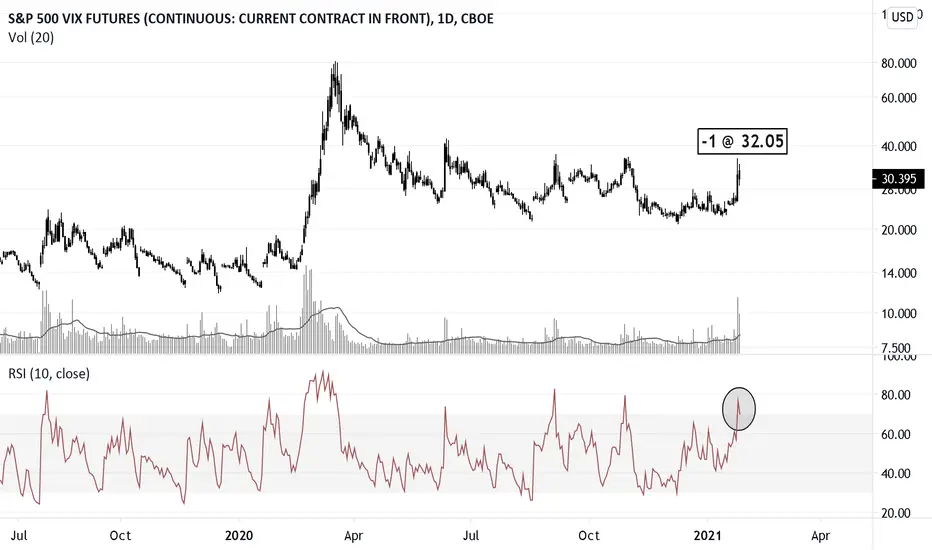

The volatility index otherwise known as the vix is overextended above 30 with the RSI well above it's upper bound.

I've opened a short at 32.05 on the March(H) contract.

Historically, the vix sells off soon after it breaches the upper RSI boundary. Unless a cataclysmic event occurs, I think history will repeat.

I've opened a short at 32.05 on the March(H) contract.

Historically, the vix sells off soon after it breaches the upper RSI boundary. Unless a cataclysmic event occurs, I think history will repeat.

Trade closed: stop reached

Stopped out for a small loss. I'll reload this on a better entry soon.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.