Hey Traders,

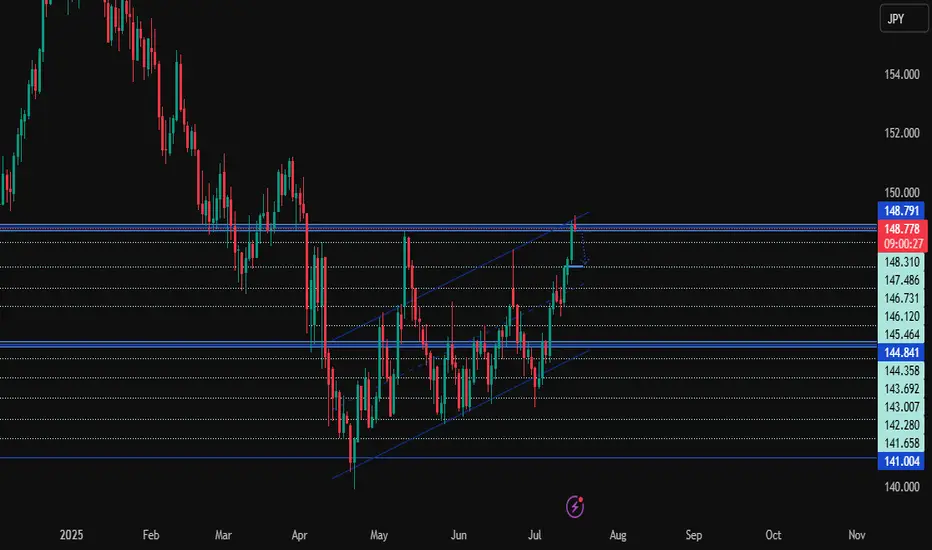

USDJPY has just tapped the top of its ascending channel around the 148.70 resistance- an area that has historically triggered bearish reactions. With signs of rejection and waning bullish momentum, we’re now at a potential inflection point for short-term downside retracement.

Current Market Conditions:

Fundamental Analysis/Outlook:

Recent USD strength has been driven by sticky U.S. inflation and hawkish Fed commentary, but JPY fundamentals are catching attention. BoJ is under pressure to shift policy due to rising wage growth and inflation spillover effects. If upcoming Japanese data supports tightening or USD weakens on risk-off sentiment, we could see a meaningful retracement in USDJPY.

Targets:

Risk Management:

Technical Outlook:

USDJPY has respected the channel boundaries since May. Unless price breaks and closes above 148.79 with strong volume and momentum, the more likely scenario is a pullback. Watch for a bearish engulfing or lower-timeframe double top confirmation to trigger entries.

Conclusion:

We’re seeing a potential top at a well-respected channel ceiling. Unless bulls break and hold above 148.79, USDJPY could be set for a healthy retracement. Keep an eye on U.S. dollar strength and BoJ policy chatter in the coming days.

Sign-off:

“In markets, clarity often lies just beyond the fear. Trade the levels, not the noise.”

💬 Drop your thoughts in the comments, give this idea a boost, and follow for more actionable setups. Stay sharp out there!

USDJPY has just tapped the top of its ascending channel around the 148.70 resistance- an area that has historically triggered bearish reactions. With signs of rejection and waning bullish momentum, we’re now at a potential inflection point for short-term downside retracement.

Current Market Conditions:

- Price has reached and slightly wicked above the upper boundary of a rising channel.

- Strong resistance zone between 148.70 – 148.79 aligns with prior swing highs.

- Early signs of bearish rejection can be seen on the latest candle close.

- Short-term structure suggests the potential for a pullback toward 147.48 or lower if sellers gain traction.

Fundamental Analysis/Outlook:

Recent USD strength has been driven by sticky U.S. inflation and hawkish Fed commentary, but JPY fundamentals are catching attention. BoJ is under pressure to shift policy due to rising wage growth and inflation spillover effects. If upcoming Japanese data supports tightening or USD weakens on risk-off sentiment, we could see a meaningful retracement in USDJPY.

Targets:

- TP1: 147.486

- TP2: 146.120

- TP3: 144.841

Risk Management:

- Stop-loss: Above 148.80 (channel breakout confirmation)

- Maintain a minimum 1:2 R:R.

- Trail stops if structure breaks lower (e.g., loss of 147.48 support).

Technical Outlook:

USDJPY has respected the channel boundaries since May. Unless price breaks and closes above 148.79 with strong volume and momentum, the more likely scenario is a pullback. Watch for a bearish engulfing or lower-timeframe double top confirmation to trigger entries.

Conclusion:

We’re seeing a potential top at a well-respected channel ceiling. Unless bulls break and hold above 148.79, USDJPY could be set for a healthy retracement. Keep an eye on U.S. dollar strength and BoJ policy chatter in the coming days.

Sign-off:

“In markets, clarity often lies just beyond the fear. Trade the levels, not the noise.”

💬 Drop your thoughts in the comments, give this idea a boost, and follow for more actionable setups. Stay sharp out there!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.