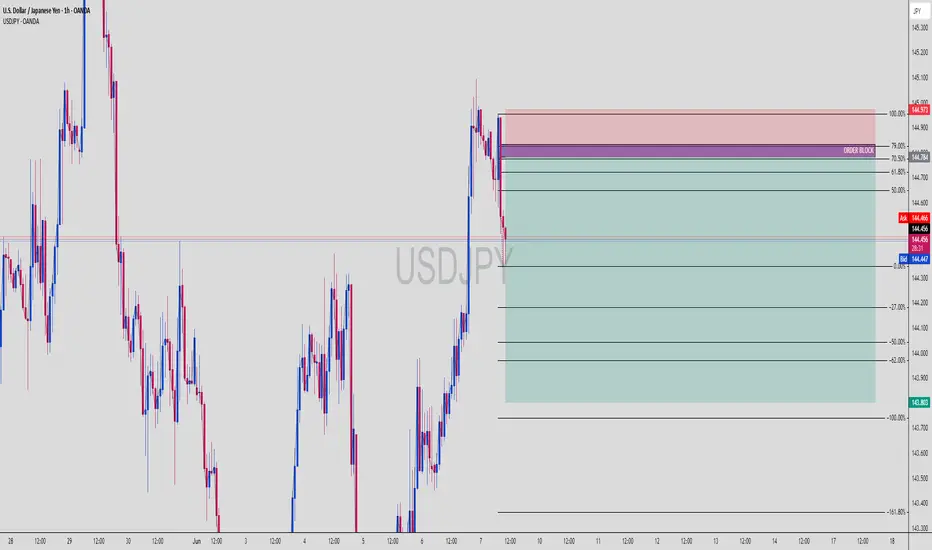

USDJPY (1H Chart) | Institutional Short Setup with OB + Fib Confluence

The market is showing clear Smart Money Distribution behavior — with a rejection from a high-confluence zone combining Order Block, Premium Fib Levels, and bearish momentum shift.

🔍 Smart Money Setup Breakdown:

🔻 Bearish Order Block Zone (OB)

Price wicked into OB zone and got instantly rejected

OB located precisely at the 70.5% – 79% premium range

Mark of institutional sell-side interest

📐 Fibonacci Retracement + Premium Zone

Retracement from swing high (144.973) to swing low (144.436)

Premium zone between 61.8% to 79% aligns with OB (144.700–144.973)

Entry taken from this zone for high-probability sell setup

📉 Bearish Confirmation

Aggressive bearish reaction post-OB tap

Market structure flipping bearish

Momentum candle breaks previous bullish leg

🔻 Target Zones (Measured Fib Extensions)

-27%: 144.200

-62%: 144.000

-100%: 143.803

-161.8%: 143.300 (extended liquidity draw)

🧠 Chart Ninja Entry Plan:

🔹 Entry Zone 144.784 – 144.973 (OB + Premium Fib + FVG rejection)

🔻 SL Above 145.000 (above OB wick)

📉 TP 1 144.200 (first fib extension)

📉 TP 2 143.803 (full -100% extension)

⚖️ RRR Approx. 1:4+ — stealthy sniper precision

💬 Pro Tip from the Ninja Dojo:

The market doesn’t move because of indicators — it moves because of liquidity.

Find the OB. Wait for the imbalance. Strike where Smart Money hides. 🥷📊

This isn’t retail — this is calculated execution.

🎯 Save this chart before price melts to 143.8

💬 Drop your entry zone & SL idea in comments

The market is showing clear Smart Money Distribution behavior — with a rejection from a high-confluence zone combining Order Block, Premium Fib Levels, and bearish momentum shift.

🔍 Smart Money Setup Breakdown:

🔻 Bearish Order Block Zone (OB)

Price wicked into OB zone and got instantly rejected

OB located precisely at the 70.5% – 79% premium range

Mark of institutional sell-side interest

📐 Fibonacci Retracement + Premium Zone

Retracement from swing high (144.973) to swing low (144.436)

Premium zone between 61.8% to 79% aligns with OB (144.700–144.973)

Entry taken from this zone for high-probability sell setup

📉 Bearish Confirmation

Aggressive bearish reaction post-OB tap

Market structure flipping bearish

Momentum candle breaks previous bullish leg

🔻 Target Zones (Measured Fib Extensions)

-27%: 144.200

-62%: 144.000

-100%: 143.803

-161.8%: 143.300 (extended liquidity draw)

🧠 Chart Ninja Entry Plan:

🔹 Entry Zone 144.784 – 144.973 (OB + Premium Fib + FVG rejection)

🔻 SL Above 145.000 (above OB wick)

📉 TP 1 144.200 (first fib extension)

📉 TP 2 143.803 (full -100% extension)

⚖️ RRR Approx. 1:4+ — stealthy sniper precision

💬 Pro Tip from the Ninja Dojo:

The market doesn’t move because of indicators — it moves because of liquidity.

Find the OB. Wait for the imbalance. Strike where Smart Money hides. 🥷📊

This isn’t retail — this is calculated execution.

🎯 Save this chart before price melts to 143.8

💬 Drop your entry zone & SL idea in comments

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.