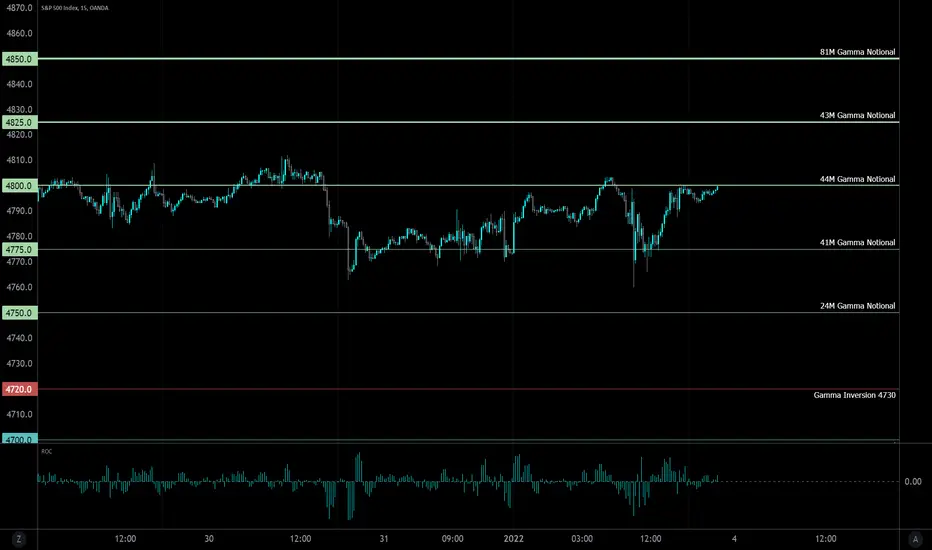

The immediate resistance from a gamma perspective is located at 4800 points and any upward move should theoretically max out at 4850 as this is the new main gamma strike.

Good luck tomorrow!

Option dealers are buying calls from institutional investors and are selling futures to hedge against the directional risk. When those calls expire at once, dealers have to buy back futures, and the sell-off after the Markit PMI release provided opportunities to cover.

The macro environment seems robust at the start of the new year and 10-year yields climbed almost 12 basis points to about 1,623 percent, which especially boosted bank stocks who finished 1.2 percent higher. As growth concerns were fading, yield hike expectations moved higher once again and I risk sounding like a broken record, but traders need to pay close attention to this metric in 2022.

The immediate resistance from a gamma perspective is located at 4800 points and any upward move should theoretically max out at 4850 as this is the new main gamma strike.

Good luck tomorrow!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.