Comprehensive analysis of the gold market and trading strategy recommendations

News analysis

Short-term support factors

Weakened US dollar: The market is in a wait-and-see mood before the Fed's interest rate meeting, and the US dollar bulls are temporarily suspended, providing support for interest-free assets such as gold.

Safe-haven demand: Policy uncertainty (such as the Fed's interest rate decision) may trigger a short-term return of funds to gold.

Repressive factors

Trade situation easing: The US-EU tariff agreement, US-Japan and US-China trade progress boost risk appetite and weaken the safe-haven appeal of gold.

Bull-bear game: Gold is currently at a balance between "macro game" and "technical adjustment", and needs to wait for the FOMC statement and economic data (GDP, PCE) to guide the direction.

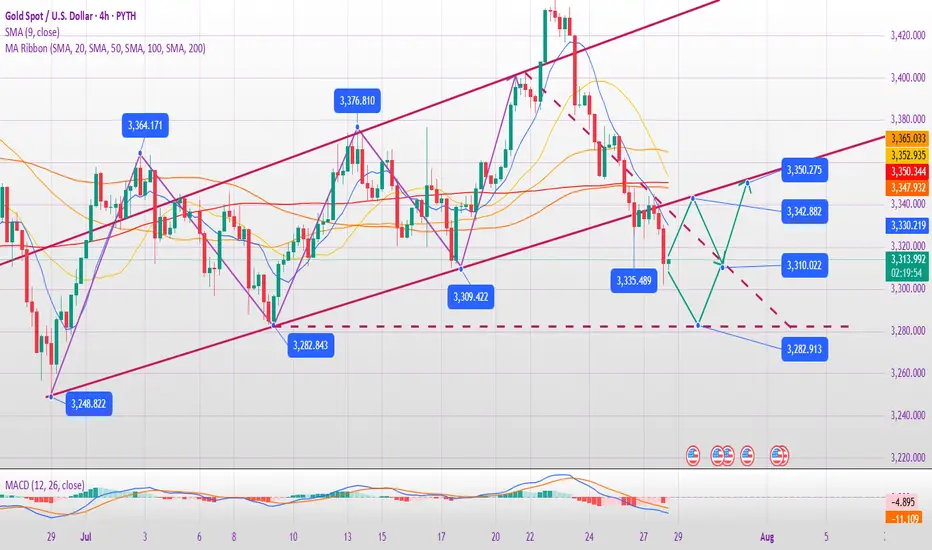

Technical analysis

Long-term trend (monthly/weekly)

Top signal appears: 3 consecutive months of long upper shadows (April-June). If the long upper shadow is closed again in July, it may confirm that the bears are dominant, and the market may drop to the 3000-2950 area in the future.

Key resistance: 3400-3500 area is a historically strong pressure. Even if the Fed cuts interest rates to stimulate the rise, it may form a "lure to buy" and then reverse.

Short-term key position (daily/4 hours)

Bull-short watershed: 3350 is the short-term strong and weak boundary. If it breaks through, it will look up to 3370-3405; if it is under pressure, it will look down to 3330-3290.

Oscillation characteristics: The recent long-short continuity is poor (such as last week's sharp rise and then a sharp drop), so be wary of repeated washes.

Today's operation strategy

Short-order opportunity

Entry area: 3330-3340 (aggressive investors can arrange in batches), stop loss above 3350.

Target position: 3290-3280, look at 3245 after breaking down.

Long-order opportunity

Pullback support: 3290-3280 light position to try long, stop loss below 3270, target 3310-3320 (short-term rebound).

Breakthrough follow-up

Break above 3350: Wait and see if it is a false breakthrough. If it stabilizes, you can buy short-term to 3370-3405 (need to cooperate with the Fed's dovish signal).

Break below 3280: Be cautious when chasing shorts, avoid low-level sweeps, and pay attention to the support of 3245.

Risk warning

Federal Reserve decision: If the interest rate is cut but the "hawkish expectations" are released (such as the subsequent suspension of interest rate cuts), gold may rise and fall.

Data impact: If GDP/PCE is stronger than expected, it may strengthen the US dollar and suppress gold prices.

Summary: At present, gold is in a volatile bearish pattern. It is recommended to sell short at the rebound high as the main trading idea, and strictly stop loss. Conservatives can wait for the trend to become clear after the Fed's decision before making a layout.

Trade active

Latest Gold Trend Analysis and Trading Strategy:

Key Levels

Resistance: 3330/3335 (Primary Resistance), 3345/3355 (Secondary Resistance)

Support: 3300/3305 (Primary Support), 3280/3270 (Breakthrough Target)

Intraday Strategy

Short-Term Bullish Opportunity (Caution)

If the price stabilizes after a pullback to 3305-3310, a light short-term long position can be adopted, with a target of 3320-3325 and a stop loss below 3300.

Primary Short Position

Option A (Weak Correction): Short in batches upon a rebound to 3330-3335, with a stop loss at 3338 and a target of 3315-3310.

Option B (Strong Correction): If the price breaks through 3335, wait for a short position in the 3345-3355 area, with a stop loss at 3360 and a target of 3320-3300.

If it breaks down directly below 3300, short on a rebound to 3305-3310, with a target of 3280-3270 and a stop loss at 3315. Logical Analysis

Trend: The daily chart shows four consecutive declines, indicating a bearish trend under pressure from the 3440 level. However, after this continuous decline, caution is warranted regarding a potential rebound at the 3300 support level.

Correction Expectation:

Weak correction: Oscillation below 3335, with a doji close on the daily chart.

Strong correction: After rebounding to 3345-3355, it will come under pressure again, accumulating momentum for subsequent decline.

Risk Warning: Avoid shorting at low levels. Wait for a rebound or confirmed breakout before entering the market.

Summary

Shorting on rebounds is the primary strategy for the day, with key levels at 3335 and 3300. If the morning session does not break through 3300, choose an opportunity to go short before or after the US session; if the European session breaks through 3335 strongly, adjust the short position to above 3350.

Trade closed: target reached

Has gold bottomed out on July 30?

Key Influencing Factors

Negative Factors:

A stronger US dollar: A rebound in the US dollar index is suppressing gold prices.

Recovering risk appetite: Market demand for safe-haven assets is weakening.

Rising real interest rates: Expectations of Fed policy are impacting the cost of holding gold.

US-EU trade agreement: Easing geopolitical tensions will weaken gold's safe-haven appeal.

Potentially bullish variables:

Federal Reserve policy signals: A dovish statement on Wednesday could boost gold prices.

Geopolitical risks: Uncertainties such as the Sino-US trade negotiations and the situation in the Middle East remain.

Technical Analysis

Trend Analysis:

Short-term weakness (four consecutive negative daily candlestick patterns), but the broader bullish trend remains.

Key support level: 3300-3285 (falling below or falling to 3250); resistance level: 3330-3345 (breaking through may end the pullback).

Key Levels:

Downward Support: 3310-3300 (short-term), 3285 (strong support). Upper resistance: 3335-3345 (trend reversal expected after a breakout).

Trading Strategy

Short-term Trading:

Long positions primarily at low levels: Try a light buy position in the 3300-3310 area, with a stop-loss below 3285 and a target of 3330-3345.

Short selling at high levels is auxiliary: If it rebounds to 3335-3345 and is under pressure, you can short sell with a stop loss above 3350 and a target of 3310-3300.

Follow up on the breakout: If it breaks through 3345 strongly, you can chase long positions; if it falls below 3285, be wary of a rebound after a false break.

Medium- to Long-term Strategy:

Watch for potential bottoming opportunities near 3285. If it stabilizes, place long positions in batches, betting on dovish signals from the Federal Reserve or escalating geopolitical risks.

Risk Warning: Data-sensitive period: This week's Federal Reserve decision and economic data may trigger significant volatility, so position management is crucial. US Dollar Trends: The US dollar and gold prices show a significant negative correlation, so the US Dollar Index should be monitored closely.

Risk of false break: There may be a trap below 3300, which needs to be confirmed in combination with the K-line pattern.

Summary: Gold is under short-term pressure, but the medium- to long-term bullish outlook remains unchanged. Focus on the effectiveness of support in the 3300-3285 area and the direction of the Federal Reserve's policy. We recommend a flexible approach, using key breakthroughs as a guide for directional analysis, and cautiously holding positions before data releases.

❤️Free gold trading signals:t.me/+OJSbWQ6F4KM2Mzk1

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

❤️Free gold trading signals:t.me/+OJSbWQ6F4KM2Mzk1

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.