Supply-Side Uncertainties Persist:

Iran is seeking mediation and restarting nuclear negotiations. If the talks succeed and sanctions are relaxed, Iran's crude oil supply is expected to increase, which will have a positive impact on market supply. However, the U.S. currently requires Iran to completely stop uranium enrichment activities, and Iran has taken a tough stance on this, leaving the negotiation prospects unclear. If Iran rejects the U.S. proposal, Israel may launch further military actions. Once Iran's oil infrastructure is affected, supply will decrease, keeping uncertainties in the crude oil supply side persistent.

Market Sentiment Eases Somewhat:

Iran's active pursuit of mediation and Saudi Arabia's promotion of a ceasefire framework have alleviated market concerns about further conflict escalation, reducing upward pressure on oil prices to a certain extent. If mediation and peace talks make progress, market panic will further subside, and oil prices may correct due to the decline in risk premiums.

Attention to U.S. Attitude:

The U.S. plays a key role in the Iran-Israel conflict. Its sanctions policy against Iran and military presence in the Middle East will both affect the crude oil market. If the U.S. promotes peace talks between Israel and Iran, it will help stabilize the market; if the U.S. supports Israel's military actions, it will intensify market concerns and push oil prices higher.

In Summary:

News related to Iran's request for mediation and the restart of nuclear negotiations has increased uncertainties in the crude oil market, but the direction remains unclear. Crude oil prices may fluctuate around current levels next week, with specific trends requiring close attention to factors such as the development of the Iran-Israel conflict, progress in nuclear negotiations, and the U.S. attitude.

Crude oil next week strategy analysis, hope it helps you

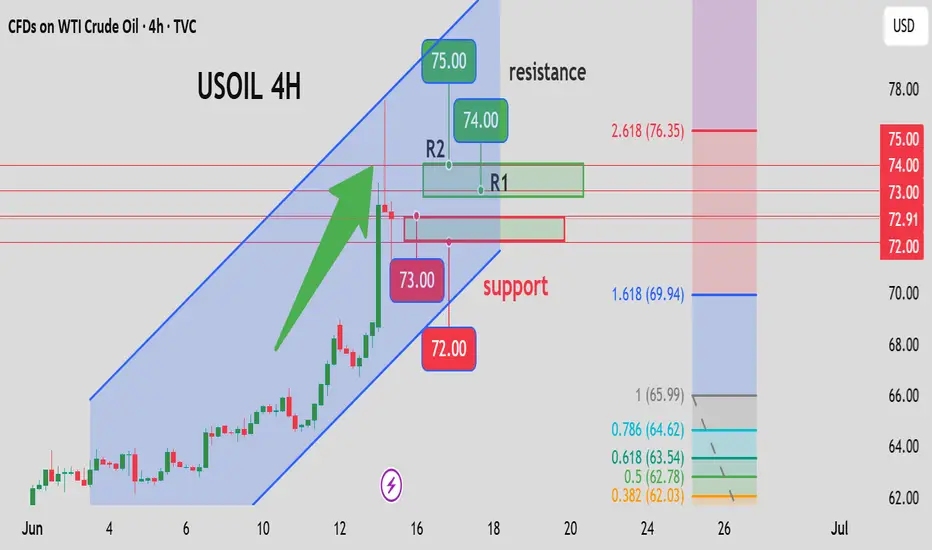

USOIL BUY72~73

SL:70

TP1:74~75

Iran is seeking mediation and restarting nuclear negotiations. If the talks succeed and sanctions are relaxed, Iran's crude oil supply is expected to increase, which will have a positive impact on market supply. However, the U.S. currently requires Iran to completely stop uranium enrichment activities, and Iran has taken a tough stance on this, leaving the negotiation prospects unclear. If Iran rejects the U.S. proposal, Israel may launch further military actions. Once Iran's oil infrastructure is affected, supply will decrease, keeping uncertainties in the crude oil supply side persistent.

Market Sentiment Eases Somewhat:

Iran's active pursuit of mediation and Saudi Arabia's promotion of a ceasefire framework have alleviated market concerns about further conflict escalation, reducing upward pressure on oil prices to a certain extent. If mediation and peace talks make progress, market panic will further subside, and oil prices may correct due to the decline in risk premiums.

Attention to U.S. Attitude:

The U.S. plays a key role in the Iran-Israel conflict. Its sanctions policy against Iran and military presence in the Middle East will both affect the crude oil market. If the U.S. promotes peace talks between Israel and Iran, it will help stabilize the market; if the U.S. supports Israel's military actions, it will intensify market concerns and push oil prices higher.

In Summary:

News related to Iran's request for mediation and the restart of nuclear negotiations has increased uncertainties in the crude oil market, but the direction remains unclear. Crude oil prices may fluctuate around current levels next week, with specific trends requiring close attention to factors such as the development of the Iran-Israel conflict, progress in nuclear negotiations, and the U.S. attitude.

Crude oil next week strategy analysis, hope it helps you

USOIL BUY72~73

SL:70

TP1:74~75

Trade active

I will update the latest data in time, please continue to pay attentionDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.