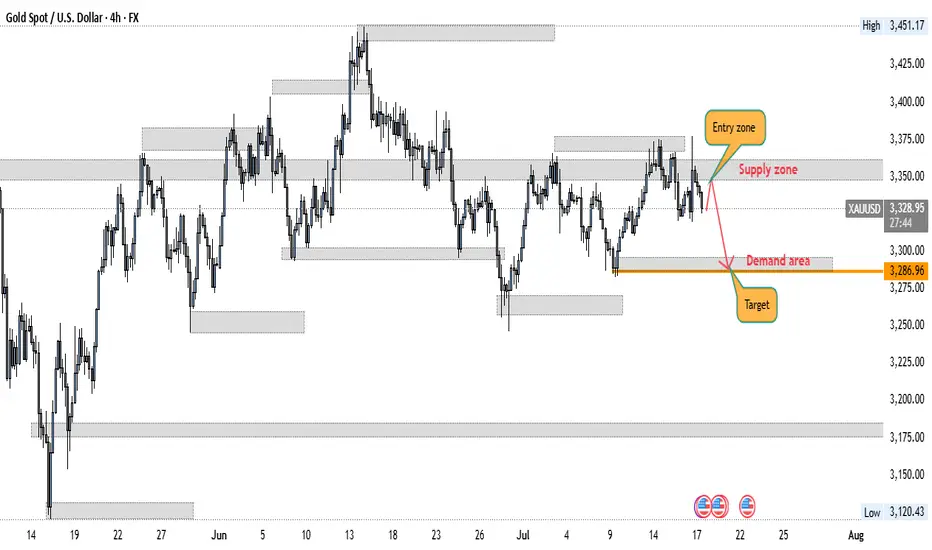

**📉 XAUUSD (Gold) – Short Setup from Supply Zone to Demand Zone**

**Timeframe:** 4H

**Instrument:** Gold Spot (XAUUSD)

**Date:** July 17, 2025

---

**🔍 Market Structure Overview:**

Gold is currently showing signs of weakness after failing to break above a key **supply zone** in the \$3,350–\$3,375 range. Price action has formed a lower high, and bearish momentum appears to be building as sellers step in at this resistance level.

---

**🔶 Trade Setup:**

* **Entry Zone:** \$3,348–\$3,355 (Confirmed supply zone with strong prior rejection)

* **Direction:** Short

* **Confirmation:** Price is respecting lower highs and failing to push higher within the supply zone.

---

**📉 Target Zone:**

* **Target:** \$3,286.96

* **Demand Area:** Strong historical demand zone just below \$3,300. Previous price reactions here suggest significant buying interest.

This target aligns with a clear horizontal level and demand zone, increasing the likelihood of a bounce or reversal upon reaching it.

---

**🎯 Trade Plan:**

* Look for short entries within the supply zone (\$3,350–\$3,375)

* Stop-loss above the supply zone (e.g., above \$3,380)

* Take profit near the demand area at \$3,286.96

Risk-reward ratio is favorable, particularly if entering near the upper boundary of the supply zone.

---

**📌 Key Notes:**

* Price remains range-bound, but the bearish rejection from the supply zone indicates a short-term move lower.

* Watch for confirmation on lower timeframes (e.g., 1H bearish engulfing or break of local structure).

* Be cautious of macroeconomic news or gold-related catalysts that could add volatility.

---

**💬 Conclusion:**

This setup offers a clean short opportunity from a well-respected supply zone, targeting a tested demand level. As always, manage your risk properly and wait for confirmation before entering the trade.

---

If you like our work please like comment and share

Team: Price Action Matrix

Trade active

JOIN MY FREE FOREX & GOLD SIGNALS TELEGRAM CHANNEL

t.me/+wX1pwTyx-0VmODI0

USER𝐍AME. @XKing05

t.me/+wX1pwTyx-0VmODI0

EXNESS BROKER : one.exnesstrack.net/a/iok5e2yuvx

t.me/+wX1pwTyx-0VmODI0

USER𝐍AME. @XKing05

t.me/+wX1pwTyx-0VmODI0

EXNESS BROKER : one.exnesstrack.net/a/iok5e2yuvx

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JOIN MY FREE FOREX & GOLD SIGNALS TELEGRAM CHANNEL

t.me/+wX1pwTyx-0VmODI0

USER𝐍AME. @XKing05

t.me/+wX1pwTyx-0VmODI0

EXNESS BROKER : one.exnesstrack.net/a/iok5e2yuvx

t.me/+wX1pwTyx-0VmODI0

USER𝐍AME. @XKing05

t.me/+wX1pwTyx-0VmODI0

EXNESS BROKER : one.exnesstrack.net/a/iok5e2yuvx

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.