Key Influencing Factors

Negative Factors:

A stronger US dollar: A rebound in the US dollar index is suppressing gold prices.

Recovering risk appetite: Market demand for safe-haven assets is weakening.

Rising real interest rates: Expectations of Fed policy are impacting the cost of holding gold.

US-EU trade agreement: Easing geopolitical tensions will weaken gold's safe-haven appeal.

Potentially bullish variables:

Federal Reserve policy signals: A dovish statement on Wednesday could boost gold prices.

Geopolitical risks: Uncertainties such as the Sino-US trade negotiations and the situation in the Middle East remain.

Technical Analysis

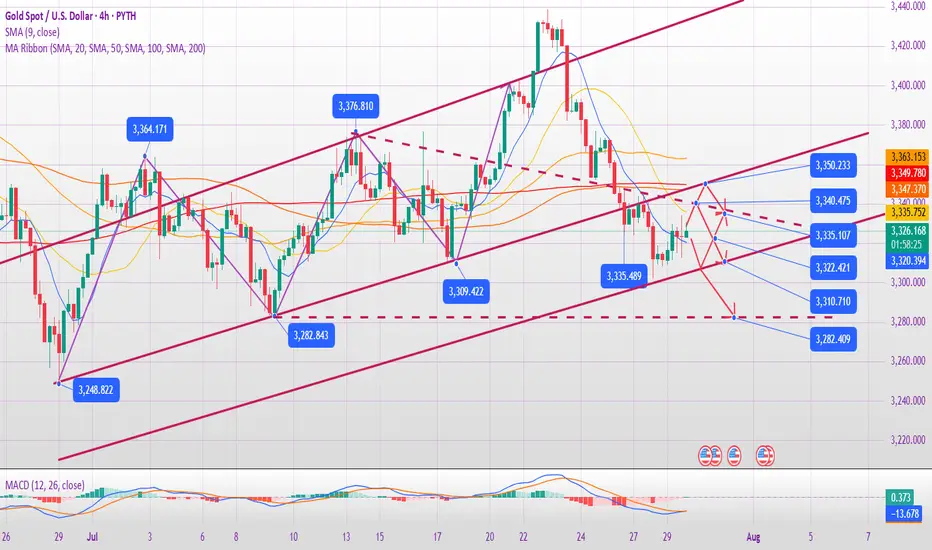

Trend Analysis:

Short-term weakness (four consecutive negative daily candlestick patterns), but the broader bullish trend remains.

Key support level: 3300-3285 (falling below or falling to 3250); resistance level: 3330-3345 (breaking through may end the pullback).

Key Levels:

Downward Support: 3310-3300 (short-term), 3285 (strong support). Upper resistance: 3335-3345 (trend reversal expected after a breakout).

Trading Strategy

Short-term Trading:

Long positions primarily at low levels: Try a light buy position in the 3300-3310 area, with a stop-loss below 3285 and a target of 3330-3345.

Short selling at high levels is auxiliary: If it rebounds to 3335-3345 and is under pressure, you can short sell with a stop loss above 3350 and a target of 3310-3300.

Follow up on the breakout: If it breaks through 3345 strongly, you can chase long positions; if it falls below 3285, be wary of a rebound after a false break.

Medium- to Long-term Strategy:

Watch for potential bottoming opportunities near 3285. If it stabilizes, place long positions in batches, betting on dovish signals from the Federal Reserve or escalating geopolitical risks.

Risk Warning: Data-sensitive period: This week's Federal Reserve decision and economic data may trigger significant volatility, so position management is crucial. US Dollar Trends: The US dollar and gold prices show a significant negative correlation, so the US Dollar Index should be monitored closely.

Risk of false break: There may be a trap below 3300, which needs to be confirmed in combination with the K-line pattern.

Summary: Gold is under short-term pressure, but the medium- to long-term bullish outlook remains unchanged. Focus on the effectiveness of support in the 3300-3285 area and the direction of the Federal Reserve's policy. We recommend a flexible approach, using key breakthroughs as a guide for directional analysis, and cautiously holding positions before data releases.

Trade active

Will gold bottom out and rebound on July 31st?

1. Key News Drivers

Federal Reserve Policy Expectations: The market generally expects the Fed to maintain a hawkish stance. If economic data (such as ADP, GDP, and PCE) show strong performance, the expected rate cut may be further postponed, which is bearish for gold.

Geopolitics and Risk Aversion: Uncertainty in the US-China trade negotiations and the situation in the Middle East may temporarily support gold prices, but the market is currently more focused on macroeconomic data.

Dollar Trend: If the US dollar index continues to strengthen (driven by expectations of a Fed rate hike), it will suppress gold's rebound potential.

2. Key Technical Signals

Trend Break Confirmation:

The daily chart shows four consecutive declines below the 60-day moving average and the rising trend line, confirming a mid-term correction following the 3439 high.

The next key support is 3245 (previous low). If it falls below this, the price could drop to 3150-3120.

Short-term oversold rebound demand:

The RSI entered the oversold zone, and a technical rebound may occur.

Key rebound resistance level:

3315-3325 (near yesterday's high, short-term short position entry area)

3345-3350 (bull-bear watershed, strong resistance area)

3380-3400 (trend reversal confirmation point, ideal layout position for medium-term short positions)

3. Today's operation strategy

(1) Short-term trading (intraday)

Mainly high-short:

Rebound to 3315-3325, light position short test, stop loss 3335, target 3280-3270.

If it touches 3345-3350, you can add short positions, stop loss 3360, target 3300-3280.

Dip-buying strategy (caution):

If the price stabilizes after a pullback to 3280-3270, short-term buying is recommended, with a stop-loss at 3260 and a target of 3300-3310 (quick entry and exit).

4. Key Risks

Federal Reserve Policy Shift: If the Fed unexpectedly releases dovish signals (such as hinting at a rate cut), it could trigger a rapid rebound in gold prices.

Unfortunate Economic Data: If US GDP, PCE, and other data fall short of expectations, it could boost gold prices in the short term, but after the rebound, it will still be an opportunity to buy higher.

Escalating Geopolitical Conflict: If a major risk event occurs (such as a escalation in the Sino-US trade war), it could temporarily boost safe-haven buying.

Summary

Short-Term: Oversold rebounds may provide opportunities to sell high, with attention to resistance at 3315-3325 and 3345-3350.

Medium-Term: The trend remains bearish, with a target of 3245 to 3150. Any upward movement is considered an opportunity to enter a short position. Trading strategy: Mainly short on rebound, be cautious when buying long orders on rebound, and strictly set stop-loss to prevent unexpected fluctuations.

❤️Free gold trading signals:t.me/+OJSbWQ6F4KM2Mzk1

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

❤️Free gold trading signals:t.me/+OJSbWQ6F4KM2Mzk1

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.