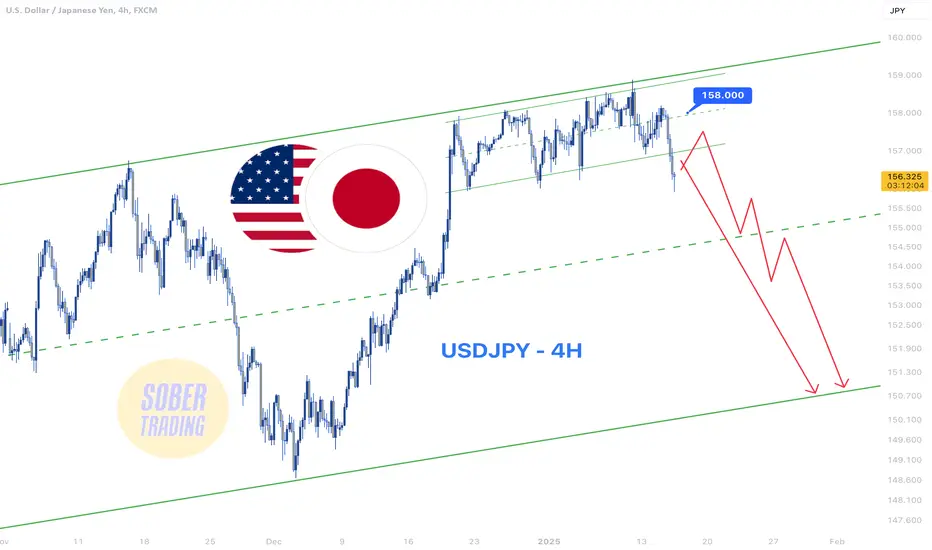

Following the sharp fall in

USDJPY after PPI and CPI news, we expect further downside, potentially reaching the middle or bottom of the channel. 📉

USDJPY after PPI and CPI news, we expect further downside, potentially reaching the middle or bottom of the channel. 📉

Each push-up could be a short entry opportunity. Even a strong rise below 158 might be a dead cat bounce and a better short entry point. Stay cautious and strategic! 🔻

Each push-up could be a short entry opportunity. Even a strong rise below 158 might be a dead cat bounce and a better short entry point. Stay cautious and strategic! 🔻

Trade active

The USDJPY pair fell as expected and reacted to the middle of the channel and after a rise reacted to the red zone, which was previously a support zone and is now acting as a resistance. Additionally, a bearish flag has formed, and the price is at the top of this flag. This provides an excellent entry point for a short position on JPY, targeting further declines. 📉💡 Don’t forget to like, comment, and follow for more timely analysis!

🚀 Stay ahead with actionable ideas!

Trade closed: target reached

As predicted in our previous analysis, USDJPY reacted perfectly to the key zones identified. After the sharp fall triggered by PPI and CPI news, the pair respected the outlined resistance and midline zones, leading to a significant decline.The market then bounced precisely from the bottom of the ascending channel, reaffirming the validity of the trend lines and support zones we highlighted earlier. This shows our recognition of crucial market levels and trend patterns.

💸 If you didn’t benefit from these moves, now’s your chance to stay ahead! Follow for real-time signals and market analysis. 🚀

🚀 Join Our Free Telegram Channels!

📈 Crypto – Bitcoin daily analysis & exclusive Altcoins opportunities!

t.me/Sober_Trading

💵 Gold & Forex – Expert insights & accurate signals!

t.me/Sober_Forex

🎯 Stay ahead with free updates!

📈 Crypto – Bitcoin daily analysis & exclusive Altcoins opportunities!

t.me/Sober_Trading

💵 Gold & Forex – Expert insights & accurate signals!

t.me/Sober_Forex

🎯 Stay ahead with free updates!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🚀 Join Our Free Telegram Channels!

📈 Crypto – Bitcoin daily analysis & exclusive Altcoins opportunities!

t.me/Sober_Trading

💵 Gold & Forex – Expert insights & accurate signals!

t.me/Sober_Forex

🎯 Stay ahead with free updates!

📈 Crypto – Bitcoin daily analysis & exclusive Altcoins opportunities!

t.me/Sober_Trading

💵 Gold & Forex – Expert insights & accurate signals!

t.me/Sober_Forex

🎯 Stay ahead with free updates!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.