Gold Analysis – Key Levels + CPI Outlook!

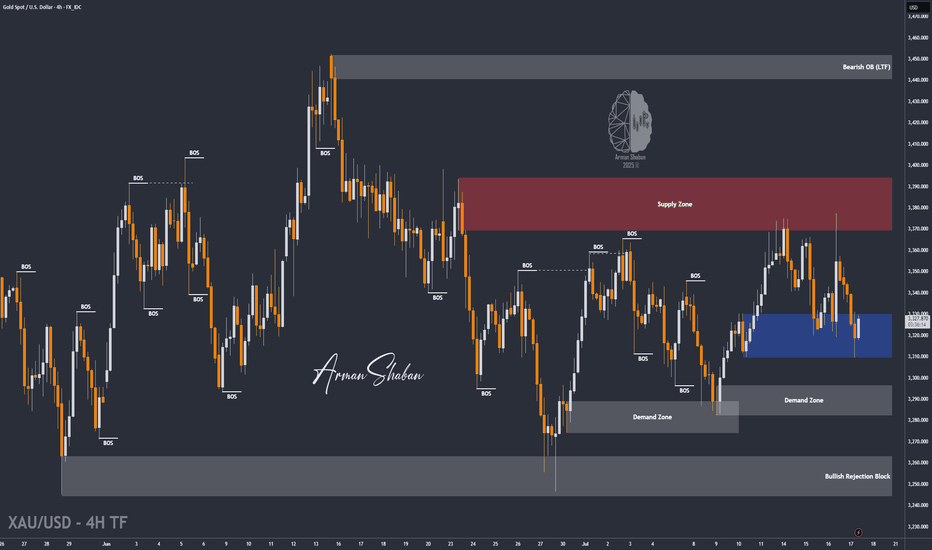

In this video, I broke down the recent rejection from the $3366–$3369 resistance zone, the drop to $3346, and current price action around $3357.

We’ll also look ahead at what to expect with the upcoming CPI report — and how it could shape gold’s next big move.

📌 I’ve covered both bullish and bearish scenarios, shared key demand/supply zones, and outlined possible targets.

👉 For full context and trading strategy, make sure to watch the video till the end — and don’t forget to drop your opinion in the comments:

Do you think gold will break $3380 next, or are we headed for another pullback?

THE MAIN ANALYSIS :

In this video, I broke down the recent rejection from the $3366–$3369 resistance zone, the drop to $3346, and current price action around $3357.

We’ll also look ahead at what to expect with the upcoming CPI report — and how it could shape gold’s next big move.

📌 I’ve covered both bullish and bearish scenarios, shared key demand/supply zones, and outlined possible targets.

👉 For full context and trading strategy, make sure to watch the video till the end — and don’t forget to drop your opinion in the comments:

Do you think gold will break $3380 next, or are we headed for another pullback?

THE MAIN ANALYSIS :

Trade active

By analyzing the gold chart on the 4-hour timeframe, we can see that, as expected from the previous analysis, gold faced a sharp drop, reaching $3341. After entering the demand zone between $3339 and $3345, it reacted strongly, rallying 250 pips to hit the $3366 target. Once it reached that level, a correction followed, and gold is currently trading around the $3328 demand area. If gold manages to hold above the $3310–$3330 range, we can expect further upside potential. The next possible targets are $3334, $3345, and $3356. This analysis will be updated!Trade closed: target reached

By analyzing the gold chart on the 4-hour timeframe, we can see that, as expected, today the price reacted strongly within the $3310–$3330 demand zone, preventing further decline. After a slight pullback to $3329, gold made a powerful upward move, hitting all three targets at $3334, $3345, and $3356. It didn’t stop there and rallied further up to the $3377 supply zone.After sweeping the liquidity above $3377, the price faced a rejection and is currently trading around $3347. Now, the key question is whether gold can hold above the critical $3340 level. If it manages to stabilize above this zone, we can expect another bullish move. Otherwise, a drop below $3310 could occur, though for now, that scenario seems less likely.

Show some love and support for this post, and stay tuned for tomorrow’s fresh gold analysis and signals! Hope you made the most out of this move — total gain: over 570 pips!

Note

Gold Pre-Closing Update – Key Levels in Play!The 4H gold chart has moved exactly as expected:

✅ Both upside targets at $3331 and $3345 were perfectly hit, showing how well these levels act as both resistance and support.

✅ After rejecting $3345, price briefly dropped to $3331, where strong buying pressure triggered a push to $3361.

Technical Bias & Scenarios:

Bullish Bias: If gold holds above $3353, we could see further upside, possibly retesting $3368–$3375 before market close.

Bearish Bias: Losing $3353 will likely trigger a rejection toward $3345, and if broken, deeper pullbacks to $3331 could follow.

Invalidation Level:

A daily close below $3331 would invalidate this bullish structure and open the path for $3310 retest next week.

Key Levels to Watch:

Upside: $3353 (support confirmation), $3368–$3375 (next resistance zone).

Downside: $3353 (pivot), $3345 & $3331 (major supports).

Keep tracking reactions at these zones — both scenarios are tradable, so patience is key!

MORE INFO IN THE LATEST ANALYSIS :

⚜️ Free Telegram Channel : t.me/PriceAction_ICT

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️ Free Telegram Channel : t.me/PriceAction_ICT

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.