⚙️ Technical Structure

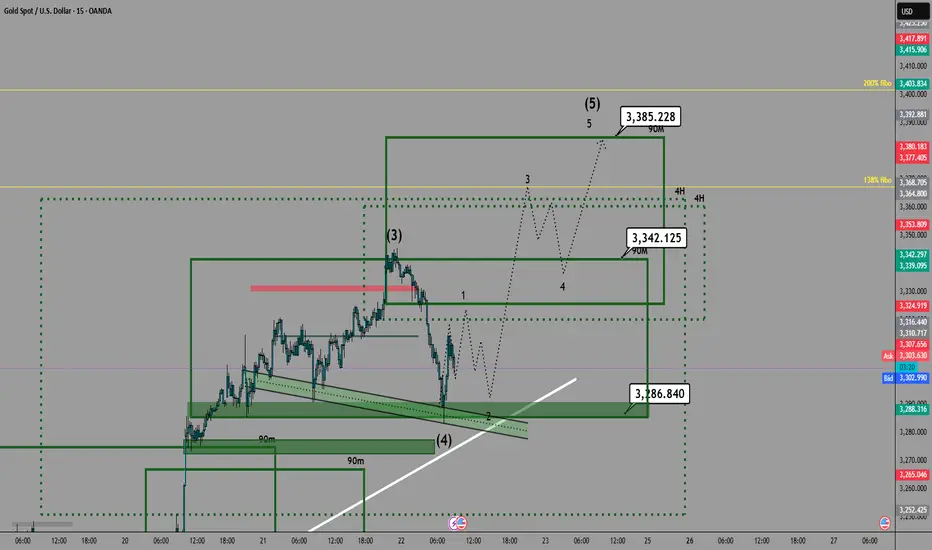

Gold (XAUUSD) appears to be completing an Elliott Wave impulsive sequence, with Wave (4) recently finding strong support and the beginning of Wave (5) now unfolding.

Wave (3) topped near 3,342

Wave (4) retraced into a high confluence support zone (green area + rising trendline)

Wave (5) is expected to unfold in 5 micro sub-waves, aiming for:

🎯 3,342.125 – short-term resistance / subwave 3 target

🎯 3,385.228 – final extension zone (200% Fib of Wave 1)

🔍 Key Zones

📉 Support: 3,286.84 – previous demand and wave (4) bottom.

📈 Intermediate Resistance: 3,342.12

🎯 Main Target: 3,385.22 (200% Fibonacci extension)

📌 Trade Setup Ideas

Aggressive entry: Already triggered from bounce at wave (4) support.

Conservative entry: Wait for micro wave 2 completion and breakout confirmation.

Suggested stop-loss: Below 3,285 (structure invalidation level).

🧠 Market Context

Overall trend remains bullish.

Buyers stepped in at major confluence support.

Structure and fib projections align with Elliott Wave theory and momentum continuation.

💬 We'll monitor price action to confirm whether gold can break above 3,342 and extend toward 3,385 to complete the full impulsive wave count.

📊 This is an idea, not financial advice. Manage your risk accordingly.

Gold (XAUUSD) appears to be completing an Elliott Wave impulsive sequence, with Wave (4) recently finding strong support and the beginning of Wave (5) now unfolding.

Wave (3) topped near 3,342

Wave (4) retraced into a high confluence support zone (green area + rising trendline)

Wave (5) is expected to unfold in 5 micro sub-waves, aiming for:

🎯 3,342.125 – short-term resistance / subwave 3 target

🎯 3,385.228 – final extension zone (200% Fib of Wave 1)

🔍 Key Zones

📉 Support: 3,286.84 – previous demand and wave (4) bottom.

📈 Intermediate Resistance: 3,342.12

🎯 Main Target: 3,385.22 (200% Fibonacci extension)

📌 Trade Setup Ideas

Aggressive entry: Already triggered from bounce at wave (4) support.

Conservative entry: Wait for micro wave 2 completion and breakout confirmation.

Suggested stop-loss: Below 3,285 (structure invalidation level).

🧠 Market Context

Overall trend remains bullish.

Buyers stepped in at major confluence support.

Structure and fib projections align with Elliott Wave theory and momentum continuation.

💬 We'll monitor price action to confirm whether gold can break above 3,342 and extend toward 3,385 to complete the full impulsive wave count.

📊 This is an idea, not financial advice. Manage your risk accordingly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.