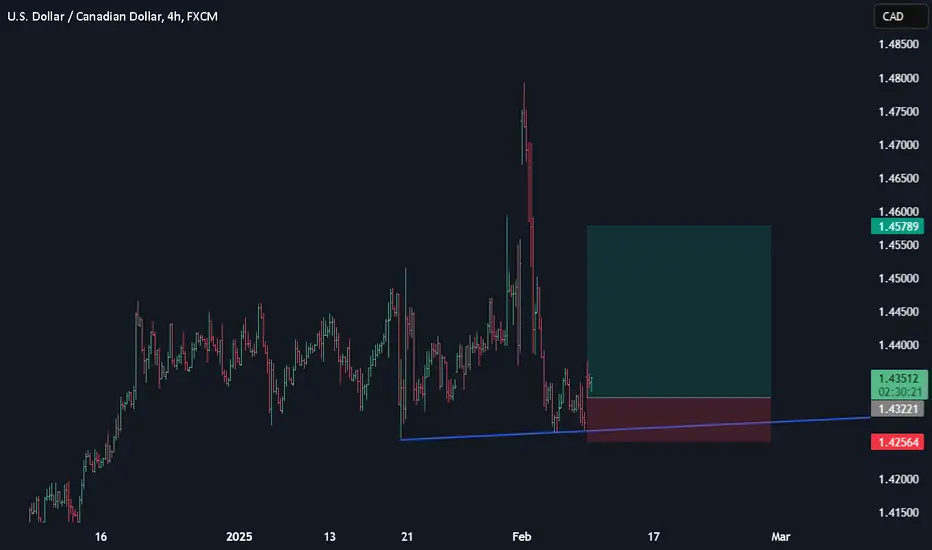

Tariffs on Canada have been delayed for now, and USD/CAD has weakened back to mid-December levels. Our economists suspect these tariffs will be pushed back again before March 4, but see the risk that the President ultimately follows through with these tariffs as higher for Canada than for Mexico. Canada’s parliamentary stand-still, upcoming election, and political transition make a longer-term resolution with the US less certain than with Mexico.

We think these risks mean that markets need to price a higher and more lasting tariff premium in USD/CAD. While tariffs are not our base case, markets have most likely gone too far towards unwinding the tariff premium since the extension.

Options markets are placing a 25% probability on USD/CAD reaching Monday’s intraday highs over the next 3 months, and only a 10% chance of reaching 1.50. Meanwhile, we think that the risk of tariffs on Canada is closer to 40%, so these probabilities seem low by comparison.

Long USD/CAD has performed quite well as a hedge when tariff risks escalate; we continue to think that it is a good option for investors looking for protection from increased trade tensions.

We think these risks mean that markets need to price a higher and more lasting tariff premium in USD/CAD. While tariffs are not our base case, markets have most likely gone too far towards unwinding the tariff premium since the extension.

Options markets are placing a 25% probability on USD/CAD reaching Monday’s intraday highs over the next 3 months, and only a 10% chance of reaching 1.50. Meanwhile, we think that the risk of tariffs on Canada is closer to 40%, so these probabilities seem low by comparison.

Long USD/CAD has performed quite well as a hedge when tariff risks escalate; we continue to think that it is a good option for investors looking for protection from increased trade tensions.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.