JPY Fundamentals (IMPORTANT):

The Bank of Japan has spent a record 9.79 trillion yen ($62.23 billion) over the past month to support the country's declining currency. Despite this significant intervention, the yen is likely to continue hovering near its critical lows.

“Authorities will likely continue to spend big on intervention.”

The data, released by Japan’s Ministry of Finance on Friday, confirmed the suspicions of traders and analysts that Tokyo entered the market in two rounds of massive dollar-selling intervention shortly after the yen hit a 34-year low of 160.245 per dollar on April 29, and again in the early hours of May 2 in Tokyo.

Japanese authorities have refrained from commenting on whether they forayed into the market. But top officials have consistently warned they are watching currency markets closely and stand ready to take all necessary measures to counter excessive volatility.

Source: Asia Financial.

Summary: If USDJPY starts aggressively moving higher, expect a sharp drop in price from the Bank of Japans intervention. This is nothing to worry about as it presents a buying opportunity. Ensure you use effective risk management with this pair!

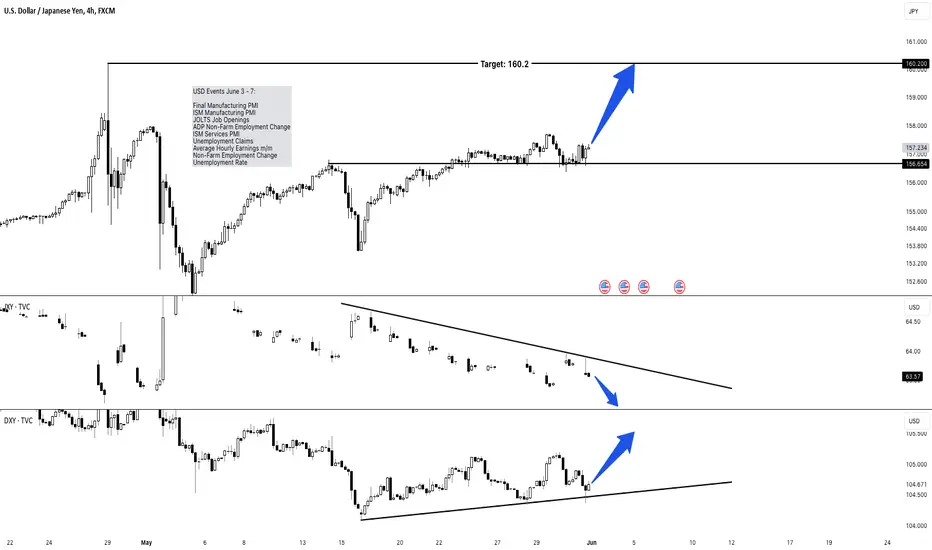

Upcoming US Economic data:

If DXY has a positive reaction to the Dollar, we can expect prices to move higher as the JXY continues to make fresh lows.

The Bank of Japan has spent a record 9.79 trillion yen ($62.23 billion) over the past month to support the country's declining currency. Despite this significant intervention, the yen is likely to continue hovering near its critical lows.

“Authorities will likely continue to spend big on intervention.”

The data, released by Japan’s Ministry of Finance on Friday, confirmed the suspicions of traders and analysts that Tokyo entered the market in two rounds of massive dollar-selling intervention shortly after the yen hit a 34-year low of 160.245 per dollar on April 29, and again in the early hours of May 2 in Tokyo.

Japanese authorities have refrained from commenting on whether they forayed into the market. But top officials have consistently warned they are watching currency markets closely and stand ready to take all necessary measures to counter excessive volatility.

Source: Asia Financial.

Summary: If USDJPY starts aggressively moving higher, expect a sharp drop in price from the Bank of Japans intervention. This is nothing to worry about as it presents a buying opportunity. Ensure you use effective risk management with this pair!

Upcoming US Economic data:

- Final Manufacturing PMI

- ISM Manufacturing PMI

- JOLTS Job Openings

- ADP Non-Farm Employment Change

- ISM Services PMI

- Unemployment Claims

- Average Hourly Earnings m/m

- Non-Farm Employment Change

- Unemployment Rate

If DXY has a positive reaction to the Dollar, we can expect prices to move higher as the JXY continues to make fresh lows.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.