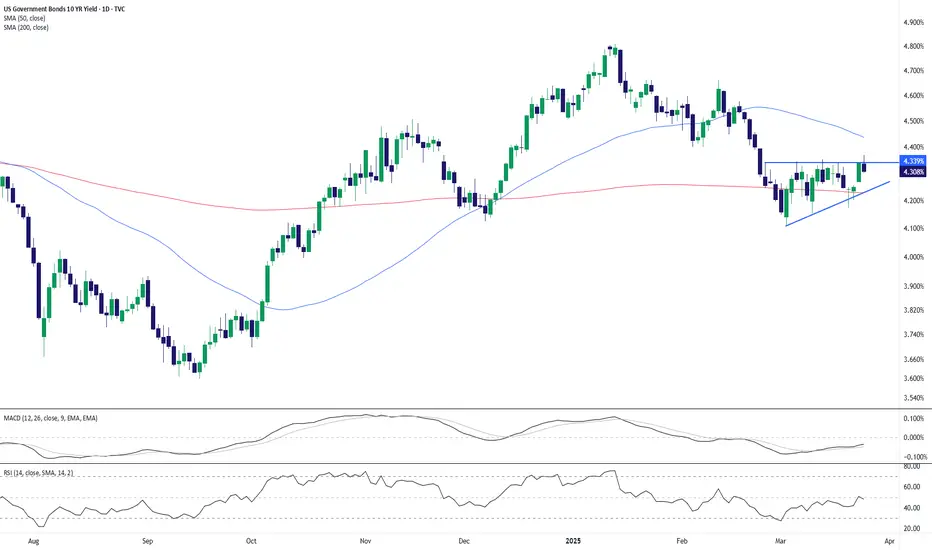

The U.S. 10-year Treasury yield is hovering just beneath the 4.34% resistance level, with price forming a tight ascending triangle just under this key level. Today’s pullback to 4.31% (-0.74%) suggests hesitation from bulls as momentum indicators turn mixed.

🔹 MACD is flat, showing a lack of directional conviction.

🔹 RSI sits at 47.94, neutral and non-committal.

🔹 Price remains sandwiched between the 50-day SMA (4.43%) and the 200-day SMA (4.22%).

A confirmed breakout above 4.34% could open the door for a run toward 4.50% or even 4.80%. Conversely, a drop below the rising trendline (~4.24%) would expose downside risk toward the 200-day SMA.

Watch for a catalyst (Fed commentary or inflation data) to break the deadlock.

-MW

🔹 MACD is flat, showing a lack of directional conviction.

🔹 RSI sits at 47.94, neutral and non-committal.

🔹 Price remains sandwiched between the 50-day SMA (4.43%) and the 200-day SMA (4.22%).

A confirmed breakout above 4.34% could open the door for a run toward 4.50% or even 4.80%. Conversely, a drop below the rising trendline (~4.24%) would expose downside risk toward the 200-day SMA.

Watch for a catalyst (Fed commentary or inflation data) to break the deadlock.

-MW

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.