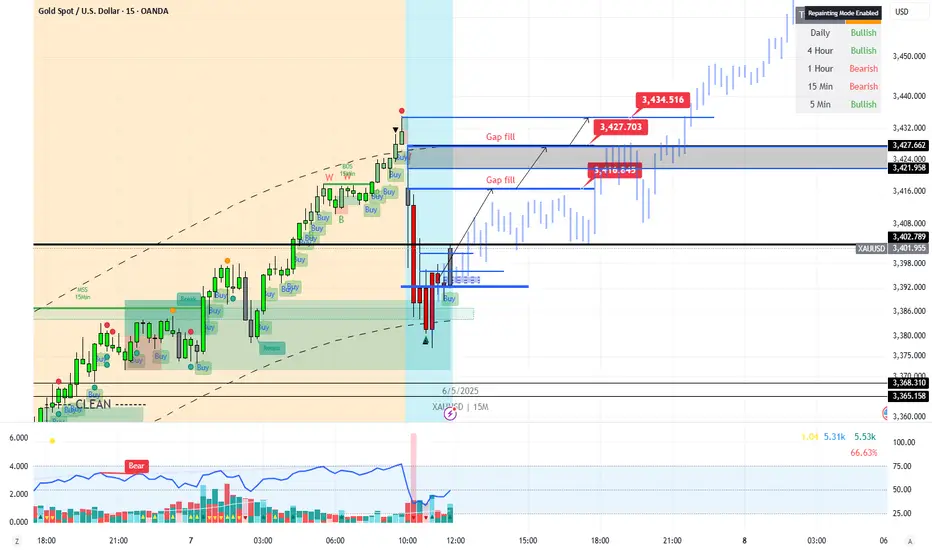

- A Shape Recovery

- Return to Previous Level imminent

- Profit taking at NZ open from the massive run-up yesterday.

- COT data didn’t show any buying of longs on Monday It could have driven down lower, but instead, they drove it up.

- First, it should fill the gap, then continue on to 4,000… then 7,000 over time, of course.

- The USA is still in hot water — Trump has ruffled a lot of feathers.

- No one trusts him, no one likes him — a snake in the grass.

- China is hunkering down until he’s gone.

- Xi Jinping will not tolerate Trump’s snide remarks or his constant demeaning of him and China.

- So, the USD will likely face 145% tariffs for quite some time.

- It’s the perfect tool to help destroy Americas economy and they did it to themselves.

- Weak Dollar. Strong Gold.

- "China has stated it will not engage until the U.S. cancels its 145% tariffs, a condition the U.S. has not met. Despite hints of openness from both sides and China evaluating U.S. approaches, no formal agreement has been confirmed, and conflicting statements suggest the situation remains fluid. The lack of a signed deal, combined with China’s retaliatory 125% tariffs and its focus on diversifying trade partners, casts doubt on an imminent resolution"

Trade active

Did it again trying to front run Aussey thinking they will Follow NZ but they taking profits to.Might move down for a sweep who the hell knows good god !

One day I will have re trained my reptilian brain to not chase breakouts NZ do it all the time Arh !

Always tweaking this and that just added Text to Trendline Template "FAKE OUT POTENTIAL DO NOT BUY !" above Trigger line where all the stops are very often creating a reversal in direction.

One day i will get the perfect entry mark my words : )

Gap will be filled 1000% though imho : )

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.