Tariff and inflation concerns have fueled safe-haven buying, with gold up more than 15% this year

US President Donald Trump said on Monday that tariffs on imported cars were coming, but hinted that not all of the threatened tariffs would take effect on April 2 and that some countries could be exempted.

This is sure to raise concerns that if the tariffs are officially implemented, they could push up inflation and stifle economic growth, so investment flows in the market have shifted to traditional safe-haven assets such as gold for allocation.

Gold has always been considered a hedge against inflation and macroeconomic instability. Since the beginning of the year, the price of gold has increased by more than 15% and reached an all-time high of $ 3,057.21 / ounce on March 20.

Market Focuses on PCE Inflation Data, Fed Maintains Dovish Expectations

The market is now paying attention to the US Personal Consumption Expenditures (PCE) price index, which will be released on Friday. This index is considered the core data for the Federal Reserve to assess inflation trends and may provide further material for assessing the path of interest rate cuts this year.

If the PCE inflation index does not show any unusual changes, it will further strengthen the Fed's dovish stance and continue to push gold prices up. More detailed assessments will be sent to readers in later publications.

Last week, the Federal Reserve kept its benchmark interest rate unchanged but signaled it could start cutting rates later this year. Since gold does not yield interest, it is often more attractive in a low-interest-rate environment.

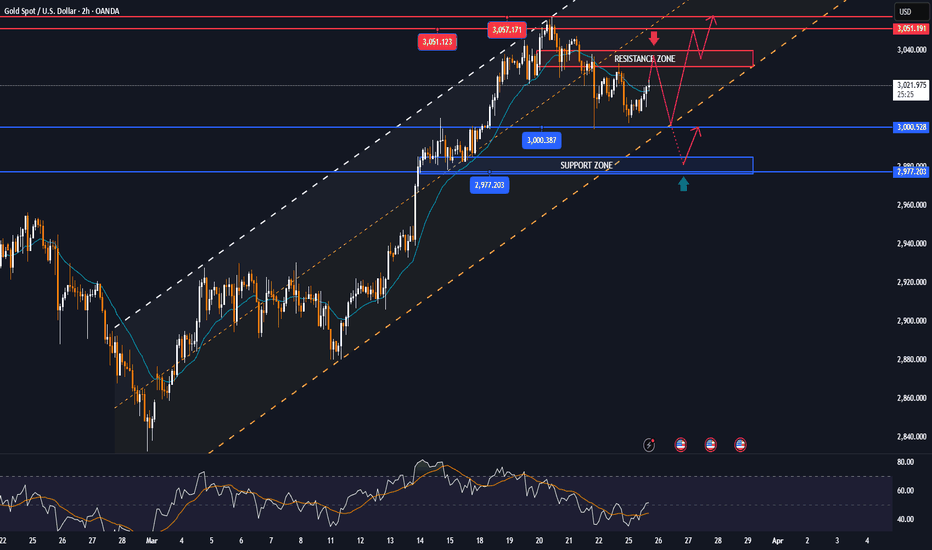

Technical Outlook Analysis

Gold continues to rally since receiving support from the $3,000 raw price level, which was a key support noted by readers in previous issues.

The current position above the 0.50% Fibonacci extension level is a positive signal for gold to target the initial upside target in the weekly issue at $3,051 in the short term, more likely an all-time high.

The relative strength index (RSI) is also bent upwards, which should be considered a corrective signal due to the weakening/ending profit-taking momentum.

Going forward, the technical structure remains unchanged with the daily chart dominated by the bullish trend with the price channel as the main trend and the EMA21 as the main support.

As long as gold remains above the EMA21, it still has a bullish outlook in the medium term, along with that, the notable positions for this trading day will be listed as follows.

Support: 3,021 – 3,000 USD

Resistance: 3,051 – 3,057 USD

SELL XAUUSD PRICE 3062 - 3060⚡️

↠↠ Stoploss 3066

→Take Profit 1 3054

↨

→Take Profit 2 3048

BUY XAUUSD PRICE 2989 - 2991⚡️

↠↠ Stoploss 2985

→Take Profit 1 2997

↨

→Take Profit 2 3003

Note

🔴Gold is trading around $3,038/ozNote

🔴Gold Spot Hits Another Record HighGold Spot broke the previous high, going as high as $3057.85/ounce, a cumulative gain of more than 16% for the year.

Note

Gold hits new high at $3,063Note

🔴SPDR Gold Trust, the world's largest gold ETF, increased its position by 2.29 tonnes from the previous day, with its current position at 931.94 tonnes.Note

Gold has continued to be a shining investment channel since the beginning of 2025. According to analysts, gold has easily surpassed the $3,000/ounce threshold, even approaching the $3,100/ounce mark. Demand for gold remains very strong from central banks, Chinese consumers, and North American investors - especially from the US, where the potential is still untapped.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.