Gold operation analysis suggestions

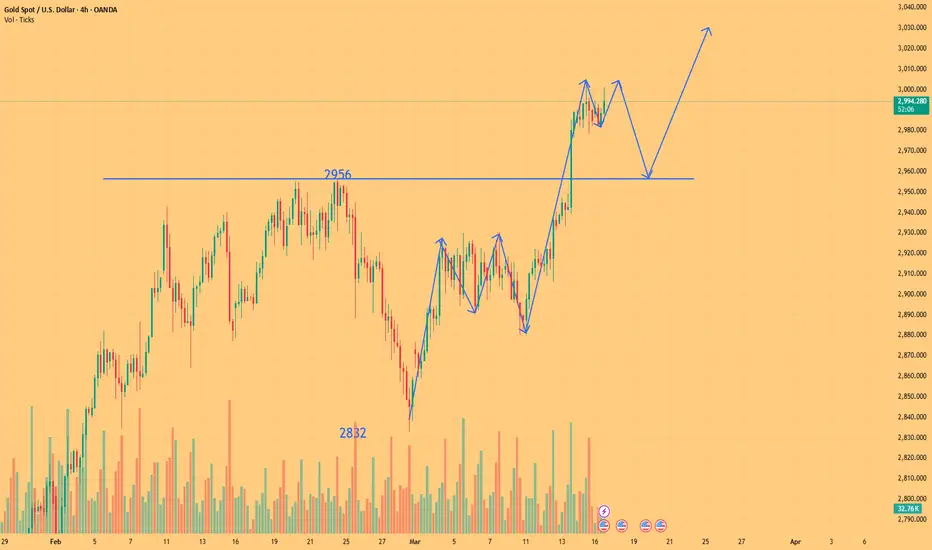

Gold needs to focus on the low point of 2980-2975 formed last Friday. If the gold price can hold this area, the strong bullish pattern will continue; if the 2980-2975 area is lost, the next opportunity for gold price to rise again after falling back to the previous top-bottom conversion area of 2950-2956 can be paid attention to. However, if this area is also broken, the market is likely to face the risk of peaking. Before this area is broken, the gold market will still be dominated by a bullish trend.

From the perspective of the upper resistance level, we should first focus on whether it can break through $3005. The further resistance level is at $3015-3020, followed by $3044-3048, $3065-3070 and $3090-3100. These points are the target positions for bullish rises, and they may also cause gold prices to fall at any time due to strong resistance. It should be noted that if the gold price falls before reaching a new high, the strategy of falling back and buying on dips should be the main strategy; if the gold price does not adjust and directly starts a large-scale rise mode, we can pay attention to the short-selling opportunities near the resistance level, and if the gold price falls again in the future, the long orders originally planned to be arranged above $2950-2956 will be closed.

From the perspective of the upper resistance level, we should first focus on whether it can break through $3005. The further resistance level is at $3015-3020, followed by $3044-3048, $3065-3070 and $3090-3100. These points are the target positions for bullish rises, and they may also cause gold prices to fall at any time due to strong resistance. It should be noted that if the gold price falls before reaching a new high, the strategy of falling back and buying on dips should be the main strategy; if the gold price does not adjust and directly starts a large-scale rise mode, we can pay attention to the short-selling opportunities near the resistance level, and if the gold price falls again in the future, the long orders originally planned to be arranged above $2950-2956 will be closed.

Trade active

The current resistance level of gold is 3007 and the support level is 2980. If it does not break through, you can choose to sell gold. Click the link to get the trading strategyt.me/+WYSalPEhDtljZDNk

100% accurate trading signals

Free trading strategies

100% accurate trading signals

Free trading strategies

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

t.me/+WYSalPEhDtljZDNk

100% accurate trading signals

Free trading strategies

100% accurate trading signals

Free trading strategies

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.