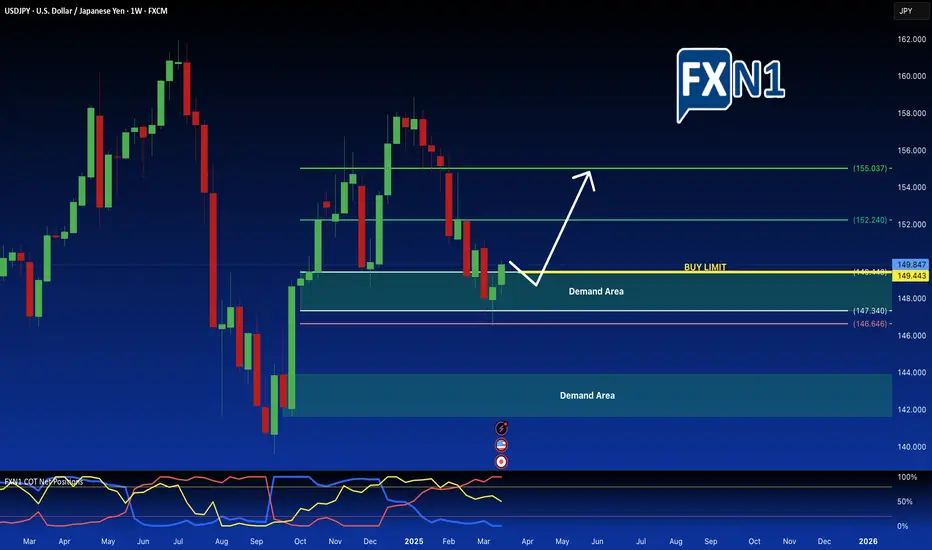

The USD/JPY currency pair is currently pulling back into a significant weekly demand area, presenting a promising opportunity for traders looking to enter long positions. This area historically denotes strong buying interest, suggesting potential upward momentum.

In contrast, the 6J1! Yen futures market displays a bearish sentiment, with many retail traders positioning against this bullish signal in USD/JPY. This divergence in market sentiment could create unique trading opportunities for those who can effectively interpret technical indicators and retail positioning.

Yen Futures

To capitalize on this potential rebound, a pending order has been set on the CFD for USD/JPY, with a buy limit positioned just above the demand zone. Effective risk management, including a stop-loss just below the demand area, is essential as traders navigate this evolving landscape.

In summary, the combination of strong demand at critical levels and contrasting sentiment in the futures market presents a strategic trading scenario for bullish plays in USD/JPY.

✅ Please share your thoughts about USD/JPY in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

In contrast, the 6J1! Yen futures market displays a bearish sentiment, with many retail traders positioning against this bullish signal in USD/JPY. This divergence in market sentiment could create unique trading opportunities for those who can effectively interpret technical indicators and retail positioning.

Yen Futures

To capitalize on this potential rebound, a pending order has been set on the CFD for USD/JPY, with a buy limit positioned just above the demand zone. Effective risk management, including a stop-loss just below the demand area, is essential as traders navigate this evolving landscape.

In summary, the combination of strong demand at critical levels and contrasting sentiment in the futures market presents a strategic trading scenario for bullish plays in USD/JPY.

✅ Please share your thoughts about USD/JPY in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Trade active

The USD/JPY (6J1!) pair is currently rebounding toward the 150.25 level in the CFD contract as I write this article. This resurgence comes in response to a recent decline triggered by US President Trump’s renewed threats regarding tariffs and hawkish comments from the Bank of Japan (BoJ). The pair’s recovery is largely influenced by a revival in risk sentiment and a strengthening US Dollar.

Market participants are keenly attentive to the developments surrounding US tariffs, as well as upcoming economic data and remarks from Federal Reserve officials. The pair appears to have reacted to the rebound from a previously identified supply area within the Futures market, indicating that it may be poised for another decline. However, there are also signs that this move could set off a bullish impulse on the CFD side for the USD/JPY.

As traders navigate this complex landscape, the interplay between market sentiment, geopolitical factors, and economic indicators will be critical in determining the next movements for the USD/JPY. Observers will be watching closely to see whether the pair can maintain its upward momentum or if further challenges lie ahead.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🔥 ZERO SPREAD BROKER: forexn1.com/usa/

🟪 Instagram: instagram.com/forexn1_com/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🔥 ZERO SPREAD BROKER: forexn1.com/usa/

🟪 Instagram: instagram.com/forexn1_com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🔥 ZERO SPREAD BROKER: forexn1.com/usa/

🟪 Instagram: instagram.com/forexn1_com/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🔥 ZERO SPREAD BROKER: forexn1.com/usa/

🟪 Instagram: instagram.com/forexn1_com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.