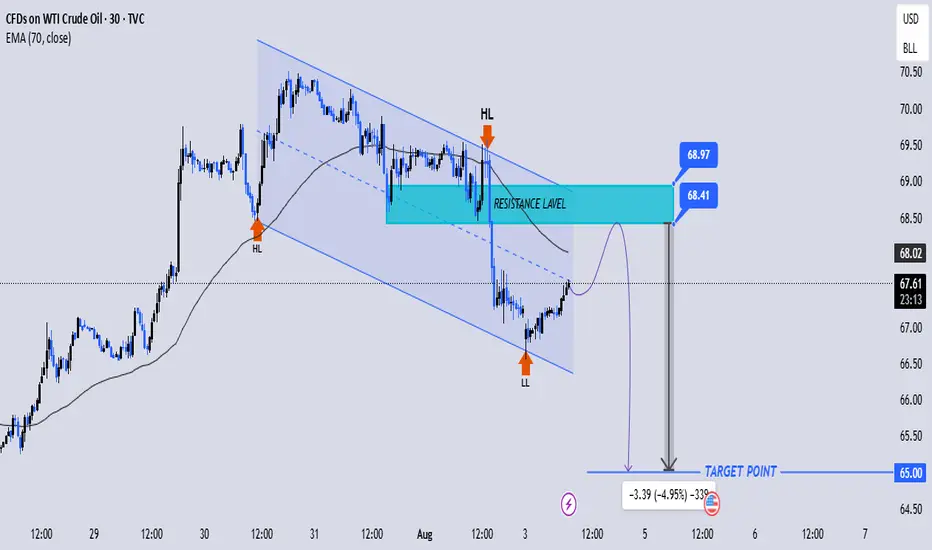

WTI Crude Oil Bearish Rejection Setup 🛢️📉

Chart Summary:

Timeframe: 30-Minute

Current Price: $67.56

EMA 70: $68.04 (acting as dynamic resistance)

Technical Analysis:

1. Trend Channel: Price is moving within a clear descending channel, respecting both upper and lower boundaries.

2. Lower High (LH) and Lower Low (LL): Confirming downtrend continuation.

3. Resistance Zone (68.41–68.97): Strong supply area aligned with previous HL and EMA 70 — ideal for rejection.

4. Price Projection: Price is expected to retest resistance, then reject sharply toward the target at $65.00.

5. Risk-Reward Ratio: ~3.39 points move, representing ~5% downside potential.

Strategies Used: ✅ Trendline & Channel Analysis

✅ EMA Rejection

✅ Market Structure (LH, LL)

✅ Supply & Demand Zone

✅ Price Action Projection

📍Bearish Bias remains valid unless price breaks and closes above $68.97.

🎯 Target: $65.00

🔐 Watch for reversal signals near resistance to confirm entry.

Chart Summary:

Timeframe: 30-Minute

Current Price: $67.56

EMA 70: $68.04 (acting as dynamic resistance)

Technical Analysis:

1. Trend Channel: Price is moving within a clear descending channel, respecting both upper and lower boundaries.

2. Lower High (LH) and Lower Low (LL): Confirming downtrend continuation.

3. Resistance Zone (68.41–68.97): Strong supply area aligned with previous HL and EMA 70 — ideal for rejection.

4. Price Projection: Price is expected to retest resistance, then reject sharply toward the target at $65.00.

5. Risk-Reward Ratio: ~3.39 points move, representing ~5% downside potential.

Strategies Used: ✅ Trendline & Channel Analysis

✅ EMA Rejection

✅ Market Structure (LH, LL)

✅ Supply & Demand Zone

✅ Price Action Projection

📍Bearish Bias remains valid unless price breaks and closes above $68.97.

🎯 Target: $65.00

🔐 Watch for reversal signals near resistance to confirm entry.

Note

target reached fighters enjoy your special profits with usjoin my tellegram channel

t.me/JaMesGoldFiGhteR786

join my refferal broker

one.exnesstrack.org/a/g565sj1uo7?source=app

t.me/JaMesGoldFiGhteR786

join my refferal broker

one.exnesstrack.org/a/g565sj1uo7?source=app

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

join my tellegram channel

t.me/JaMesGoldFiGhteR786

join my refferal broker

one.exnesstrack.org/a/g565sj1uo7?source=app

t.me/JaMesGoldFiGhteR786

join my refferal broker

one.exnesstrack.org/a/g565sj1uo7?source=app

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.