India’s Fiscal Discipline Stands Out in a High-Debt Global Economy

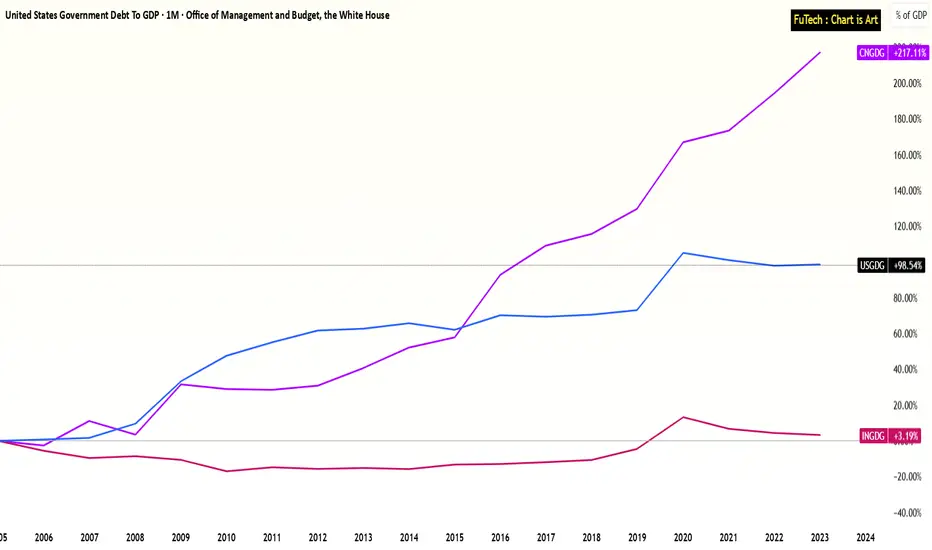

Government Debt to GDP Performance Over the Last 20 Years:

China: +217%

USA: +99%

India: +3%

Over the last 2 decades, global economies have increasingly relied on debt to stimulate growth and manage crises.

However, a closer look at long-term Debt-to-GDP trends reveals a stark contrast in fiscal discipline among major economies:

-----------------------------------------------------------------------

India: A Beacon of Fiscal Stability

India has maintained remarkable fiscal discipline, with government debt increasing by just +3% relative to its GDP over the past 20 years.

This demonstrates India’s conservative borrowing strategy, especially notable given the country’s ambitious development goals, infrastructure push, and welfare programs.

This level of restraint positions India well in the face of rising global interest rates and inflation risks.

-----------------------------------------------------------------------

USA: Steady Climb Amid Stimulus Spending

The United States has seen a +99% increase in its debt-to-GDP ratio over the same period, driven by successive rounds of stimulus, defense spending, and entitlement obligations.

While the U.S. enjoys the unique advantage of issuing the world’s reserve currency, the long-term implications of rising debt—especially as interest payments rise—pose potential challenges to fiscal sustainability.

-----------------------------------------------------------------------

China: Debt-Fueled Expansion

China’s debt-to-GDP has surged +217% over the past two decades, reflecting its aggressive infrastructure-led growth model and significant off-balance-sheet local government borrowing.

While this has powered China's rapid urbanization and industrial growth, the mounting debt burden raises questions about long-term efficiency, default risks in the shadow banking sector, and the need for deleveraging.

-----------------------------------------------------------------------

🔍 Key Insights:

1) India’s 3% debt growth over 20 years highlights an underleveraged economy, offering headroom for targeted fiscal expansion if needed.

2) In a world where debt sustainability is becoming a key investment theme, India stands out as a relatively safer macro environment.

3) This fiscal prudence complements India’s improving trade metrics and strengthens its position in global economic leadership.

-----------------------------------------------------------------------

📈 Conclusion:

As the global economy grapples with inflation, rising interest rates, and debt concerns, India’s modest rise in government debt is a key macro strength.

While China and the USA have seen significant increases in their debt burdens, India’s fiscal balance provides confidence to both investors and policymakers for future growth cycles.

This makes India an attractive long-term investment destination in a world of rising uncertainty.

Government Debt to GDP Performance Over the Last 20 Years:

China: +217%

USA: +99%

India: +3%

Over the last 2 decades, global economies have increasingly relied on debt to stimulate growth and manage crises.

However, a closer look at long-term Debt-to-GDP trends reveals a stark contrast in fiscal discipline among major economies:

-----------------------------------------------------------------------

India: A Beacon of Fiscal Stability

India has maintained remarkable fiscal discipline, with government debt increasing by just +3% relative to its GDP over the past 20 years.

This demonstrates India’s conservative borrowing strategy, especially notable given the country’s ambitious development goals, infrastructure push, and welfare programs.

This level of restraint positions India well in the face of rising global interest rates and inflation risks.

-----------------------------------------------------------------------

USA: Steady Climb Amid Stimulus Spending

The United States has seen a +99% increase in its debt-to-GDP ratio over the same period, driven by successive rounds of stimulus, defense spending, and entitlement obligations.

While the U.S. enjoys the unique advantage of issuing the world’s reserve currency, the long-term implications of rising debt—especially as interest payments rise—pose potential challenges to fiscal sustainability.

-----------------------------------------------------------------------

China: Debt-Fueled Expansion

China’s debt-to-GDP has surged +217% over the past two decades, reflecting its aggressive infrastructure-led growth model and significant off-balance-sheet local government borrowing.

While this has powered China's rapid urbanization and industrial growth, the mounting debt burden raises questions about long-term efficiency, default risks in the shadow banking sector, and the need for deleveraging.

-----------------------------------------------------------------------

🔍 Key Insights:

1) India’s 3% debt growth over 20 years highlights an underleveraged economy, offering headroom for targeted fiscal expansion if needed.

2) In a world where debt sustainability is becoming a key investment theme, India stands out as a relatively safer macro environment.

3) This fiscal prudence complements India’s improving trade metrics and strengthens its position in global economic leadership.

-----------------------------------------------------------------------

📈 Conclusion:

As the global economy grapples with inflation, rising interest rates, and debt concerns, India’s modest rise in government debt is a key macro strength.

While China and the USA have seen significant increases in their debt burdens, India’s fiscal balance provides confidence to both investors and policymakers for future growth cycles.

This makes India an attractive long-term investment destination in a world of rising uncertainty.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.