The Yen has been one of the best

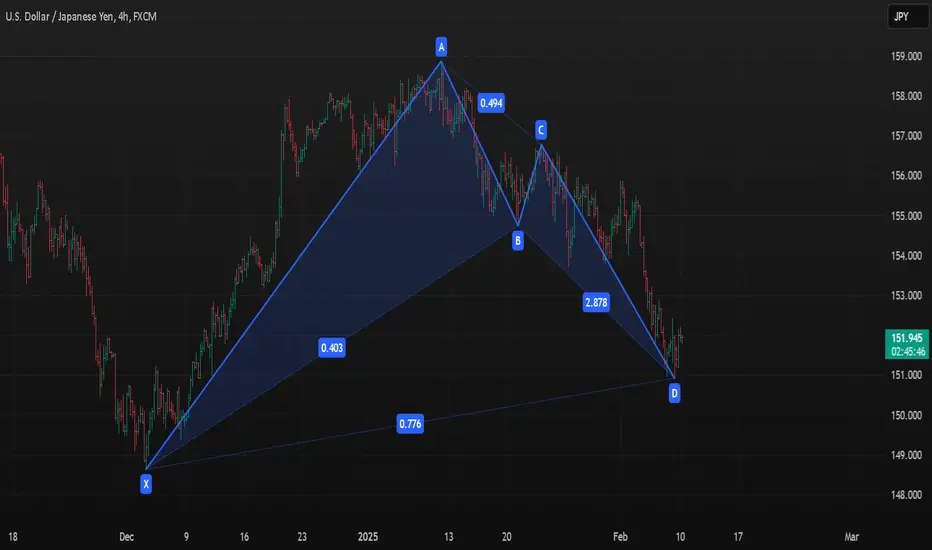

performing currencies globally since the January BoJ meeting. Most of the move has been driven by the decline in US long-end real yields as well as higher JGB yields on stronger wage data, but there has been growing outperformance over the past few trading days (Exhibit 3). First, anticipation around recent meetings between government officials, including President Trump and Prime Minister Ishiba on February 7, seems to have triggered speculation of a potential currency deal between the US and Japan to weaken the Dollar. That also then sparked renewed focus on the upcoming GPIF strategy review that many expect to result in an increased allocation to domestic bonds. While either would be positive for the Yen by definition, we are skeptical that markets can price either on a sustained basis in the very near-term. In the case of a currency agreement, the path to get there appears complicated by the US administration’s desire for easier financial conditions and the possibility that Japan would need to sell US Treasuries. On GPIF, a question remains whether the reallocation would involve foreign bond sales or simply greater FX hedging. Meanwhile, tariff risks also still loom large, with likely more yet to come. And the announcement of possible reciprocal tariffs added an extra to boost to the Yen at the end of the week. We do think the Yen will continue to outperform on tariff escalation in the very near-term as long as markets price in a hit to growth expectations and continue to flatten the rates curve in response. But we see a risk that the drag to growth turns out to be less than anticipated (as the FCI response has already so far been more muted). That would mean greater focus on the upside risks to inflation and a less positive backdrop for JPY, particularly relative to CHF. So we would caution on leaning into recent momentum. In fact, we think the recent Yen outperformance sets up for a tactical reversal, if US CPI inflation comes in firm next week and tariff risks ease (temporarily) once again.

performing currencies globally since the January BoJ meeting. Most of the move has been driven by the decline in US long-end real yields as well as higher JGB yields on stronger wage data, but there has been growing outperformance over the past few trading days (Exhibit 3). First, anticipation around recent meetings between government officials, including President Trump and Prime Minister Ishiba on February 7, seems to have triggered speculation of a potential currency deal between the US and Japan to weaken the Dollar. That also then sparked renewed focus on the upcoming GPIF strategy review that many expect to result in an increased allocation to domestic bonds. While either would be positive for the Yen by definition, we are skeptical that markets can price either on a sustained basis in the very near-term. In the case of a currency agreement, the path to get there appears complicated by the US administration’s desire for easier financial conditions and the possibility that Japan would need to sell US Treasuries. On GPIF, a question remains whether the reallocation would involve foreign bond sales or simply greater FX hedging. Meanwhile, tariff risks also still loom large, with likely more yet to come. And the announcement of possible reciprocal tariffs added an extra to boost to the Yen at the end of the week. We do think the Yen will continue to outperform on tariff escalation in the very near-term as long as markets price in a hit to growth expectations and continue to flatten the rates curve in response. But we see a risk that the drag to growth turns out to be less than anticipated (as the FCI response has already so far been more muted). That would mean greater focus on the upside risks to inflation and a less positive backdrop for JPY, particularly relative to CHF. So we would caution on leaning into recent momentum. In fact, we think the recent Yen outperformance sets up for a tactical reversal, if US CPI inflation comes in firm next week and tariff risks ease (temporarily) once again.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.